Using journal tokens

Think of a token as the sum of a group of other items, this can be other tokens or nominals. So, every pay element assigned the token will be added to the running total and will be output to the journal file.

Tokens can be used with both normal nominal codes and with nominal mappings. You can use multiple journal tokens together if required.

When mapping a nominal journal it is now possible to use an array of tokens

Token names are not case sensitive.

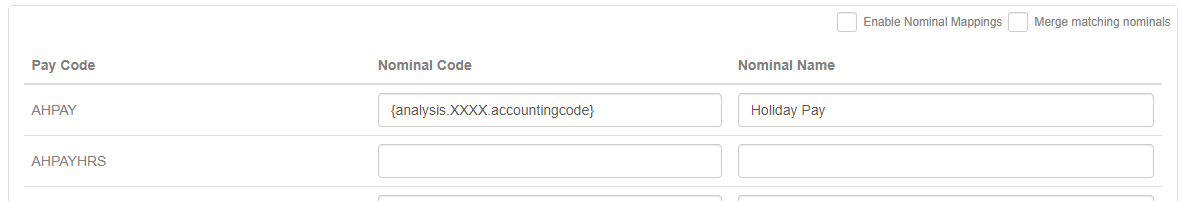

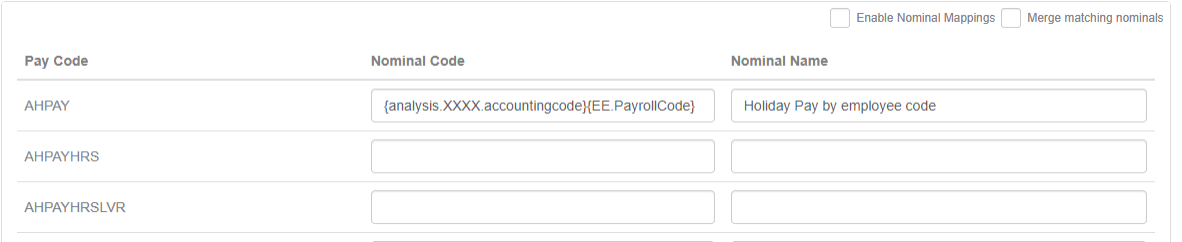

Nominal code without nominal mappings

Each pay code can be mapped and the user is able to use one or many tokens within the field.

-

Go to nominal settings.

-

Go to the Nominal Code for the required pay code.

-

Enter the required journal token.

-

If you require multiple journal codes.

-

Select Update Mappings.

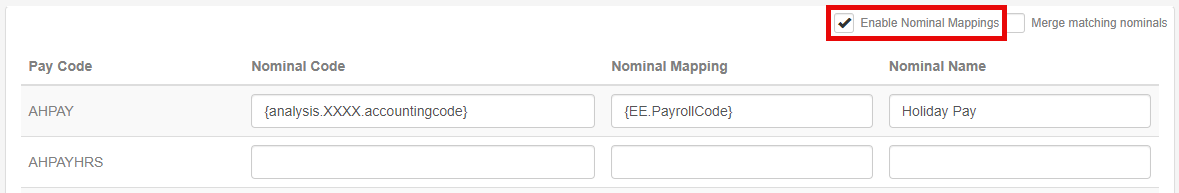

Nominal code with nominal mappings

-

Go to nominal settings.

-

Select Enable Nominal Mappings - When selected, the fields can be split for use in mapped output files.

-

Go to the Nominal Code or Nominal Mapping for the required pay code.

-

Enter the required journal token.

-

If you require multiple journal codes.

-

Select Update Mappings.

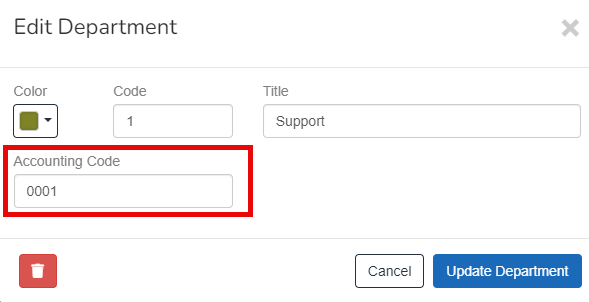

Department override

Before you begin, departments must have an accounting code.

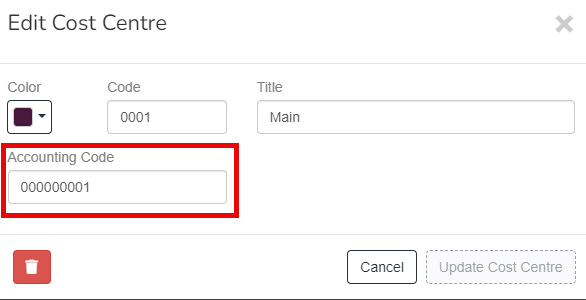

Cost Centre override

Before you begin, cost centres must have an accounting code.

Pension override

You can set a global nominal for all pension schemes. However, this may not be detailed enough. If you enter {pension.override} as the global nominal, pension overrides can be used.

Pension overrides are used when operating more than one pension scheme and want to apply separate nominal mappings for each scheme.

Employee record

Example...

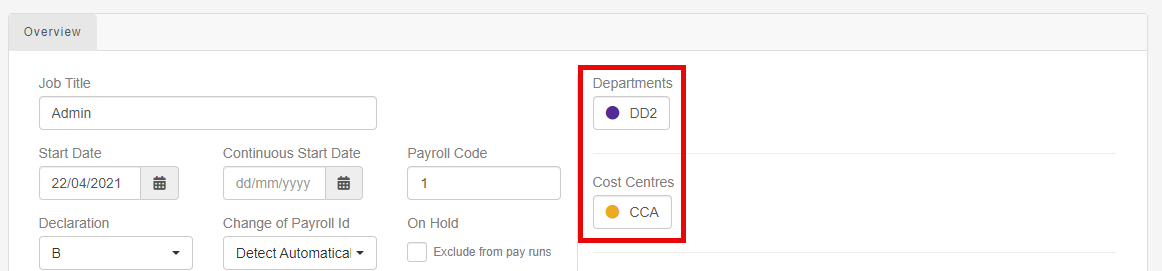

Two employees, each in a different departments and cost centre. Example showing basic pay The standard amount paid to an employee which excludes additional payments like bonuses, overtime, and allowances..

-

Department accounting codes: DD1 and DD2.

-

Cost centre account code: CCA and CCB.

-

Employee 1: DD1 and CCA .

-

Employee 2: DD2 and CCB.

-

Go to the required employee and select Employment.

-

Ensure the employees are in the correct department and cost centre.

-

Go to Settings.

-

Go to Pay Codesand select Nominal Codes.

-

Select System Codes.

-

Go to BASIC.

-

If we enter 700 {dept.accountingcode} {cc.accountingcode}

700 is the nominal and {dept.accountingcode} {cc.accountingcode} are system tokens.

This is the output on the journal file with 2 employees:

700 DD1 CCA

700 DD2 CCB

The nominal is the same for each department and cost centre.