Payment and deduction statements

Every time you pay a subcontractor, if you take a deduction from them, you must give them a written statement within 14 days of the end of each tax month.

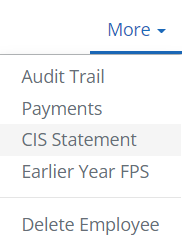

Go to the Reports then select the CIS Construction Industry Scheme - An alternative to PAYE payroll for the construction indusry. Using the Construction Industry Scheme, contractors deduct money from a subcontractor’s payments and pass it to HMRC. The deductions count as advance payments towards the subcontractor’s tax and National Insurance. tab to access CIS Payment and Deduction Statements. These reports are also accessible from a Subcontractor's record by selecting More, then CIS Statement.

Automatic distribution of email CIS statements

-

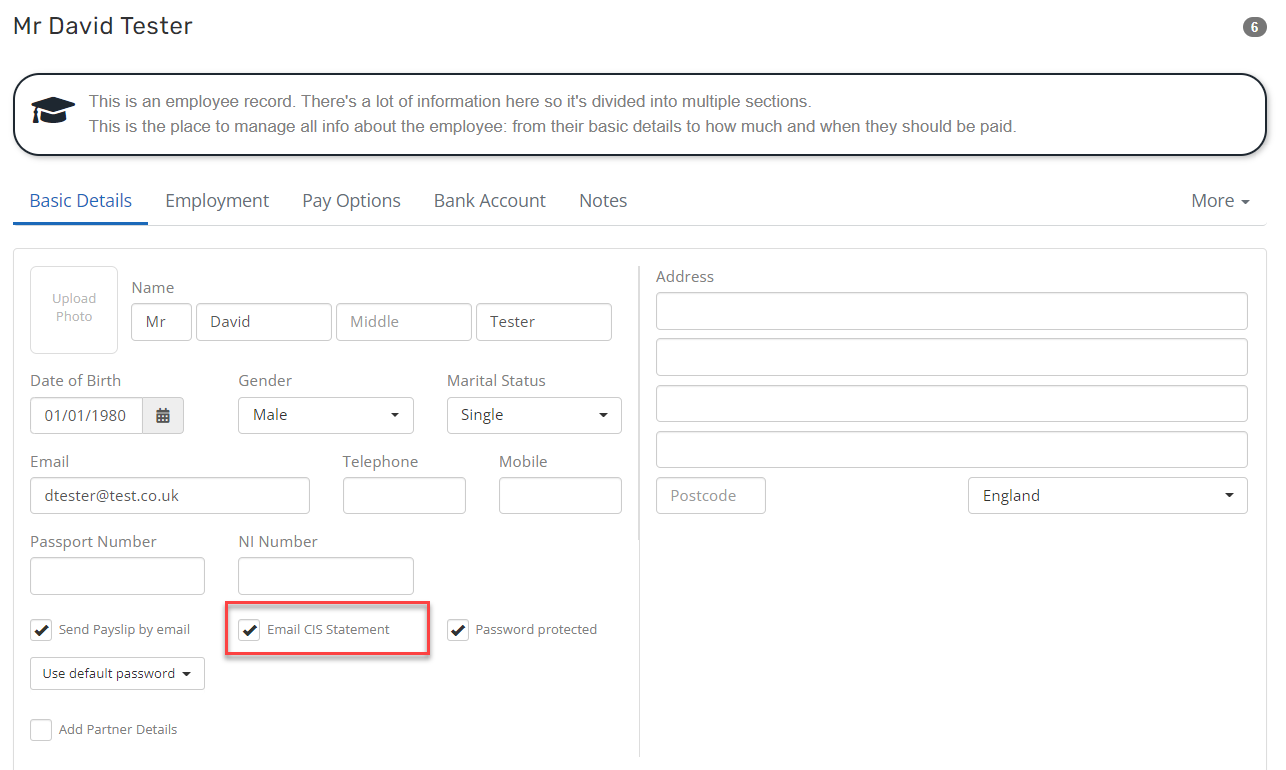

Go to Employees and select the relevant subcontractor's record.

-

in the Basic Details section, ensure Email is complete.

-

Select Email CIS Statement.

Whenever a CIS300 CIS stands for Construction Industry Scheme, and CIS300 is the monthly return that construction businesses must file with HMRC to report their payments to subcontractors. CIS Verification is the process of verifying a subcontractor's status with HMRC. is accepted by HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers., if any of the subcontractors included have Email CIS Statement enabled, a PDF of their Payments and Deductions statement for the relevant month is sent.

Customise email content

-

Go to the employer and choose Settings > Templates.

-

From the list select MONTHLY CIS STATEMENT and make your required changes.

-

Select Save Changes.

You can view your Mail Logs to check that an email has been sent.