VAT

If your subcontractor is VAT registered, they may charge you VAT which you need to pay but should not include on your CIS300 CIS stands for Construction Industry Scheme, and CIS300 is the monthly return that construction businesses must file with HMRC to report their payments to subcontractors. CIS Verification is the process of verifying a subcontractor's status with HMRC. or CIS Construction Industry Scheme - An alternative to PAYE payroll for the construction indusry. Using the Construction Industry Scheme, contractors deduct money from a subcontractor’s payments and pass it to HMRC. The deductions count as advance payments towards the subcontractor’s tax and National Insurance. Statements.

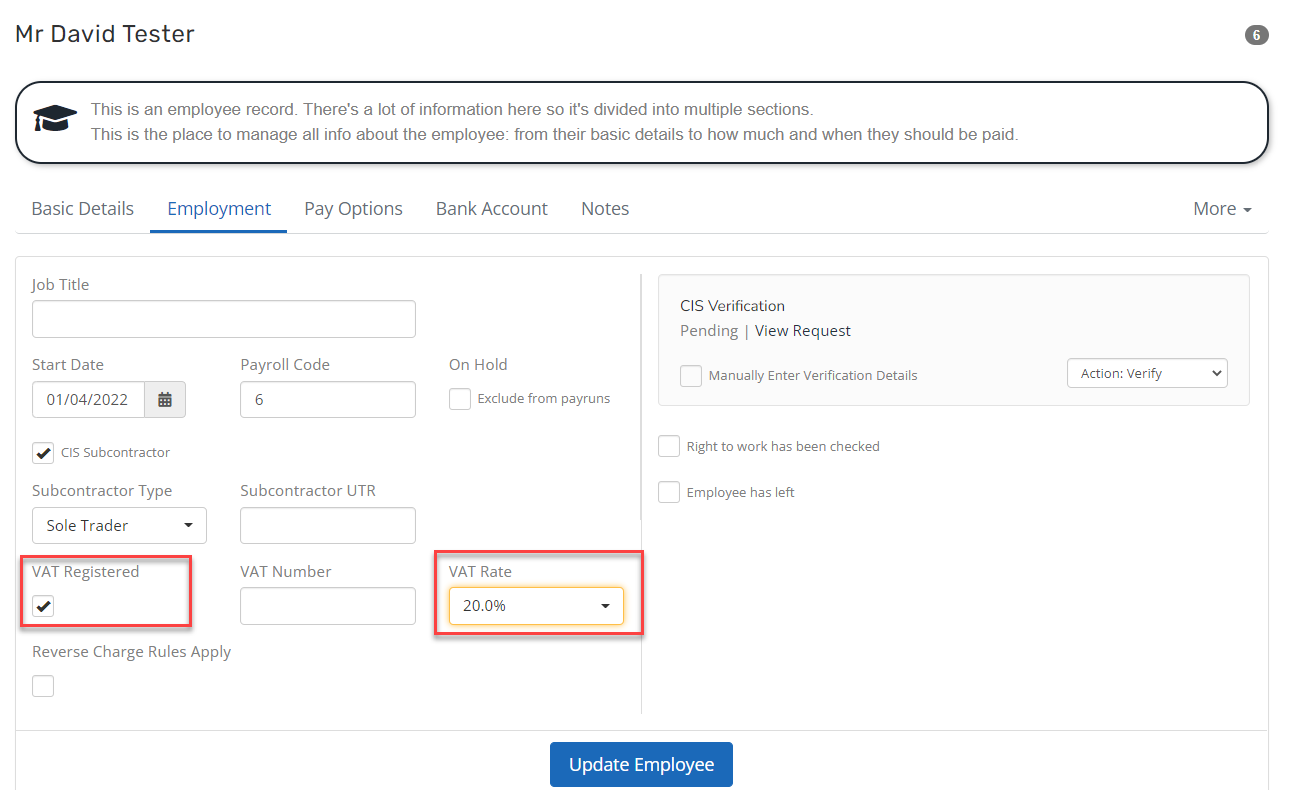

Subcontractor VAT settings

-

Go to Employeesand select the subcontractor.

-

On the Employment tab, confirm that they are VAT registered.

-

Once selected, set the VAT Rate and then Update Employee.

Automatic VAT calculations

Whenever you create a pay run that includes a VAT registered subcontractor, VAT will automatically calculate.

If you change the amount you pay a subcontractor, the VAT amount will automatically update.

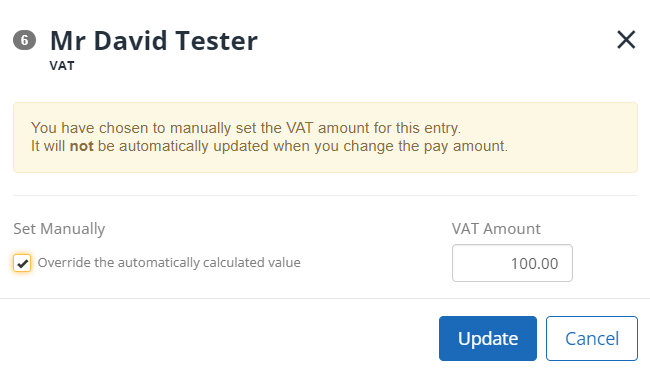

Manually override VAT amount

There may be occasions when you want to override the VAT amount calculated.

-

Go to Payroll and select the relevant subcontractor from the list to edit the payslip A statement provided by an employer to an employee, detailing their wages, deductions, and net pay for a specific pay period.This is a legal requirement under the employment rights act and should be received on or before the pay date..

-

Select the line that shows the VAT amount and select Override the automatically calculated value.

-

Enter the required VAT Amount, then Update.

If you do manually set an amount, it will no longer automatically update when you make changes. On the next pay run, it will automatically calculate. You can follow this process again to change it if you need to.