Non deductibles (i.e. materials)

CIS Construction Industry Scheme - An alternative to PAYE payroll for the construction indusry. Using the Construction Industry Scheme, contractors deduct money from a subcontractor’s payments and pass it to HMRC. The deductions count as advance payments towards the subcontractor’s tax and National Insurance. Deductions made only apply to labour – not materials.

Create a pay code

If a subcontractor bills you for materials, then you need to create a new Pay Code. You only need to do this once.

-

Open the required employer.

-

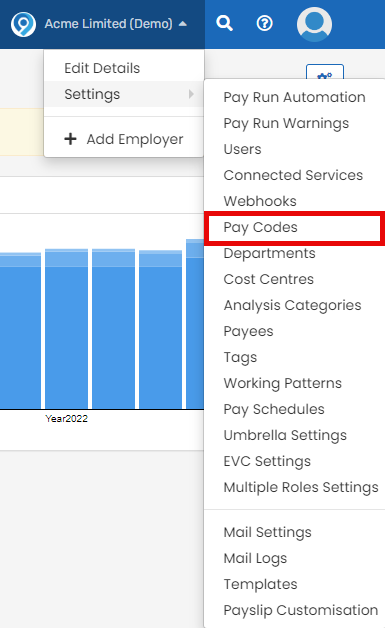

Go to your company name > Settings.

-

Select Pay Codes.

-

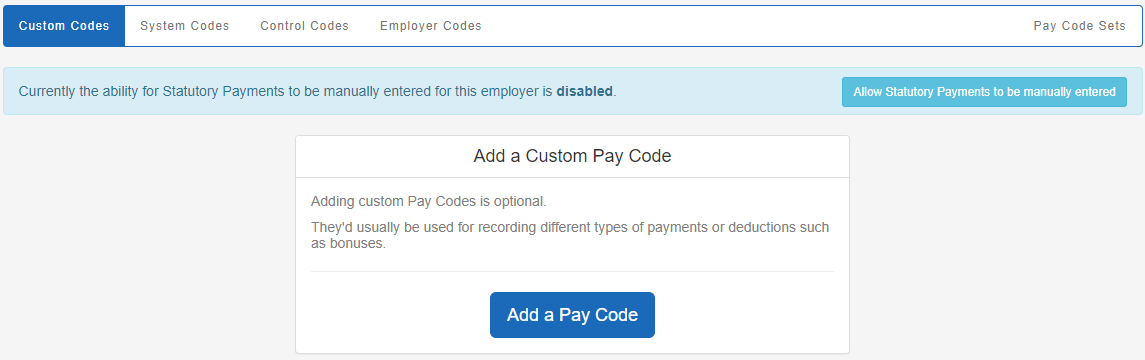

Select Add a Pay Code.

-

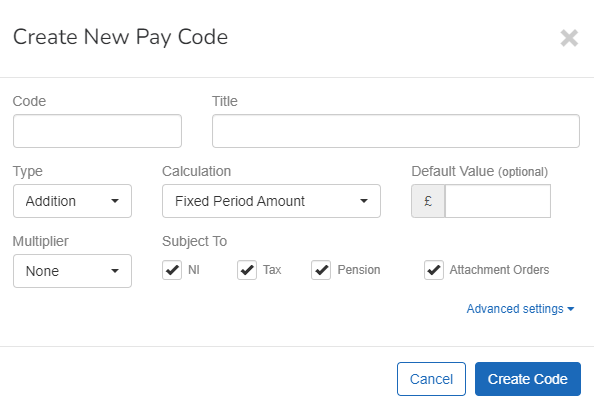

Enter a Code and Title

The code and title both appear on the payslips. Giving them descriptive names, such as "Materials", is recommended to avoid confusion.

-

Set the Type to Addition, and Calculation to Fixed Amount.

-

De-select Tax, NI, and Pension.

-

Select Create Code.

Add the addition

To add the addition for materials to the payslip A statement provided by an employer to an employee, detailing their wages, deductions, and net pay for a specific pay period.This is a legal requirement under the employment rights act and should be received on or before the pay date.:

-

Go to Payroll and select the Payslips tab.

-

Select the relevant subcontractor from the list, then select Edit Additions/Deductions.

-

Select + New Deduction / Addition and from the Code list, choose the one you created for materials.

-

Enter the amount and then Create then Update.

Good to know...

-

Once a pay code has been used in a pay run, it can no longer be deleted

-

When you update the Payslip you’ll see that the materials have been added but the deduction is only being applied to the labour, as required.