Verifying a subcontractor

Automatic verifications

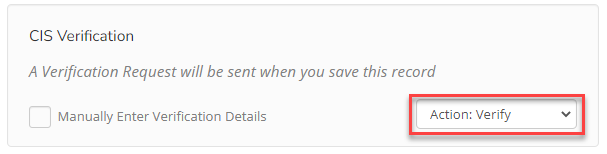

When creating a subcontractor, we can automatically send a CIS Construction Industry Scheme - An alternative to PAYE payroll for the construction indusry. Using the Construction Industry Scheme, contractors deduct money from a subcontractor’s payments and pass it to HMRC. The deductions count as advance payments towards the subcontractor’s tax and National Insurance. Verification for you.

-

During the Adding a subcontractor process, from the CIS Verification list, select Action: Verify.

-

Select Update - a CIS Verification request is then sent to HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers..

Viewing CIS verification requests

You can view requests sent to HMRC, along with their status and any response received.

-

Select RTI Real Time Information is the current method for reporting PAYE to HMRC, comprising FPS and EPS submissions. from the main menu and choose CIS Verification CIS stands for Construction Industry Scheme, and CIS300 is the monthly return that construction businesses must file with HMRC to report their payments to subcontractors. CIS Verification is the process of verifying a subcontractor's status with HMRC..

-

From here, you can see any requests sent to HMRC, along with the status and any response received.

-

Once a response is received, the subcontractor record is automatically updated with the result, including saving the Verification Number and setting the deduction rate.

If a notification shows as an error, you should resolve the error shown and select Re-Submit CISVERIFICATION

Manual verifications

If you have already verified the subcontractor, skip the automatic verification process, and mark their record accordingly.

-

During the Adding a subcontractor process, from the CIS Verification list, select Manually Enter Verification Details.

-

Complete the fields displayed and select Update.

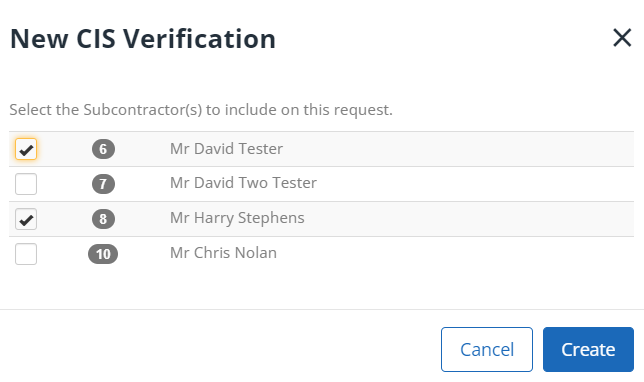

Batch verifications

It is possible to verify multiple subcontractors in a single request. To do this:

-

Go to RTI and choose CIS Verification.

-

Select + Create New CISVERIFICATION.

-

From the list of subcontractors, select those you want to verify and then Create.

-

Subcontractors' records will automatically update when we receive a response from HMRC.