Adding a subcontractor

You create a subcontractor the same way you do an employee:

-

Open the required company.

-

Go to Employees and select + Add New.

-

Enter the sub-contractor's details, ensuring Employee Type is set to Sub Contractor.

-

Once you have entered all information, select Update Employee, this creates the sub-contractor record.

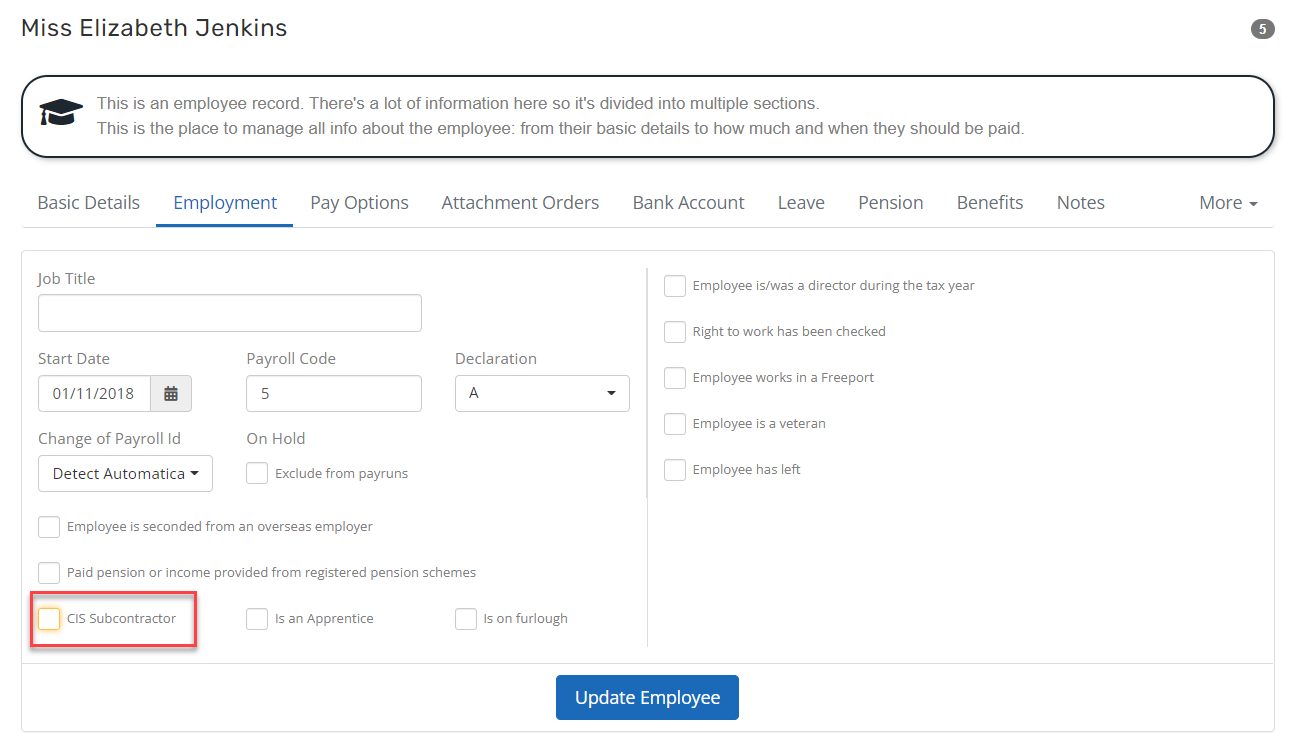

If you have already created a record withEmployee Type set as Employee, on the Employment tab, select CIS Construction Industry Scheme - An alternative to PAYE payroll for the construction indusry. Using the Construction Industry Scheme, contractors deduct money from a subcontractor’s payments and pass it to HMRC. The deductions count as advance payments towards the subcontractor’s tax and National Insurance. Subcontractor. If you have already paid the individual, you will not be able to select this option.

When you mark an individual as a Sub-Contractor, some fields and options are hidden, for instance, those related to Leave, Pensions and Company Directors, and new options display, such as those to set the Subcontractor Type, their UTR A Unique Taxpayer Reference number (usually 10 digits). Required to file a self assessment tax return. Most employees will not be required to complete a self assessment tax return if they are in a PAYE scheme. HMRC can request employees to complete a self assessment tax return for a number of years, even if they are only in a PAYE scheme., etc.