Running the payroll for subcontractors

The process of running a payroll for a CIS Construction Industry Scheme - An alternative to PAYE payroll for the construction indusry. Using the Construction Industry Scheme, contractors deduct money from a subcontractor’s payments and pass it to HMRC. The deductions count as advance payments towards the subcontractor’s tax and National Insurance. Subcontractors is just as easy as it is for regular employees. You can run a payroll containing a mix of regular employees and subcontractors.

-

Select Payroll and get started by following the on-screen prompts.

-

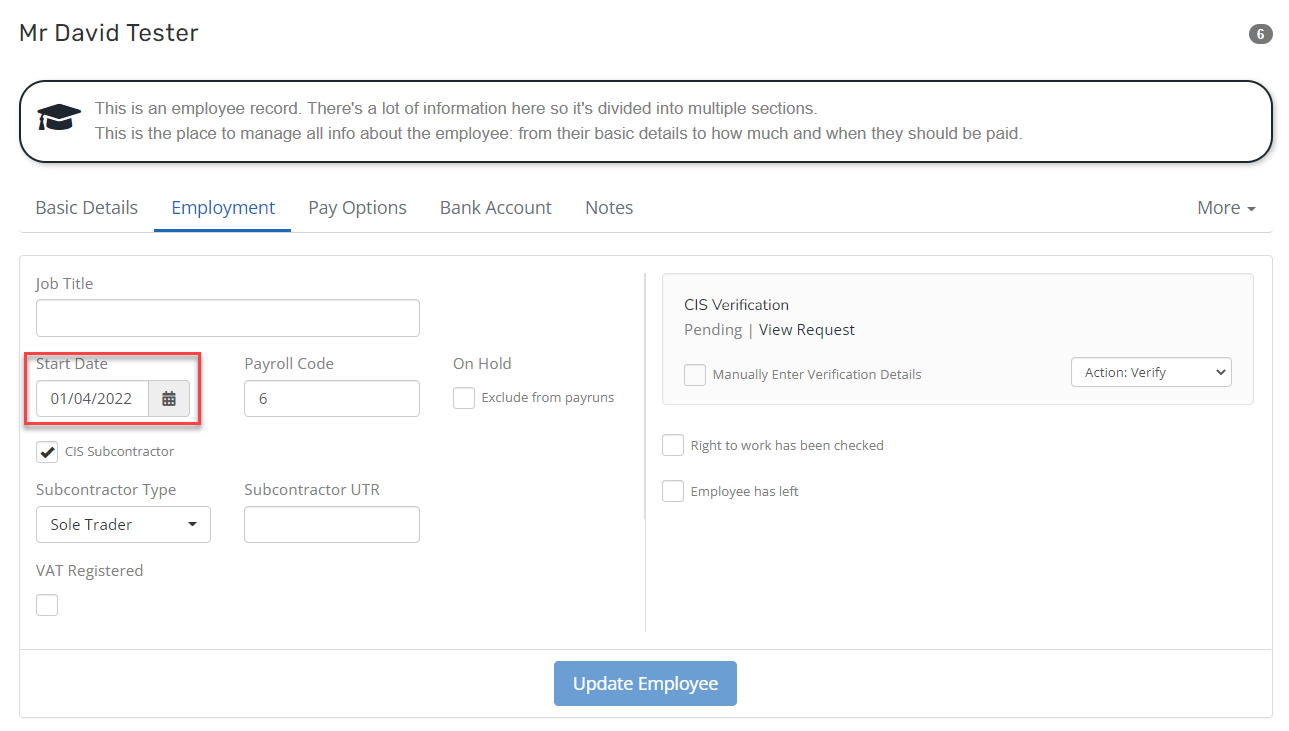

If you have added subcontractors, who are not showing in the list as expected, the most likely cause is the Start Date entered.

-

To check the Start Date, go to Employees, select the individual from the list and choose the Employment tab.