Payline costings: Single payrun

Payline costings assigns analysis categories and analysis codes to an individual pay code or pay line. This assigns all the costs of that pay elements to the analysis category and analysis code. This is in addition but separate to the general employee analysis category.

If the payline costing is permanent, this can be set in the employee record.

-

Open the required payroll.

-

Go to Payroll.

-

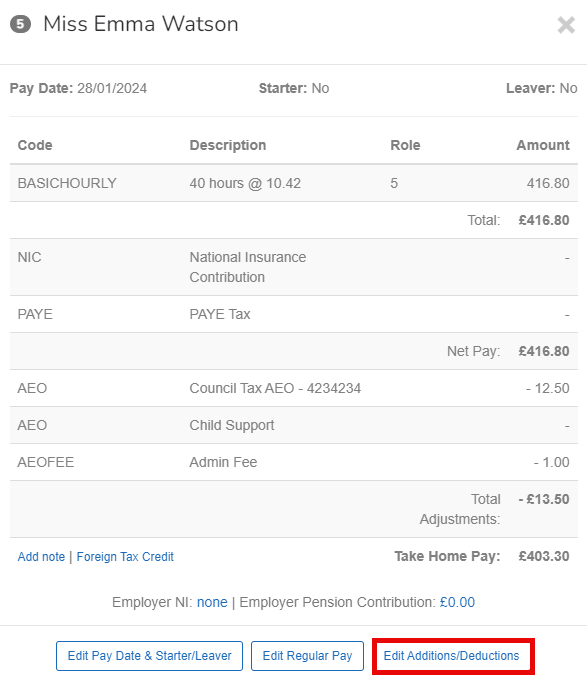

Select the required employee.

-

Select Edit Additions/Deductions.

-

Select + New Decuction/Addition or select the required pay element to make changes.

- Select the Role if multi role is enabled.

-

Select the required Code.

-

Enter the amount.

This can be a value, fixed amount, rate or percentage. This is set when you create the pay code.

-

Select Gross up Target Net if required.

-

Select Pro-rata Adjustments if required.

-

Edit the Description if required.

-

Enter the Effective From if required.

-

Leave blank: Will start from the next pay period.

-

Date entered in the past: The pay line will be backdated to this date. A pro-rata calculation is made if the date is part way though a pay period.

-

Date entered in the future: The pay line will start on this date. A pro-rata calculation is made if the date is part way though a pay period.

-

-

Enter the Effective To if required.

-

Leave blank: Will continue forever.

-

Date entered in the future: The pay line continues until the date entered. A pro-rata calculation is made if the date is part way though a pay period.

-

-

Enter the Earned From if required.

-

Leave blank: Current pay line stops and the replacement starts from the next pay period.

-

Date entered in the past: The new pay line is backdated to this date. A pro-rata calculation is made if the date is part way though a pay period.

-

Date entered in the future: The new pay line will start on this date. A pro-rata calculation is made if the date is part way though a pay period.

-

Enter the Earned To if required.

-

Leave blank: Will continue forever.

-

Date entered in the future: The pay line will continue until the date entered. A pro-rata calculation is made if the date is part way though a pay period.

-

-

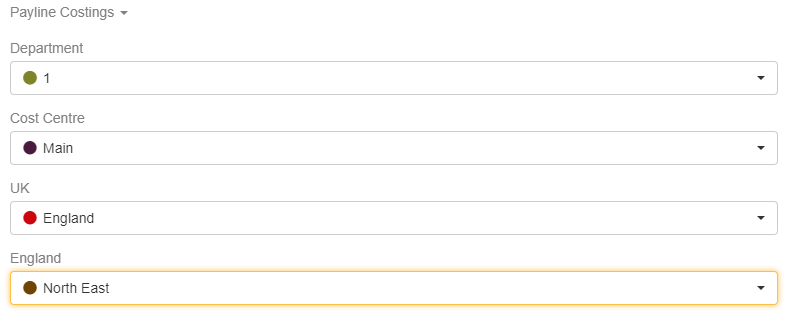

Enter any Payline Costings and Tags if required.

Only one analysis code per analysis category, department and cost centre can be set per pay element.

-

Select the required department and cost canter for the pay element.

-

Select the required analysis category and select the analysis code.

The analysis categories and analysis codes names come from the configuration.

-

-

Select Create.

-

Add any additional pay elements if required.

-

Select Update.