Employer Payment Summary (EPS)

Need to send EPS Employer Payment Summary is an RTI online submission sent monthly if, you are reclaiming statutory payments, claiming Employment Allowance (EA is only reported once per tax year), reporting Construction Industry Scheme (CIS) deductions or reporting how much Apprenticeship Levy is due. The EPS is also used to report if no employees will be paid for a whole tax month or longer. submissions for multiple companies with the same PAYE PAYE or Pay as you earn is an HM Revenue and Customs’ (HMRC) system to collect Income Tax and National Insurance from employment. Reference? Find out more

You can create an EPS from HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. Payments. Go to the HMRC menu and select the period.

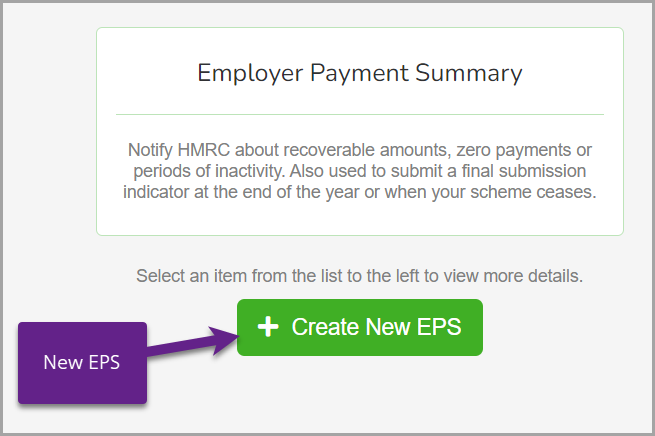

You can use an EPS (Employer Payment Summary Employer Payment Summary is an RTI online submission sent monthly if, you are reclaiming statutory payments, claiming Employment Allowance (EA is only reported once per tax year), reporting Construction Industry Scheme (CIS) deductions or reporting how much Apprenticeship Levy is due. The EPS is also used to report if no employees will be paid for a whole tax month or longer.) to notify HMRC about recoverable amounts, zero payments or periods of inactivity as well as submit a final submission indicator at the end of the year or when your scheme ceases.

You can automate many tasks, including an automatic EPS submission.

Create a new EPS

-

Go to RTI Real Time Information is the current method for reporting PAYE to HMRC, comprising FPS and EPS submissions. > EPS and select the EPS you want to submit or Create New EPS.

-

To create a new EPS, select the type of EPS you want.

-

Fill in the required details, depending on the EPS type.

You can select multiple options for one EPS.

- Select Create.

- An EPS displays and is logged into your system. You can continue to submit or leave it and come back to it later.

-

-

When it's ready, you can Submit an EPS.

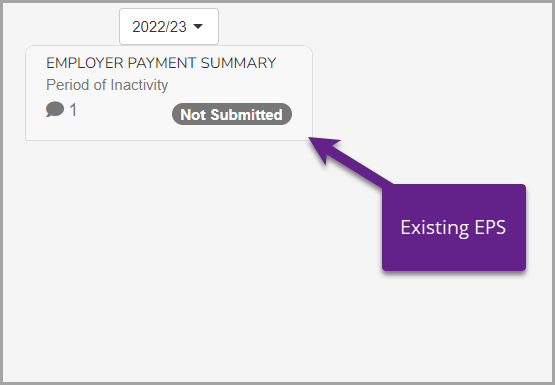

Review an existing EPS

-

Go to RTI > EPS and select the EPS you want to submit.

-

Review the details.

-

When it's ready, you can Submit an EPS.

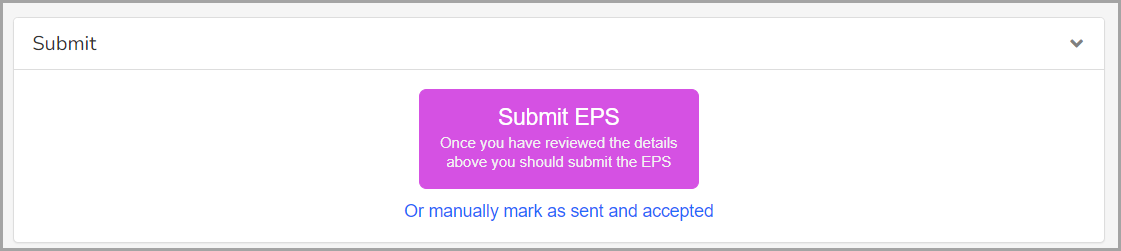

Submit an EPS

-

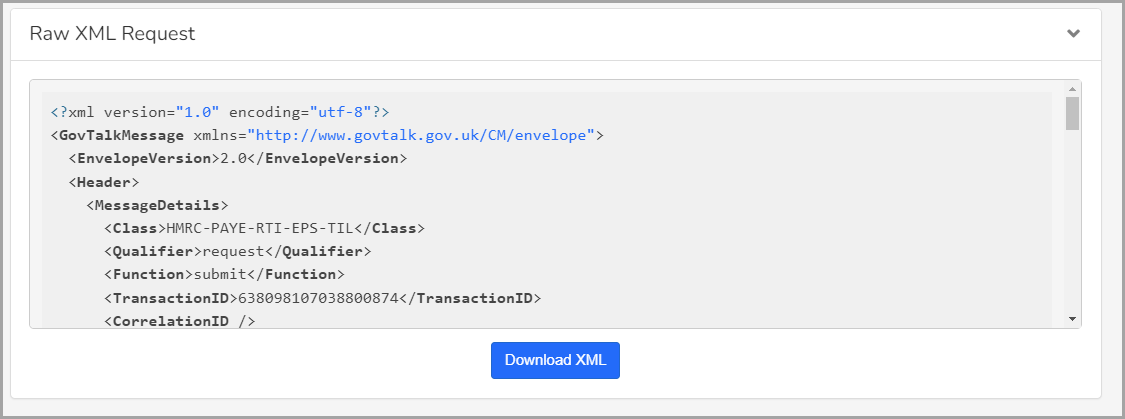

To submit a new or existing EPS, on Gateway, you can choose to Submit or manually download the request.

-

To automatically send, select Submit EPS. You can also manually mark as sent and accepted.

-

To manually send, select Raw XML Request and Download XML.

-

You can use this file to send to HMRC outside of Staffology Payroll.