Expenses and benefits (EXB)

You can create an Expense and Benefits (EXB Expenses and Benefits. EXB refers to any benefits or expenses that an employee receives from their employer that are not included in their regular salary.) Report end-of-year P11D P11D is used by employers to report end-of-year expenses and benefits for employees who earned more than £8,500. Employees who receive Benefits in Kind (BiK) are entitled to an end of year report that outlines their benefits and expenses in the tax year.(b) employer Class 1A Employers pay these directly on their employee’s expenses or benefits. NICs and employee expenses and benefits returns.

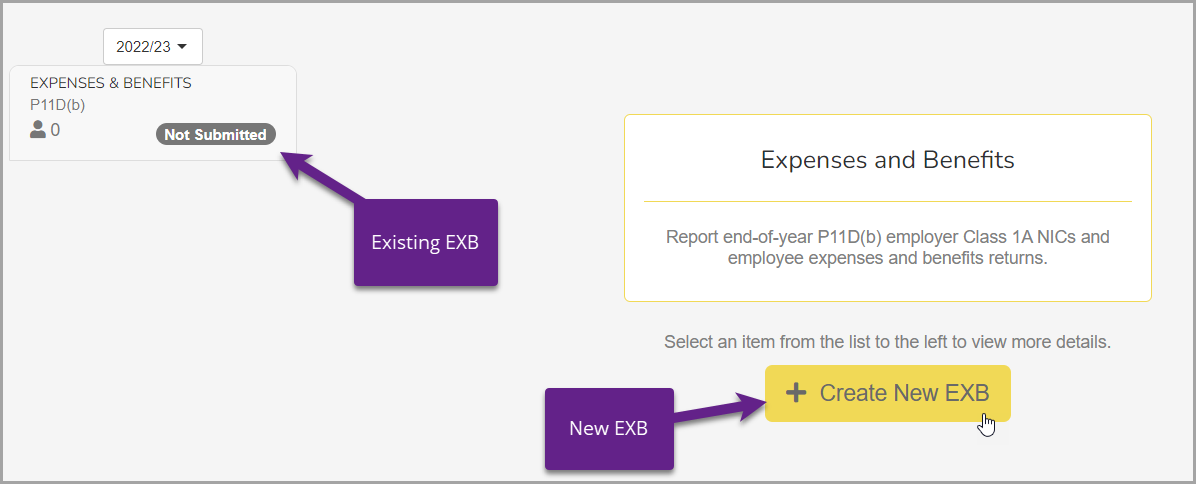

To create and EXB:

-

Go to RTI Real Time Information is the current method for reporting PAYE to HMRC, comprising FPS and EPS submissions.> EXB and select the existing EXB you want to submit or Create New EXB.

-

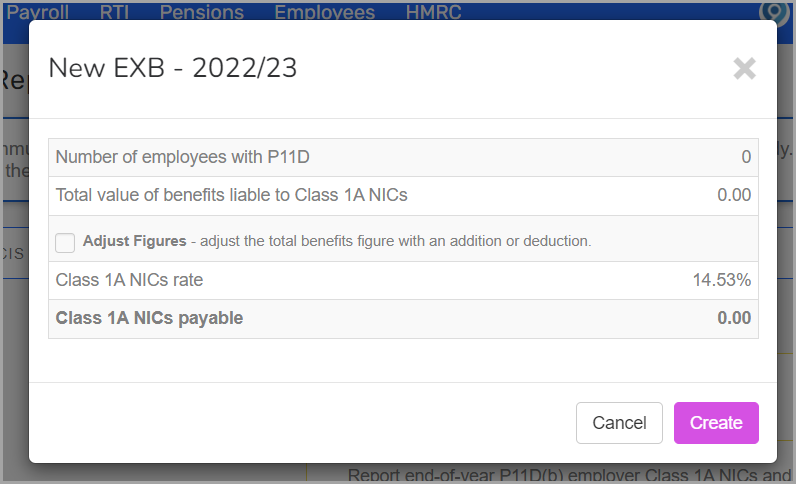

Review the options for the report and select Create.

The details for the EXBappear on the page.

-

In Gateway, you can choose to Submit or manually download the request.

-

To automatically send, select Submit EXB. You can also manually mark as sent and accepted.

-

To manually send, select Raw XML Request and Download XML.

You can use this file to send to HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. outside of Staffology Payroll.

-