National Insurance Verification Request (NVR)

You can request the National Insurance A system of contributions paid by workers and employers in the UK, which funds various state benefits, such as the State Pension and Jobseeker's Allowance. Number for one or more employees using a NI No Verification(NVR National Insurance number Verification Request is an RTI online submission requesting HMRC provide or verify an employees National Insurance number.) request. You can then view HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers.’s response through your PAYE PAYE or Pay as you earn is an HM Revenue and Customs’ (HMRC) system to collect Income Tax and National Insurance from employment. Online utility.

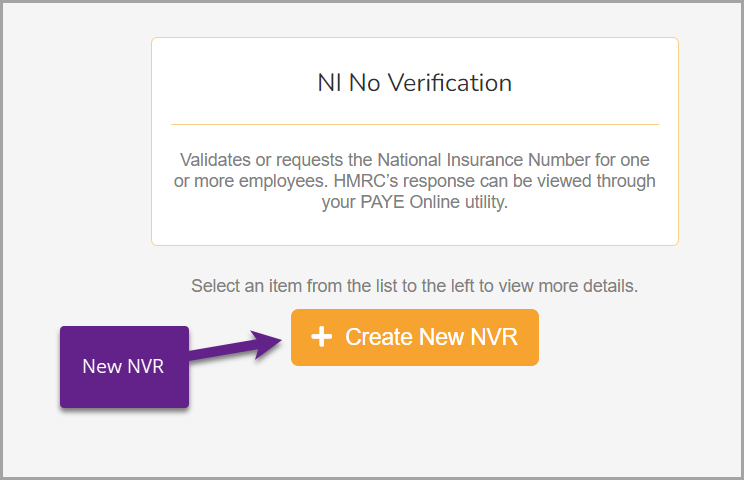

Create a new NVR

-

Go to RTI Real Time Information is the current method for reporting PAYE to HMRC, comprising FPS and EPS submissions. and select Create a New NVR.

-

Select the employee(s) you want to get details about.

-

Select Create.

The details for the NVR appear on the page.

Review an existing NVR

-

Go to RTI> NVR and select the NVR you want to submit.

-

Review the details.

-

When it's ready, you can Submit an NVR.

Submit an NVR

-

In Gateway, you can choose to Submit or manually download the request.

-

To automatically send, select Submit NVR. You can also manually mark as sent and accepted.

-

To manually send, select Raw XML Request and Download XML.

You can use this file to send to HMRC outside of Staffology Payroll.

-