Multiple Company Employer Payment Summary (EPS)

This should only be used if you have two employers with the same PAYE PAYE or Pay as you earn is an HM Revenue and Customs’ (HMRC) system to collect Income Tax and National Insurance from employment.-reference within Staffology Payroll

-

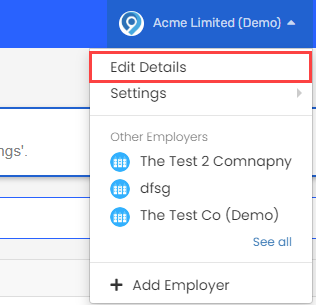

Select the required employer.

-

Go to your company name > Edit Details.

-

-

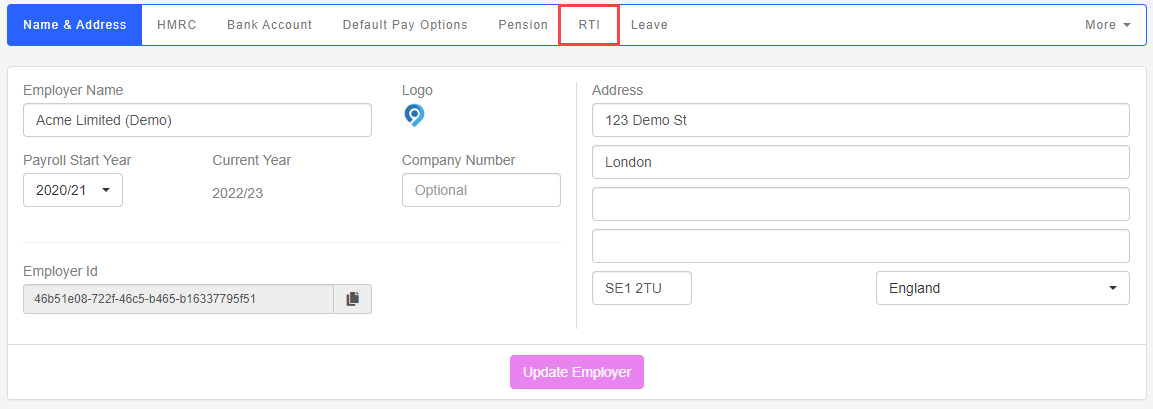

Repeat for each company you wish to submit a combined EPS.

Good to know...

-

Each company must have the same PAYE-reference .

-

This should only be used if you have two employers with the same PAYE-reference within Staffology Payroll

-

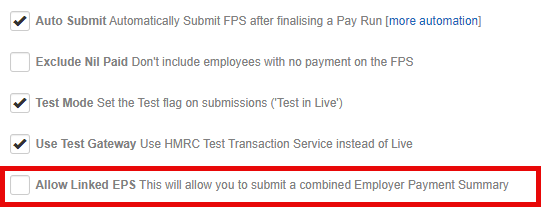

Each company needs to have Allow Linked EPS selected.

-

If you wish to split the employment allowance or apprenticeship levy, this will be done in each company.

-

The month end reports will be produced separately.

-

Any journals will be produced separately.