Employment Allowance

-

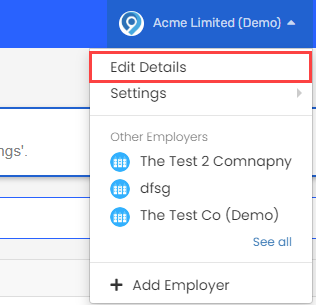

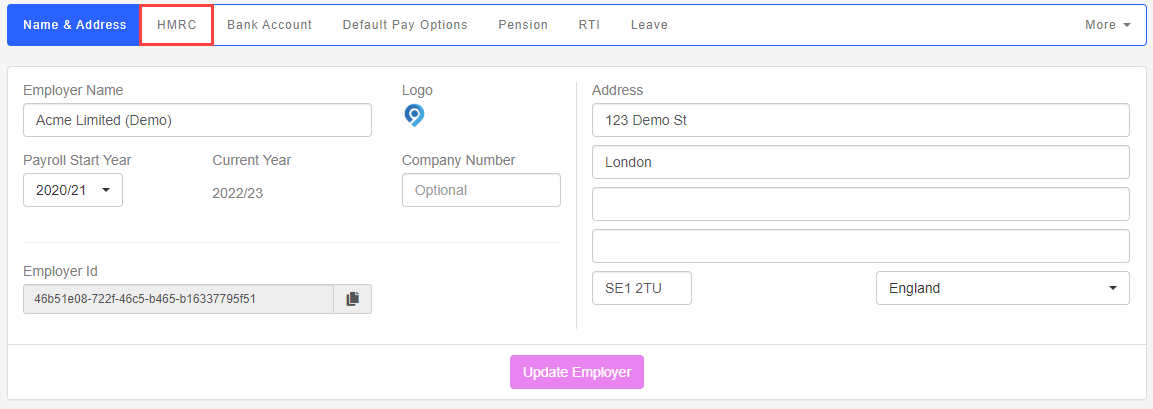

Select the required employer.

-

Go to your company name > Edit Details.

-

-

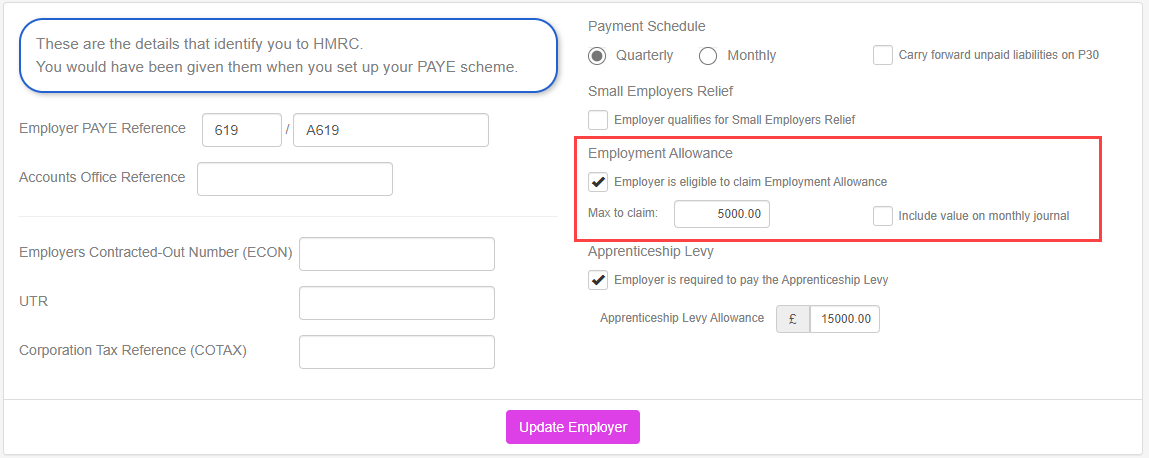

If you are moving from another payroll provider, check the Employment Allowance Claimed opening balances.

-

Select Include value on monthly journal (if required).

-

Select Update Employer.

Good to know...

-

GOV.UK Guide: Employment Allowance. External website

-

If you are moving from another payroll provider, check the Employment Allowance Claimed opening balances.