Apprenticeship levy

-

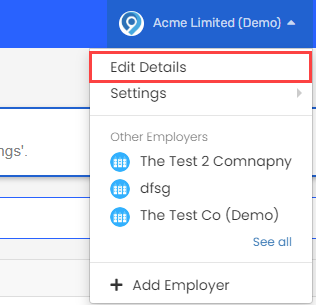

Select the required employer.

-

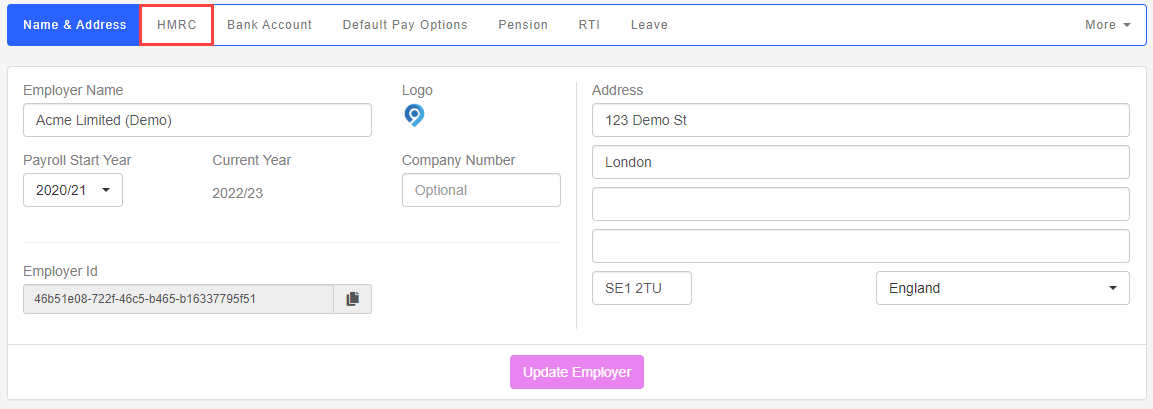

Go to your company name > Edit Details.

-

-

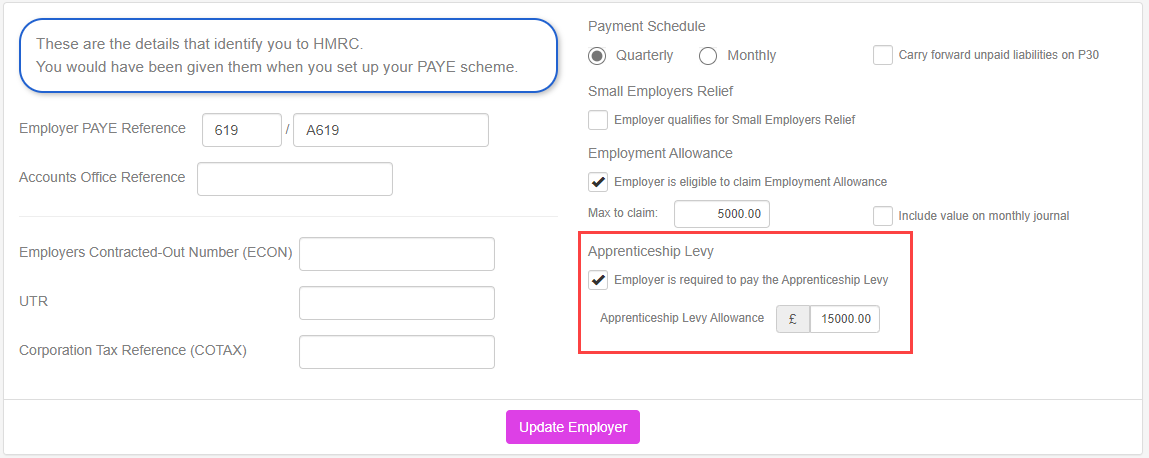

Select Employer is required to pay the Apprenticeship Levy The Apprenticeship Levy is a UK tax on employers which is used to fund apprenticeship training. It is payable by all employers with an annual pay bill of more than £3 million, at a rate of 0.5% of their total pay bill. It is collected through PAYE alongside other employment taxes..

If you are moving from another payroll provider, check the Apprenticeship Levy Paid YTD The cumulative amount of an employee's earnings or deductions from the beginning of the current fiscal year up to the current pay period. opening balances.

-

Select Update Employer.

Good to know...

-

GOV.UK Guide: Pay Apprenticeship Levy. External website

-

When Apprenticeship Levy is deducted, an EPS Employer Payment Summary is an RTI online submission sent monthly if, you are reclaiming statutory payments, claiming Employment Allowance (EA is only reported once per tax year), reporting Construction Industry Scheme (CIS) deductions or reporting how much Apprenticeship Levy is due. The EPS is also used to report if no employees will be paid for a whole tax month or longer. must be sent each period. Even if no further deductions are made.

-

The Apprenticeship Levy is calculated on a Year To Date (YTD basis.

-

Refunds are possible.

-

If you are moving from another payroll provider, check the Apprenticeship Levy Paid YTD opening balances.