Payslips

Payslips show a history of payments made to the employee covering 6 years.

To delay or hold the release of scheduled payslips, reopen the payrun.

Only payments made with Staffology Payroll are recorded.

-

Open the required company.

-

Go to Employees.

-

Select the required employee.

-

Select More.

-

Select Payslips.

-

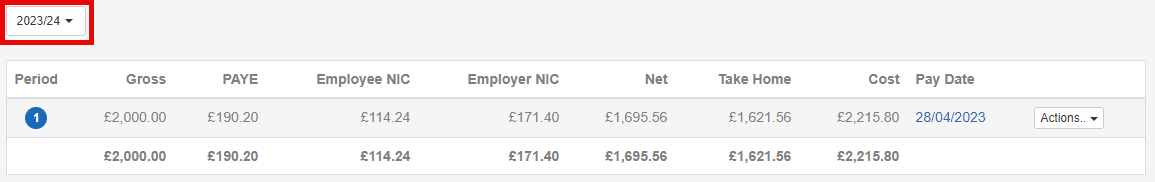

Select the required year.

You will only have a year selection if the selected employee has payslips in more than one tax year.

-

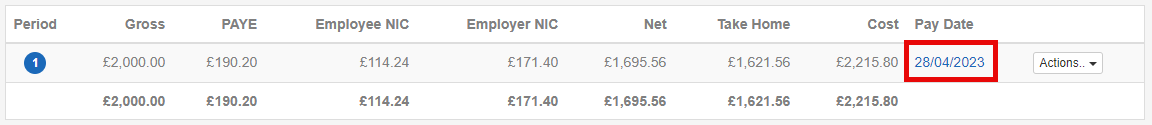

Select a Pay Date to view the RTI Real Time Information is the current method for reporting PAYE to HMRC, comprising FPS and EPS submissions. details for the period (if required).

A review of that period's RTI details will appear. This will include the relevant date, submitted indicator, employer details, totals, employees included, reason for late reporting indicator, and the ability to submit if it has not been already. You can also download a report on the period.

-

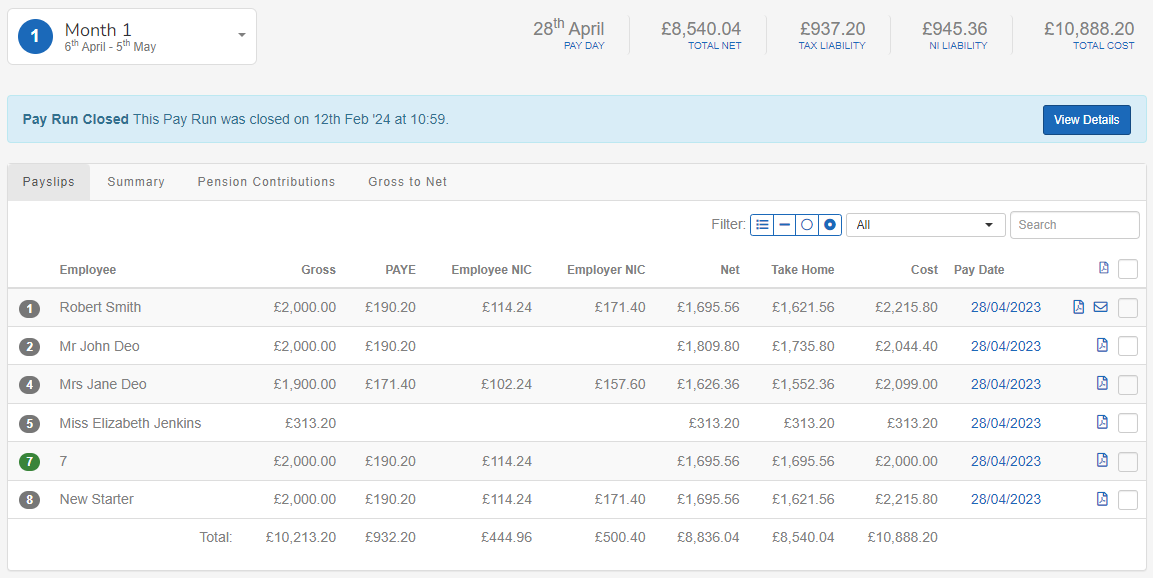

Select the period to list all the employees paid in the period (if required).

-

Select Actions, then Download Payslip A statement provided by an employer to an employee, detailing their wages, deductions, and net pay for a specific pay period.This is a legal requirement under the employment rights act and should be received on or before the pay date. to download a pdf (if required).

Example...

Good to know...

-

The Net pay can be different from the Take Home if there are any after tax and national insurance A system of contributions paid by workers and employers in the UK, which funds various state benefits, such as the State Pension and Jobseeker's Allowance. deductions.

-

You can send individual payslips after you have reopened the pay run or performed a rollback. This replaces the previous payslip.

-

To delay or hold the release of scheduled payslips, reopen the payrun.