NI year to date balances report

Export the NI YTD values for your employees.

-

Open the required company.

-

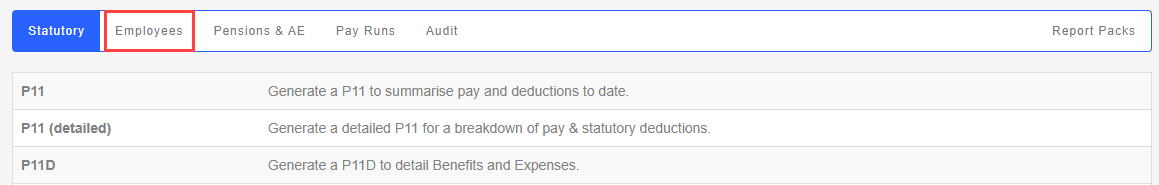

Go to Reports.

-

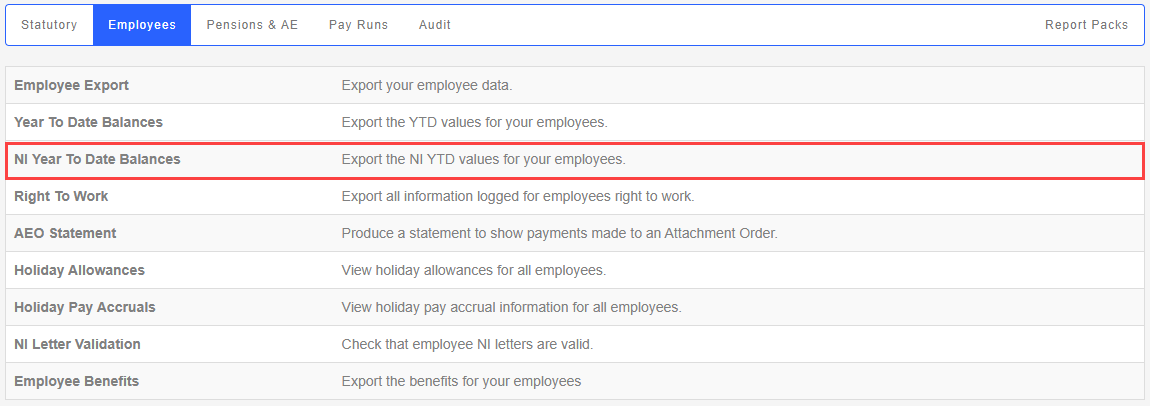

Select Employees.

-

Select NI Year To Date Balances.

-

Select the required Tax Year and Month.

-

Select Preview.

-

You have the option to download a CSV for all employees.

-

Select Download as.. (if required)

-

Download as PDF.

-

Download as CSV.

-

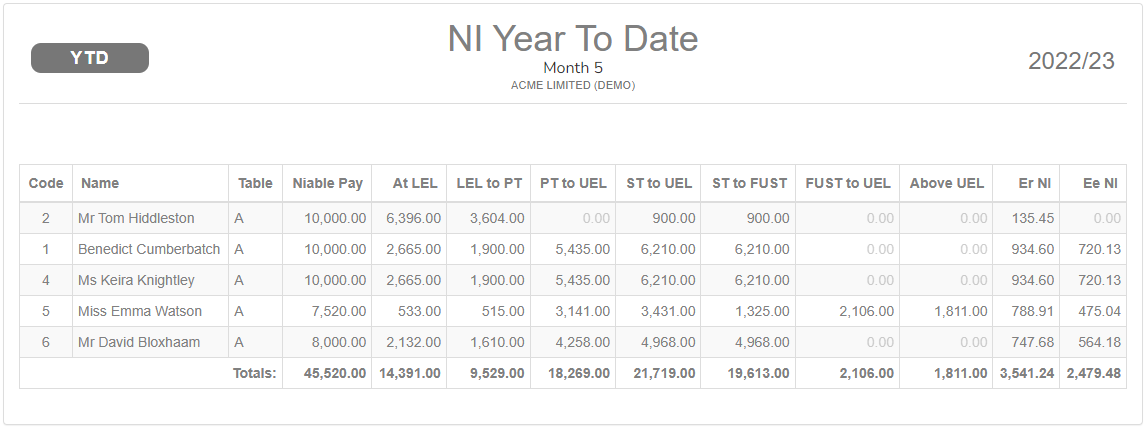

Example...

-

NI year to date balances - Single period. PDF

-

NI year to date balances - Single period. CSV

-

NI year to date balances - All employees. CSV

Good to know...

-

If a company is moving payroll software or payroll bureau. It's common to be asked for the year to date information. A payslip A statement provided by an employer to an employee, detailing their wages, deductions, and net pay for a specific pay period.This is a legal requirement under the employment rights act and should be received on or before the pay date. does not have all the information needed.

-

A P11 A P11 (standing for Paper form No. 11) used to be posted to employers and hand written for each employee. This was used before computerized payroll. A P11 is used throughout the industry and usually contains similar information. It usually contains the taxable earnings, tax paid, National Insurance breakdown as well as statutory payments. It may also contain additions and deductions. (not to be confused with a P11D Car). report will provide most of the employee figures. This will need to be completed for each employee.

-

A Year to date balances report and NI year to date balances reports contains similar information to a P11.

-

Recommended: You can export the full employee record.