Manual entry

If you are transferring from another payroll system, or taking your payroll in-house, you should mark the employee as Not a New Starter Don't flag this Employee as a New Starter on their first pay run. This can have serious consequences if not done correctly. Do not select this options if you are adding a new employer or new employees.

-

Open the required company.

-

Go to Employees.

-

Select the required employee.

-

Select More > Opening Balances.

If entering details for a Director who has already reached the lower earnings limit Lower Earnings Limit (LEL) This is the minimum a person must earn in order to qualify for any state benefits or statutory payments. If an employee's earnings reach or exceed this level, but do not exceed the Primary Threshold, they will not pay NICs but will be treated as having paid NICs when claiming state benefits. (LEL Lower Earnings Limit (LEL) This is the minimum a person must earn in order to qualify for any state benefits or statutory payments. If an employee's earnings reach or exceed this level, but do not exceed the Primary Threshold, they will not pay NICs but will be treated as having paid NICs when claiming state benefits.), when entering Opening Balances for the National Insurance A system of contributions paid by workers and employers in the UK, which funds various state benefits, such as the State Pension and Jobseeker's Allowance. Contributions (NIC) Table Summary, select Director: Employee was a Director at the time this NI was paid.

-

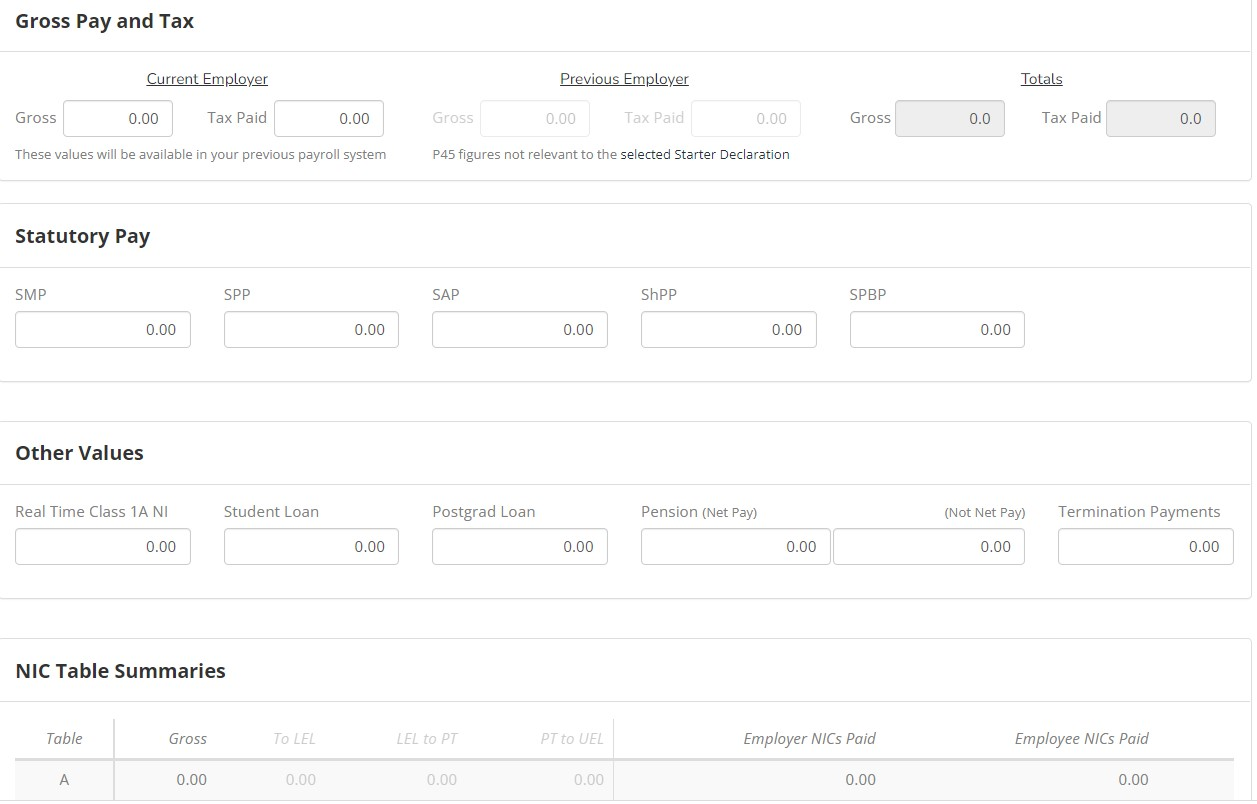

Enter the relevant values and select Update Opening Balances.

Good to know...

-

A payslip A statement provided by an employer to an employee, detailing their wages, deductions, and net pay for a specific pay period.This is a legal requirement under the employment rights act and should be received on or before the pay date. does not contain enough information to complete the opening balances, as it does not contain the breakdown of National Insurance (NI). There is more to NI than Employees NI and Employers NI.

-

If the employee started part way through the year, and had another job, it is important to get the Current Employer (sometimes known as This Employment) and Previous Employer (P45 A P45 is a document issued by an employer to an employee when they leave a job. It shows details about the's employment, including their start and end dates, how much they were paid, and how much tax they paid during their employment. The is made up of four parts: Part 1 is sent to HM Revenue & Customs (HMRC), Part 1A is kept by the employer, and Parts 2 and 3 are to the employee as a record of their earnings and tax paid. The P45 is an important document that employees need to give to their new employer when they start a new job as it provides information about their tax code and previous earnings, which helps the employer calculate their tax and National Insurance contributions.) (sometimes known as Previous Employment) correct. If you don't split the figures correctly, HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. thinks you paid the employee for the previous job and come looking for the tax due.