Import from Full Payment Submission (FPS)

If you’ve been running payroll in another system, you can import an Full Payment Submission Full Payment Submission is an RTI online submission to be sent on or before each payday. This informs HMRC about the payments and deductions for each employee..

Only current employees, with the period processed on the FPS Full Payment Submission is an RTI online submission to be sent on or before each payday. This informs HMRC about the payments and deductions for each employee. will be imported.

Importing an FPS file allows you to create employees with appropriate opening balances as well as automatically set your RTI Real Time Information is the current method for reporting PAYE to HMRC, comprising FPS and EPS submissions. credentials, HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. references and Payment Schedule.

Directors: If you imported the employees from an FPS, check the Opening Balances and select Director: Employee was a Director at the time this NI was paid.

About a FPS

Your payroll software creates a Full Payment Submission (FPS) file and sends it to HMRC every time you pay your employees.

Your software should give you access to the raw data as an XML file that looks similar to the example shown below:

FPS Example

<?xml version="1.0" encoding="utf-8"?>

<GovTalkMessage xmlns="http://www.govtalk.gov.uk/CM/envelope">

<EnvelopeVersion>2.0</EnvelopeVersion>

<Header>

<MessageDetails>

<Class>HMRC-PAYE-RTI-FPS-TIL</Class>

<Qualifier>request</Qualifier>

<Function>submit</Function>

<TransactionID>636949935539317270</TransactionID>

<CorrelationID />

<Transformation>XML</Transformation>

<GatewayTest>1</GatewayTest>

</MessageDetails>

<SenderDetails>

<IDAuthentication>

<SenderID>ISV619</SenderID>

<Authentication>

<Method>clear</Method>

<Role>principal</Role>

<Value>testing1</Value>

</Authentication>

</IDAuthentication>

</SenderDetails>

</Header>

<GovTalkDetails>

<Keys>

<Key Type="TaxOfficeNumber">619</Key>

<Key Type="TaxOfficeReference">A619</Key>

</Keys>

<TargetDetails>

<Organisation>IR</Organisation>

</TargetDetails>

<ChannelRouting>

<Channel>

<URI>7798</URI>

<Product>Staffology</Product>

<Version>0.1</Version>

</Channel>

<Timestamp>2019-06-01T12:45:53</Timestamp>

</ChannelRouting>

</GovTalkDetails>

<Body>

<IRenvelope xmlns="http://www.govtalk.gov.uk/taxation/PAYE/RTI/FullPaymentSubmission/18-19/1">

<IRheader>

<Keys>

<Key Type="TaxOfficeNumber">619</Key>

<Key Type="TaxOfficeReference">A619</Key>

</Keys>

<PeriodEnd>2019-04-05</PeriodEnd>

<DefaultCurrency>GBP</DefaultCurrency>

<Sender>Employer</Sender>

</IRheader>

<FullPaymentSubmission>

<EmpRefs>

<OfficeNo>619</OfficeNo>

<PayeRef>A619</PayeRef>

<AORef>123PQ7654321X</AORef>

</EmpRefs>

<RelatedTaxYear>18-19</RelatedTaxYear>

<Employee>

<EmployeeDetails>

<NINO>JM888888A</NINO>

<Name>

<Fore>Benedict</Fore>

<Initials>C</Initials>

<Sur>Cumberbatch</Sur>

</Name>

<Address>

<Line>221B Baker St</Line>

<Line>Marylebone</Line>

<Line>London</Line>

<UKPostcode>NW1 6XE</UKPostcode>

</Address>

<BirthDate>1976-07-19</BirthDate>

<Gender>M</Gender>

</EmployeeDetails>

<Employment>

<DirectorsNIC>AL</DirectorsNIC>

<TaxWkOfApptOfDirector>1</TaxWkOfApptOfDirector>

<PayId>1</PayId>

<FiguresToDate>

<TaxablePay>8000.00</TaxablePay>

<TotalTax>809.20</TotalTax>

<StudentLoansTD>0.00</StudentLoansTD>

<EmpeePenContribnsPaidYTD>0.00</EmpeePenContribnsPaidYTD>

<EmpeePenContribnsNotPaidYTD>179.68</EmpeePenContribnsNotPaidYTD>

</FiguresToDate>

<Payment>

<PayFreq>M1</PayFreq>

<PmtDate>2018-08-02</PmtDate>

<MonthNo>4</MonthNo>

<PeriodsCovered>1</PeriodsCovered>

<HoursWorked>D</HoursWorked>

<TaxCode>1185L</TaxCode>

<TaxablePay>2000.00</TaxablePay>

<NonTaxOrNICPmt>0.00</NonTaxOrNICPmt>

<DednsFromNetPay>-44.92</DednsFromNetPay>

<PayAfterStatDedns>1642.04</PayAfterStatDedns>

<EmpeePenContribnsNotPaid>44.92</EmpeePenContribnsNotPaid>

<TaxDeductedOrRefunded>202.20</TaxDeductedOrRefunded>

</Payment>

<NIlettersAndValues>

<NIletter>A</NIletter>

<GrossEarningsForNICsInPd>2000.00</GrossEarningsForNICsInPd>

<GrossEarningsForNICsYTD>8000.00</GrossEarningsForNICsYTD>

<AtLELYTD>2012.00</AtLELYTD>

<LELtoPTYTD>796.00</LELtoPTYTD>

<PTtoUELYTD>5192.00</PTtoUELYTD>

<TotalEmpNICInPd>179.12</TotalEmpNICInPd>

<TotalEmpNICYTD>716.48</TotalEmpNICYTD>

<EmpeeContribnsInPd>155.76</EmpeeContribnsInPd>

<EmpeeContribnsYTD>623.04</EmpeeContribnsYTD>

</NIlettersAndValues>

</Employment>

</Employee>

<Employee>

<EmployeeDetails>

<NINO>JM333333A</NINO>

<Name>

<Ttl>Mr</Ttl>

<Fore>Tom</Fore>

<Initials>H</Initials>

<Sur>Hiddleston</Sur>

</Name>

<Address>

<Line>12 High Street</Line>

<Line>Belsize Park</Line>

<Line>London</Line>

<UKPostcode>NW3 4BU</UKPostcode>

</Address>

<BirthDate>1981-02-09</BirthDate>

<Gender>M</Gender>

</EmployeeDetails>

<Employment>

<DirectorsNIC>AN</DirectorsNIC>

<TaxWkOfApptOfDirector>1</TaxWkOfApptOfDirector>

<PayId>2</PayId>

<FiguresToDate>

<TaxablePay>8000.00</TaxablePay>

<TotalTax>809.20</TotalTax>

<StudentLoansTD>0.00</StudentLoansTD>

<EmpeePenContribnsPaidYTD>0.00</EmpeePenContribnsPaidYTD>

<EmpeePenContribnsNotPaidYTD>179.68</EmpeePenContribnsNotPaidYTD>

</FiguresToDate>

<Payment>

<PayFreq>M1</PayFreq>

<PmtDate>2018-08-02</PmtDate>

<MonthNo>4</MonthNo>

<PeriodsCovered>1</PeriodsCovered>

<HoursWorked>D</HoursWorked>

<TaxCode>1185L</TaxCode>

<TaxablePay>2000.00</TaxablePay>

<NonTaxOrNICPmt>0.00</NonTaxOrNICPmt>

<DednsFromNetPay>-44.92</DednsFromNetPay>

<PayAfterStatDedns>1797.80</PayAfterStatDedns>

<EmpeePenContribnsNotPaid>44.92</EmpeePenContribnsNotPaid>

<TaxDeductedOrRefunded>202.20</TaxDeductedOrRefunded>

</Payment>

<NIlettersAndValues>

<NIletter>A</NIletter>

<GrossEarningsForNICsInPd>2000.00</GrossEarningsForNICsInPd>

<GrossEarningsForNICsYTD>8000.00</GrossEarningsForNICsYTD>

<AtLELYTD>2012.00</AtLELYTD>

<LELtoPTYTD>796.00</LELtoPTYTD>

<PTtoUELYTD>5192.00</PTtoUELYTD>

<TotalEmpNICInPd>0.00</TotalEmpNICInPd>

<TotalEmpNICYTD>0.00</TotalEmpNICYTD>

<EmpeeContribnsInPd>0.00</EmpeeContribnsInPd>

<EmpeeContribnsYTD>0.00</EmpeeContribnsYTD>

</NIlettersAndValues>

</Employment>

</Employee>

<Employee>

<EmployeeDetails>

<NINO>JM111111A</NINO>

<Name>

<Ttl>Ms</Ttl>

<Fore>Keira</Fore>

<Initials>K</Initials>

<Sur>Knightley</Sur>

</Name>

<Address>

<Line>Somerset House</Line>

<Line>London</Line>

<UKPostcode>WC2R 1LA</UKPostcode>

</Address>

<BirthDate>1985-03-26</BirthDate>

<Gender>F</Gender>

</EmployeeDetails>

<Employment>

<PayId>4</PayId>

<LeavingDate>2018-08-02</LeavingDate>

<FiguresToDate>

<TaxablePay>8000.00</TaxablePay>

<TotalTax>809.20</TotalTax>

<StudentLoansTD>0.00</StudentLoansTD>

<EmpeePenContribnsPaidYTD>0.00</EmpeePenContribnsPaidYTD>

<EmpeePenContribnsNotPaidYTD>179.68</EmpeePenContribnsNotPaidYTD>

</FiguresToDate>

<Payment>

<PayFreq>M1</PayFreq>

<PmtDate>2018-08-02</PmtDate>

<MonthNo>4</MonthNo>

<PeriodsCovered>1</PeriodsCovered>

<HoursWorked>D</HoursWorked>

<TaxCode>1185L</TaxCode>

<TaxablePay>2000.00</TaxablePay>

<NonTaxOrNICPmt>0.00</NonTaxOrNICPmt>

<DednsFromNetPay>-44.92</DednsFromNetPay>

<PayAfterStatDedns>1642.04</PayAfterStatDedns>

<EmpeePenContribnsNotPaid>44.92</EmpeePenContribnsNotPaid>

<TaxDeductedOrRefunded>202.20</TaxDeductedOrRefunded>

</Payment>

<NIlettersAndValues>

<NIletter>A</NIletter>

<GrossEarningsForNICsInPd>2000.00</GrossEarningsForNICsInPd>

<GrossEarningsForNICsYTD>8000.00</GrossEarningsForNICsYTD>

<AtLELYTD>2012.00</AtLELYTD>

<LELtoPTYTD>796.00</LELtoPTYTD>

<PTtoUELYTD>5192.00</PTtoUELYTD>

<TotalEmpNICInPd>179.12</TotalEmpNICInPd>

<TotalEmpNICYTD>716.48</TotalEmpNICYTD>

<EmpeeContribnsInPd>155.76</EmpeeContribnsInPd>

<EmpeeContribnsYTD>623.04</EmpeeContribnsYTD>

</NIlettersAndValues>

</Employment>

</Employee>

<Employee>

<EmployeeDetails>

<Name>

<Ttl>Miss</Ttl>

<Fore>Emma</Fore>

<Initials>W</Initials>

<Sur>Watson</Sur>

</Name>

<Address>

<Line>7 Heathgate</Line>

<Line>Hampstead Garden</Line>

<Line>London</Line>

<UKPostcode>NW11 7AR</UKPostcode>

</Address>

<BirthDate>1990-04-15</BirthDate>

<Gender>F</Gender>

</EmployeeDetails>

<Employment>

<PayId>5</PayId>

<FiguresToDate>

<TaxablePay>1252.80</TaxablePay>

<TotalTax>0.00</TotalTax>

<StudentLoansTD>0.00</StudentLoansTD>

<EmpeePenContribnsPaidYTD>0.00</EmpeePenContribnsPaidYTD>

<EmpeePenContribnsNotPaidYTD>0.00</EmpeePenContribnsNotPaidYTD>

</FiguresToDate>

<Payment>

<PayFreq>M1</PayFreq>

<PmtDate>2018-08-02</PmtDate>

<MonthNo>4</MonthNo>

<PeriodsCovered>1</PeriodsCovered>

<HoursWorked>D</HoursWorked>

<TaxCode>1185L</TaxCode>

<TaxablePay>313.20</TaxablePay>

<NonTaxOrNICPmt>0.00</NonTaxOrNICPmt>

<DednsFromNetPay>0.00</DednsFromNetPay>

<PayAfterStatDedns>313.20</PayAfterStatDedns>

<TaxDeductedOrRefunded>0.00</TaxDeductedOrRefunded>

</Payment>

<NIlettersAndValues>

<NIletter>A</NIletter>

<GrossEarningsForNICsInPd>313.20</GrossEarningsForNICsInPd>

<GrossEarningsForNICsYTD>1252.80</GrossEarningsForNICsYTD>

<AtLELYTD>1252.00</AtLELYTD>

<LELtoPTYTD>0.00</LELtoPTYTD>

<PTtoUELYTD>0.00</PTtoUELYTD>

<TotalEmpNICInPd>0.00</TotalEmpNICInPd>

<TotalEmpNICYTD>0.00</TotalEmpNICYTD>

<EmpeeContribnsInPd>0.00</EmpeeContribnsInPd>

<EmpeeContribnsYTD>0.00</EmpeeContribnsYTD>

</NIlettersAndValues>

</Employment>

</Employee>

</FullPaymentSubmission>

</IRenvelope>

</Body>

</GovTalkMessage>Import an FPS file

-

Create the employer and then choose the option to upload an FPS.

If the starting year you choose for the employer matches the tax year for the FPS, the opening balances are imported. Otherwise, they are ignored.

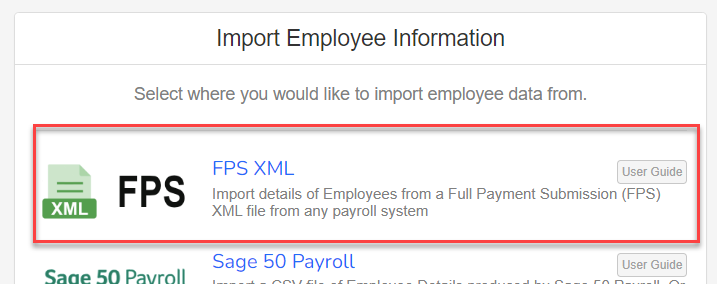

- Alternatively, from the Employees tab, select Import.

-

Select the FPS XML option.

-

Locate the XML file on your computer and upload it.

A preview of the data displays.

-

You can choose whether or not you want us to set your RTI Credentials, HMRC Details and Payment Schedule with the values we found in your FPS file.

You can edit the Payment Schedule dates before you start your pay run. A list of employees that will be imported displays.

-

Scroll to the bottom of the page and select the button to import the information.

The details from the FPS are now be imported. Your employees are imported along with any opening balances and director information.

If you select the Payroll tab, you can start the next pay run or edit the payment schedule.

The default for pay options to pay your employees is the same gross amount as set in the FPS; you can change this if required.

The gross amount doesn’t include pension deductions for any Net Pay Pensions. If you want this adding back in, then create at least one Pension Scheme before importing and ensure you do not set any of your Pension Schemes to the Relief At Source Basic rate tax relief(Most common with NEST)

The pension is caculated after tax and NI. However, basic rate tax relief is applied to the deduction. rule.

If you’ve pasted the XML data into Notepad or similar, make sure you save it with the encoding option set to UTF8 to avoid errors when importing it.

FPS files don’t contain Pension Scheme information, so you may need to manually create these.