Teachers pension

Step 5: Create the worker groups

-

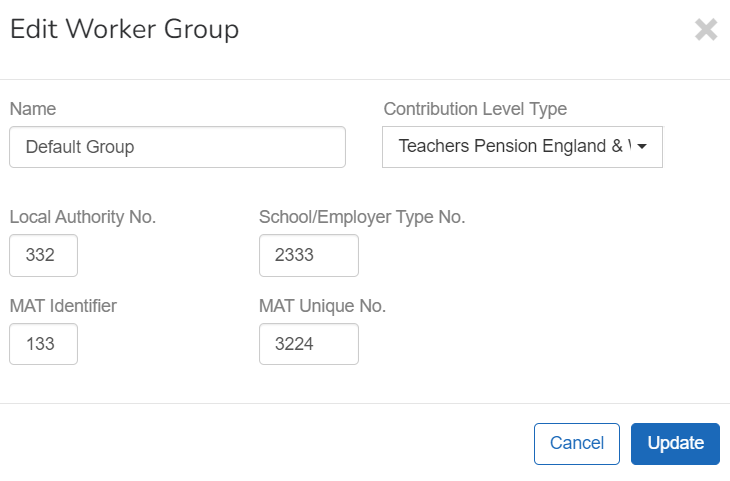

Select Worker Groups and select Default Group.

The first worker group A group of employees who have the same pension contribution level and other settings. must be Teachers Pension England & Wales.

If you have any AVCs or added years, create additional worker groups. Go to Worker Groups and choose +New Worker Group.

-

Go to Contribution Level Type and choose:

-

Teachers Pension England & Wales.

-

Local Authority No.

-

School/Employer Type No.

-

MAT Identifier.

-

MAT Unique No.

-

-

TP Faster Accrual.

-

Enter the Employer Contribution and Additional Voluntary Contribution as a Percentage or Fixed amount.

-

-

TP Additional Pension Conts.

-

Enter the Employer Contribution and Additional Voluntary Contribution as a Percentage or Fixed amount.

-

-

TP AAB.

-

Enter the Employer Contribution and Additional Voluntary Contribution as a Percentage or Fixed amount.

-

-

TP Family Benefits.

-

Enter the Employer Contribution and Additional Voluntary Contribution as a Percentage or Fixed amount.

-

-

TP PAY.

-

Enter the Employer Contribution and Additional Voluntary Contribution as a Percentage or Fixed amount.

-

-

TP Higher Salaries.

-

Enter the Employer Contribution and Additional Voluntary Contribution as a Percentage or Fixed amount.

-

-

TP Preston.

-

Enter the Employer Contribution and Additional Voluntary Contribution as a Percentage or Fixed amount.

-

-

TP Elected Further Employment (EFE).

-

Enter the Employer Contribution and Additional Voluntary Contribution as a Percentage or Fixed amount.

-

-

-

Select Update.

Check the pension rule is set to Net Pay Arrangement Employees only get Tax Relief. The deduction is made after the NI is caculated but before tax is caculated..

-

Select Settings.

-

Go to Pension Rule and select Net Pay Arrangement.

-

Go to Administrator and enter the Contact Name, Telephone number, Email, and postal Address.

This is the contact within your organisation

-

Select Update Pension Scheme.