Step by step guide to running a payroll

Step 10: Check the payroll (Reconciliation)

As you process payroll regularly, you start to have a rough idea the amounts of a regular payrun. If something doesn’t feel right, check it. It's good practice to check the payroll thoroughly.

It's impossible to tell you exactly what you are looking for and items will still slip through. Employees should not be out of pocket due to a mistake so its good to check. There's always the ability to correct mistakes, for this pay period or over multi periods using rollback.

Open the required company.

-

Select Payroll.

-

If you pay multiple pay frequencies, choose the frequency you are running payroll.

Items to check:

-

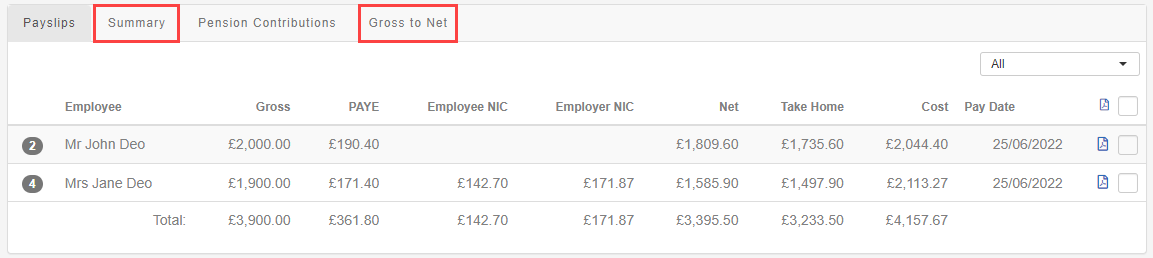

Check each payslip A statement provided by an employer to an employee, detailing their wages, deductions, and net pay for a specific pay period.This is a legal requirement under the employment rights act and should be received on or before the pay date. for mistakes, amounts entered incorrectly or wrong pay elements entered. View the payslip by selecting the payslip icon.

-

Check the Summary report and Gross to Net report. This gives a big picture overview of the payroll.

Step 11: Finalise the payroll (close the period).