July 2025

What's new

Find out about the changes we've made.

You can also check our known issues, fixes and what's coming soon.

30th July

-

We have fixed an issue where the year to date figures were not matching with payroll when published using My ePayWindow.

-

When in the employee record, you can now search for employees. Enter at least three characters. This includes letters, numbers, special characters and spaces.

-

You can search for employees by name, payroll code or NI Number.

-

There is a limit of 50 results shown in the results.

-

-

When you select the employees name while in the employee record, we now show a list of employees with payroll code. This is displayed by employee code.

29th July

-

You can now choose to include Apprenticeship Levy The Apprenticeship Levy is a UK tax on employers which is used to fund apprenticeship training. It is payable by all employers with an annual pay bill of more than £3 million, at a rate of 0.5% of their total pay bill. It is collected through PAYE alongside other employment taxes. values in your Payrun Journal. This allows for more complete payroll costings and accurate reconciliation.

24th July

-

You can now import pension memberships directly using a CSV import file.

-

You can now import and update benefits directly using a CSV file.

18th July

-

When you make changes to an employee record, and select Update Employee, we now remain in the employee record. To get the employee list, select Employees.

-

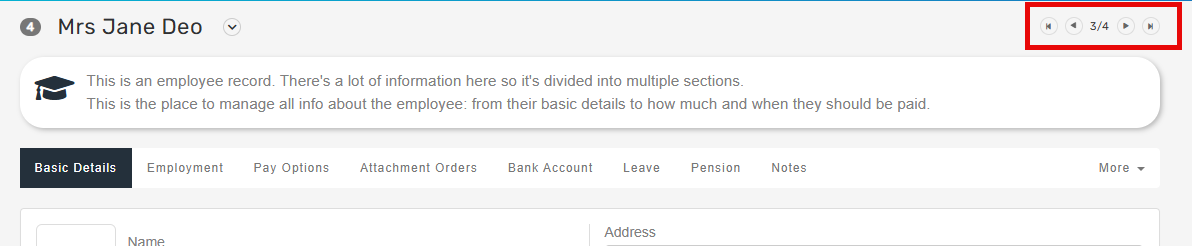

We have added navigation buttons to skip between employees, the current tab selected will now be automatically selected when moving to the new employee.

15th July

-

You can now run a pension report for Aegon Smart Enrol. This has to be set by:

-

Open the required company.

-

Go to Pensions.

-

Select the required pension.

-

Go to Provider.

-

Go to CSV Format and select Aegon Smart Enrol.

The report can be produced using the Pensions & AE report.

-

14th July

-

You can now import and update benefits, this replaces the previous import of benefits.

Fields which can be updated:

-

Declaration Type

-

Tax year

-

Description

-

Value

-

Employee Contribution

-

Asset Type

-

Use of Asset Type

-

Class 1A Employers pay these directly on their employee’s expenses or benefits. Type

-

Non Class 1A Type

-

Payment Type

-

Is Period Value

-

Start Date

-

End Date

-

-

You can now import and update payments and deductions. Permanent addition & deductions payments fields.

8th July

- We now restrict uploading of documents to pdf, doc, docx, jpg, jpeg, png, tiff, csv, xls, xlsx. This is a security measure.