Payroll year end process

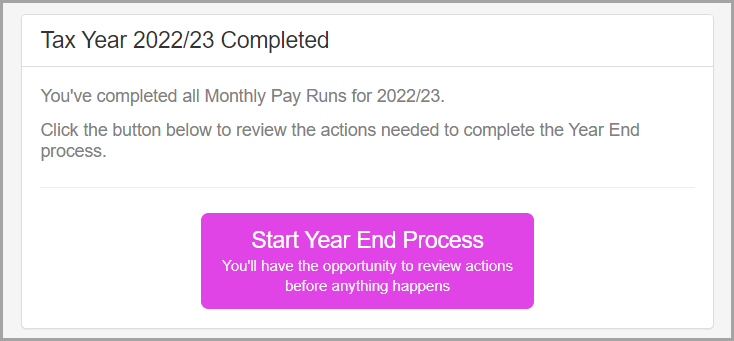

Step 4: Start year end process

-

Once all your pay runs are complete, Start Monthly* Pay Run on the Payroll tab changes to Start Year End Process.

*This displays your relevant pay frequency.

-

Select Start Year End Process.

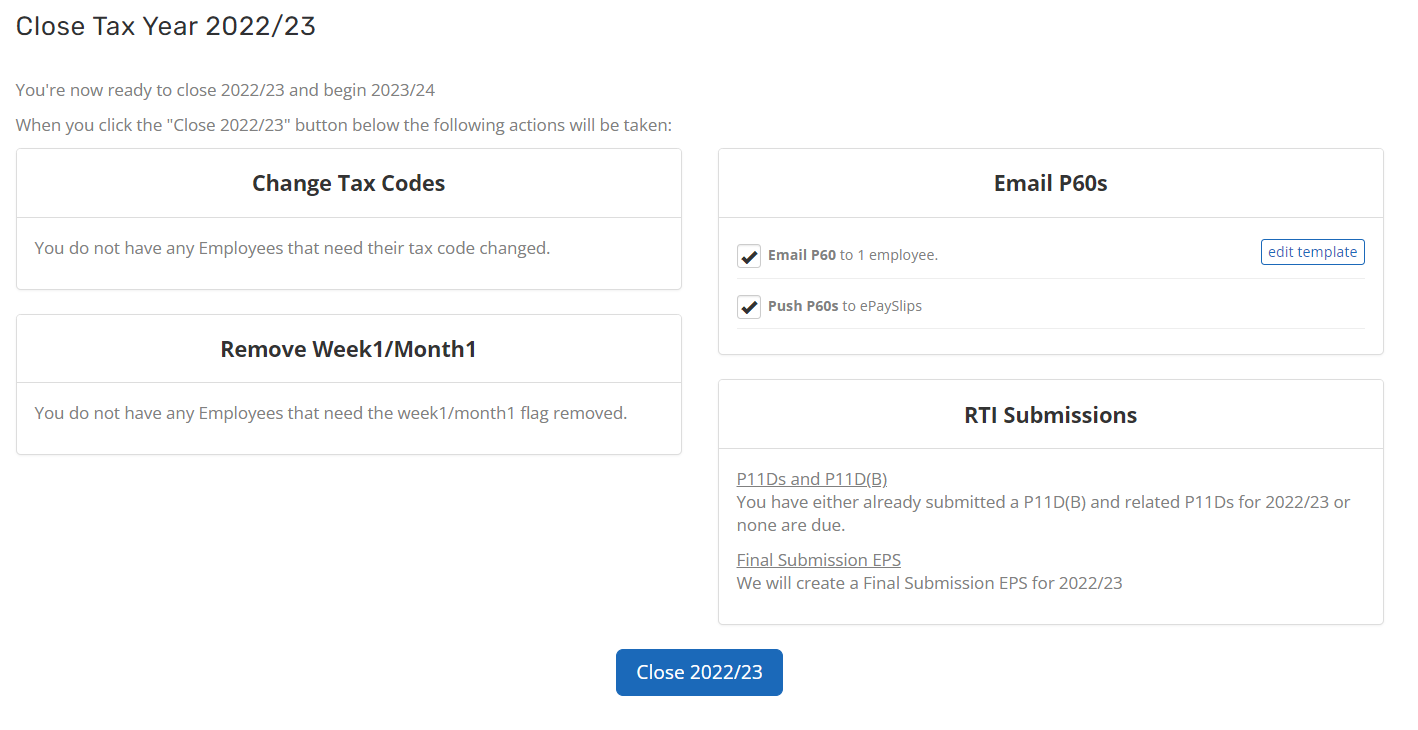

The Close Tax Year screen appears.

-

Preview changes that will take place.

As part of the year end process an EPS Employer Payment Summary is an RTI online submission sent monthly if, you are reclaiming statutory payments, claiming Employment Allowance (EA is only reported once per tax year), reporting Construction Industry Scheme (CIS) deductions or reporting how much Apprenticeship Levy is due. The EPS is also used to report if no employees will be paid for a whole tax month or longer. is generated. This is sent to HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. as normal. If you have payroll automation enabled it will be sent automatically.

P60s will be automatically sent to employees with an email address, My ePayWindow or ePaySlips account.

If you want to send the P60s after moving into the new tax year, you can Produce a duplicate P60

Example:

-

Select Close 2024/25.

If a message displays advising you to configure your pay schedule, select it and confirm your First Payment Date.

-

Choose an entry from the and then drop-down, and enter the date For the Monthly* payroll ending.

*This displays your relevant pay frequency…

-

Select Update.

You are now ready to start your first pay run of the new tax year.

Change Tax Codes

Changes to the employees tax codes are usually applied automatically in bulk, with changes to individual employees tax codes made based on HMRC notices.

Create a case Sign in required | hello@staffology.co.uk | 0344 815 5555

Create a case guide | 'One Number' Telephone guide | HMRC Service Availability External website