Payroll year end process

Step 1: Issue P45s for employees not being paid

HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. rules state that an employee should be made a leaver upon their final pay. This information is not always known. However, if you are not sure the employee is returning to work, they should be made a leaver on the final payroll of the year. should they return to work, they should be set up as a new employee.

This should be completed before the final payroll.

To make an employee a leaver:

Processing a leaver

-

Open the required company.

-

Go to Employees.

-

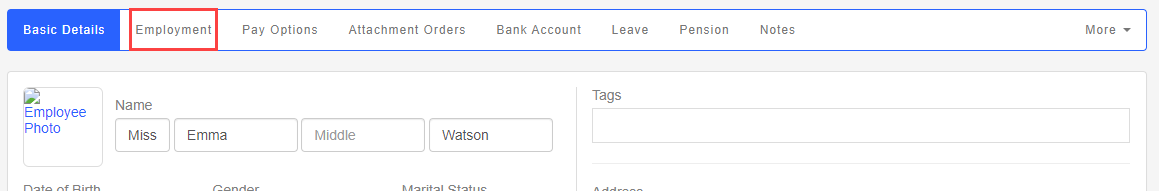

Select the required employee.

-

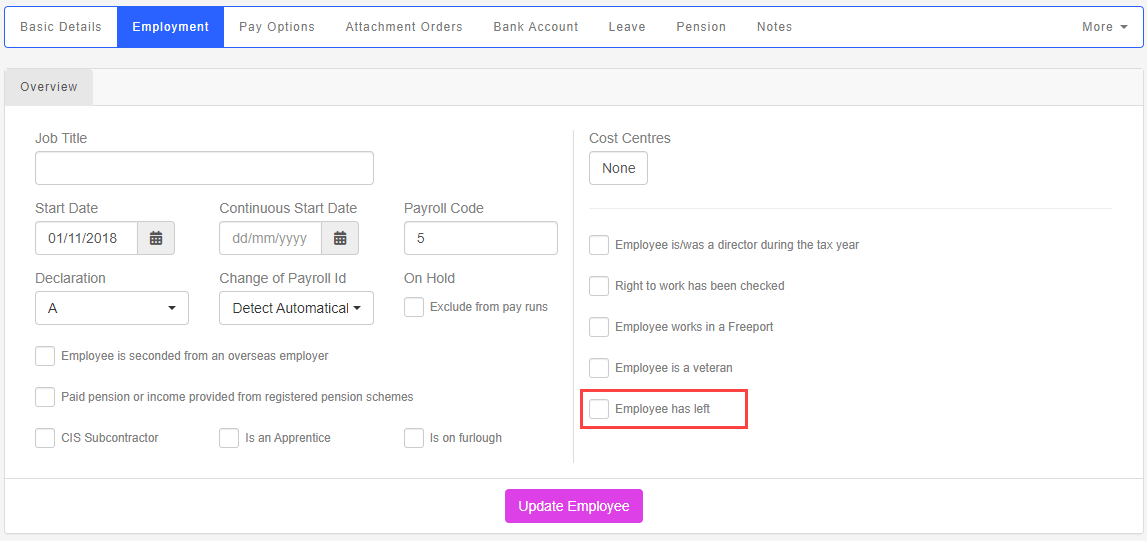

Select Employment.

-

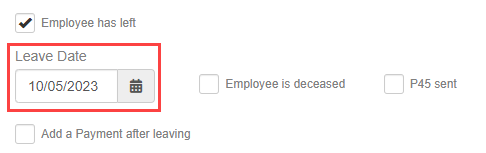

Select Employee Has Left.

-

Enter the Leave Date.

- If required, select Add a Payment after leaving.

-

Select Update Employee.

Pension contributions continue to come out on the payment if the employee meets the criteria and are already a member of a scheme

If an employees dies, you will need use the Employee is deceased indicator as part of the reporting process.

HMRC do not allow a leave date earlier than 6th April of this tax year to be submitted.

Create a case Sign in required | hello@staffology.co.uk | 0344 815 5555

Create a case guide | 'One Number' Telephone guide | HMRC Service Availability External website