What to do when an employee dies

Paying an employee who has died.

The death of an employee or colleague can be a challenging time. There are certain steps needed in payroll to keep HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. informed. Their final pay is subject to tax, but no employee's national insurance A system of contributions paid by workers and employers in the UK, which funds various state benefits, such as the State Pension and Jobseeker's Allowance. contributions are to be taken. You should make all outstanding payments when an employee dies and use the date of death as the leave date.

Indicate that the Employee is deceased, and provide the date they died You must make all outstanding payments when an employee dies. - put the date the employee died into the ‘Date of leaving’ field. - final payments are subject to tax, so use the employee's existing tax code. - final payments are not subject to national insurance, so use NI letter X (unless your payroll software automatically takes zero rate employee's national insurance in the circumstances). - do not produce a p45. Payments to a person who has died are usually made to the personal representative or executor of that person’s estate. as their leave date .

-

Open the required company.

-

Go to Employees.

-

Select the required employee.

-

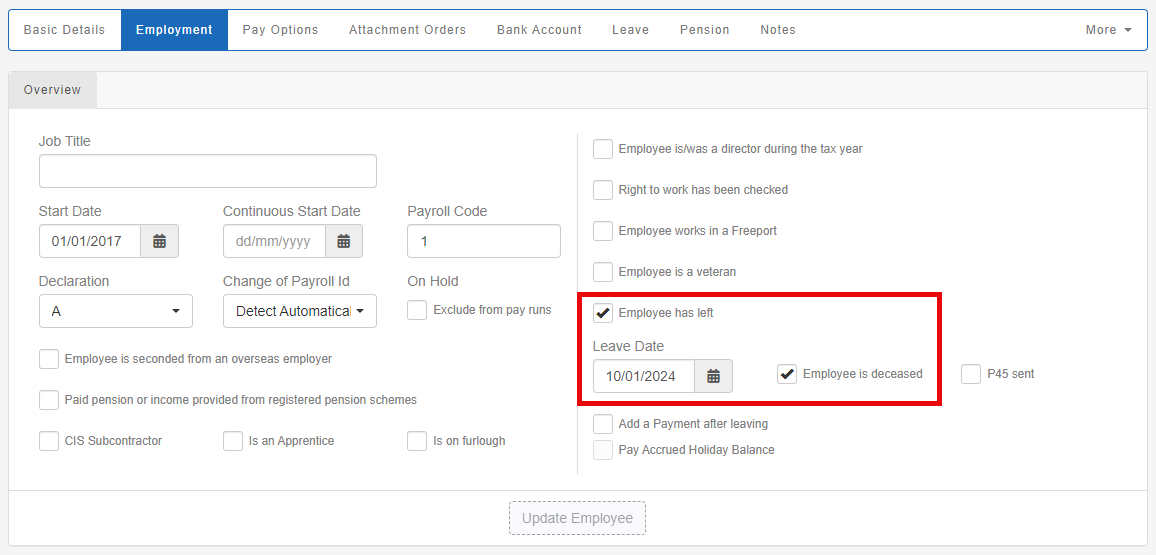

Go to Employment then Overview.

-

Select Employee has left.

-

Enter the Leave date as the date the employee died.

-

Select Employee is deceased.

-

Select Update Employee.

Final payments are subject to tax, so use the employee's existing tax code.

-

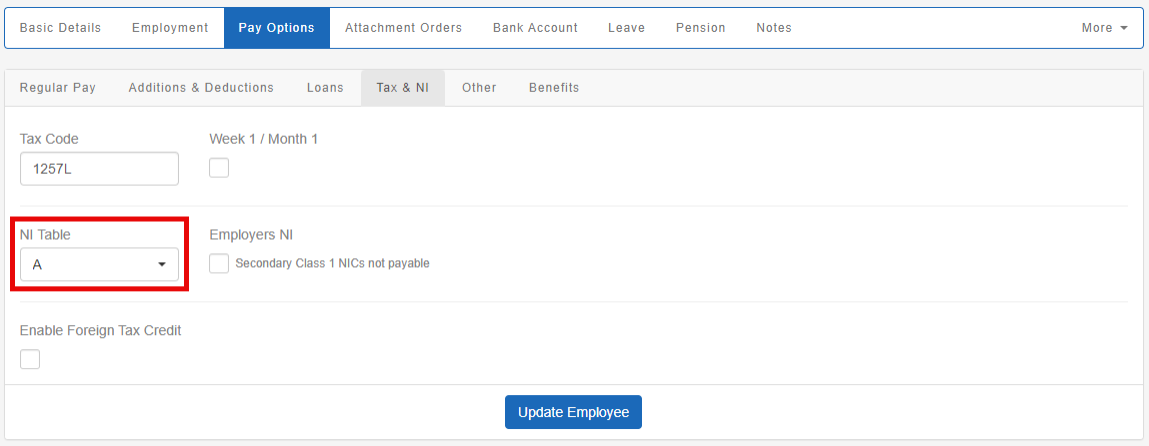

Select Pay Options.

-

Change NI Table to X.

Final payments are not subject to employee's national insurance, so change their national insurance table letter to X if required.

-

Select Update Employee.

Pay employee all outstanding pay elements, including any basic pay The standard amount paid to an employee which excludes additional payments like bonuses, overtime, and allowances., commission, etc as well as unused pro rata holiday allowance.

Do not produce a p45 A P45 is a document issued by an employer to an employee when they leave a job. It shows details about the's employment, including their start and end dates, how much they were paid, and how much tax they paid during their employment. The is made up of four parts: Part 1 is sent to HM Revenue & Customs (HMRC), Part 1A is kept by the employer, and Parts 2 and 3 are to the employee as a record of their earnings and tax paid. The P45 is an important document that employees need to give to their new employer when they start a new job as it provides information about their tax code and previous earnings, which helps the employer calculate their tax and National Insurance contributions.. HMRC will receive all required information when the next FPS Full Payment Submission is an RTI online submission to be sent on or before each payday. This informs HMRC about the payments and deductions for each employee. is submitted.

Making a late payment

Need to make a general payment after leaving? Find out more.

If you need to pay someone after you’ve sent an FPS with their leave date (the date they died).

Use tax code 0T on a ‘week 1’ or ‘month 1’ basis.

-

Open the required company.

-

Go to Employees.

-

Select the required employee.

-

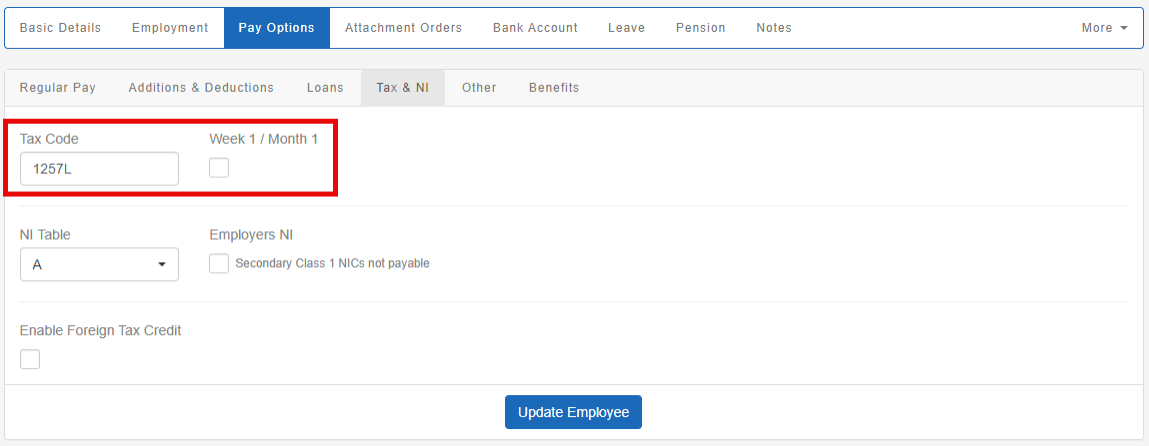

Select Pay Options then Tax & NI.

-

Change Tax Code to 0T.

-

Select Week 1 / Month 1.

-

Select Update Employee.

Good to know...

-

GOV.UK Guide: What to do when an employee dies. External website