Payroll year end process

Step 2: Perform a final reconciliation

If you discover a mistake after the 15th April covering the previous tax year you will need to preform a Earlier Year Full Payment Submission (FPS).

Check the following:

-

Payments made to HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. using your Bank Statement.

-

Check your HM Revenue and Customs (HMRC) online account. This should update within six working days of making payment.

Find out more about making payments to HMRC for Tax and NI.

External website

-

The P30 Month end summary report, highlights the amount to be paid to the HMRC for that tax month. report.

-

The P32 Month end summary report, highlights the amount to be paid to the HMRC for that tax month. summary.

To produce the P30 or P32:

-

Select the required company.

-

Go to Reports.

-

Select Statutory.

-

Select the P30 or P32.

-

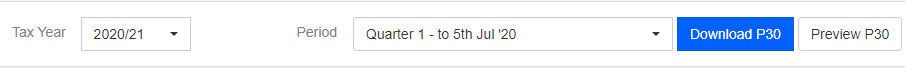

For the P30 choose the Tax Year and Period.

-

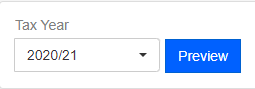

For the P32, choose the Tax Year.

-

-

Select Preview.

The report can be downloaded.

Create a case Sign in required | hello@staffology.co.uk | 0344 815 5555

Create a case guide | 'One Number' Telephone guide | HMRC Service Availability External website