Change payment date

The payment date for a pay run is determined when you set the pay schedule at the beginning of the year. There may be occasions where you wish to change the standard date for one or more employees. For example, if an employee is leaving and you are paying them early or you are paying employees early as a bank holiday falls on the normal payment date.

The payment date is usually the date the employees are paid the money, not when they earn it. Learn more about the tax calendar.

Before you finalise a pay run, you can change the pay date on individual or multiple payslips. If you have already finalised, you can reopen the period.

-

Open the required company.

-

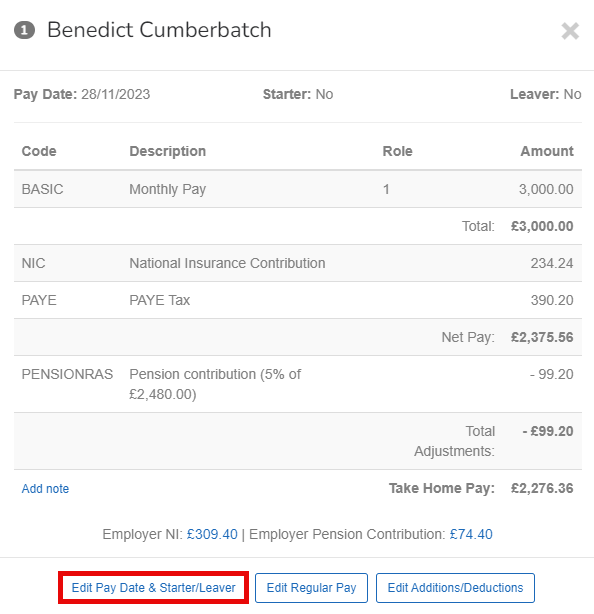

Go to Payroll and Select the required employee.

-

Select Edit Pay Date & Starter/Leaver.

-

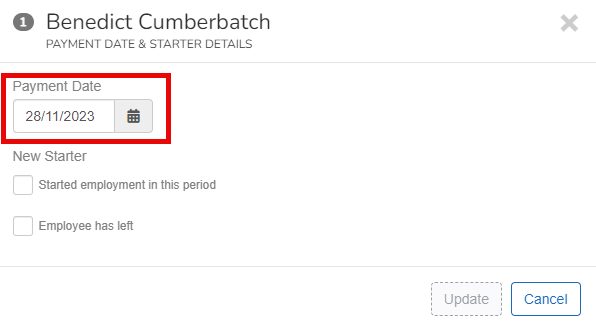

Select the new Payment Date.

-

Select Update.

If you need to update multiple employees at once:

-

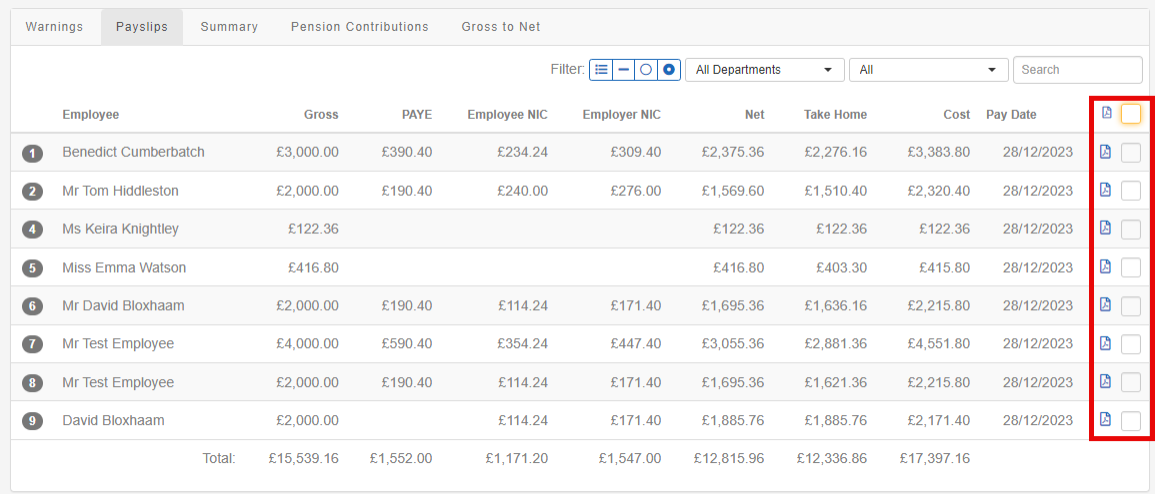

Go to the open payroll.

-

Select each employees required using the filter checkbox.

-

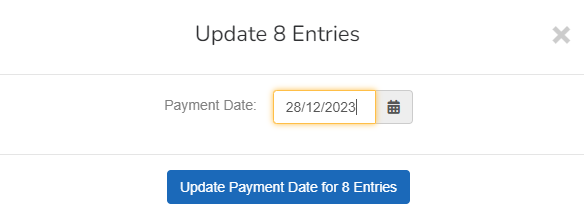

Go to with X selected entries... (X will be the number of employees selected.

-

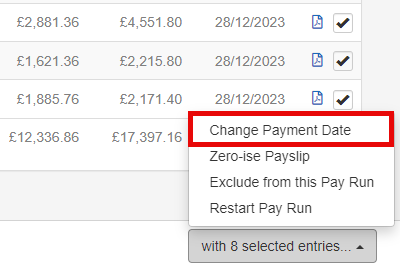

Select Change Payment Date.

-

Enter the required new Payment Date.

-

Select Update Payment Date for X Entries.

How does Staffology Payroll deal with the change in payment date on the FPS Full Payment Submission is an RTI online submission to be sent on or before each payday. This informs HMRC about the payments and deductions for each employee. submission?

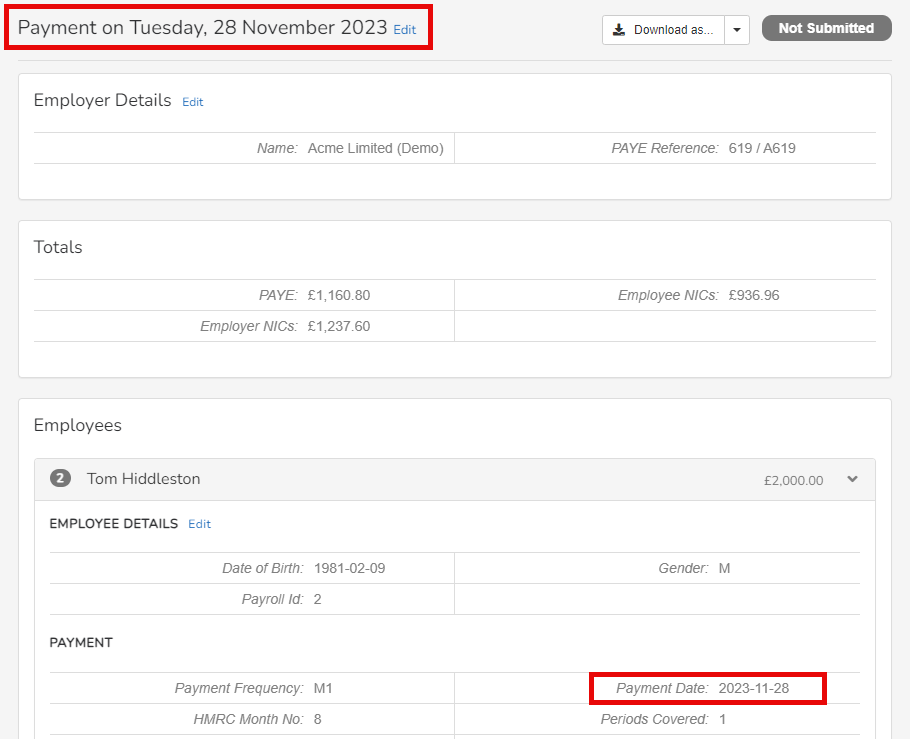

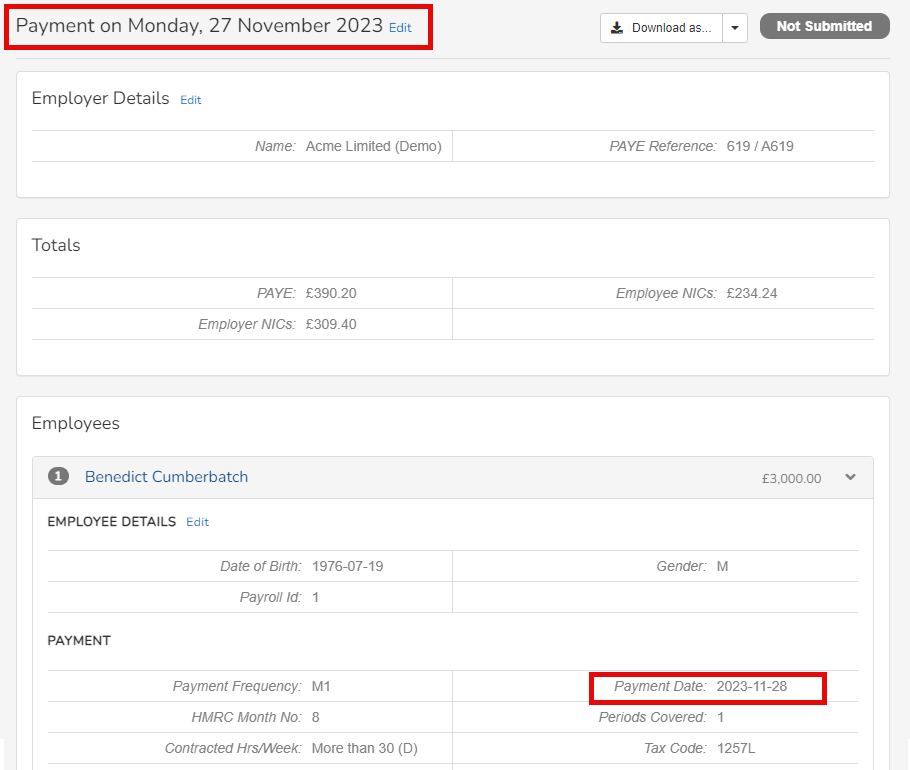

After you finalise the payroll, Staffology Payroll will create a separate FPS for each payment date changed within this payrun, however the original payment date is listed on employee contained within the submission. The amended payment date will show for heading of the submission.

To view the FPS: Go to the RTI Real Time Information is the current method for reporting PAYE to HMRC, comprising FPS and EPS submissions. menu.

This new FPS will contain the original payment date, based on the pay schedule.

FPS without a payment date change shows the normal payment date, based on the pay schedule for both the overall submission and on each employee contained within the FPS.

When the payment date is changed, the FPS shows the amended payment date in the title of the submission, however the original payment date is still shown for each employee.

Select Edit if you want or need to change the date on the title of the submission.

Good to know...

-

Changing the payment date will change the RTI deadline for the FPS. HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. rules state that the FPS must be sent on or before the payment date for the employee.

-

The payment date is usually the date the employees are paid the money, not when they earn it. Learn more about the tax calendar.

-

A separate FPS for each changed payment date is generated.

-

This new FPS will contain the original payment date, based on the pay schedule against each employee.

-

The amended payment date will show for heading of the submission.

-

Select Edit if you want or need to change the date on the title of the submission.