How to process a Supplementary Pay Run.

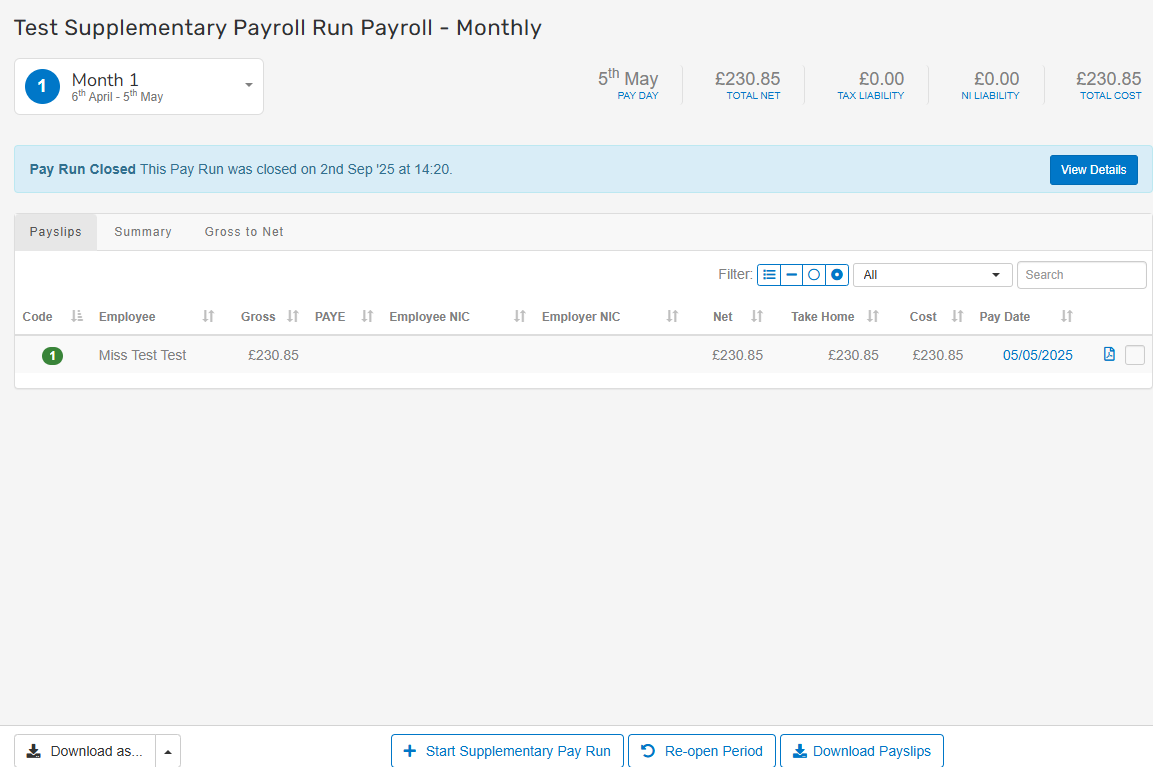

Go to your most recently finalised Payroll run, by selecting Payroll, View Previous Runs, and selecting the most recently finalised Pay Run.

To process a supplementary pay run for a historic leaver, please see this guide.

-

Select Start Supplementary Pay Run.

-

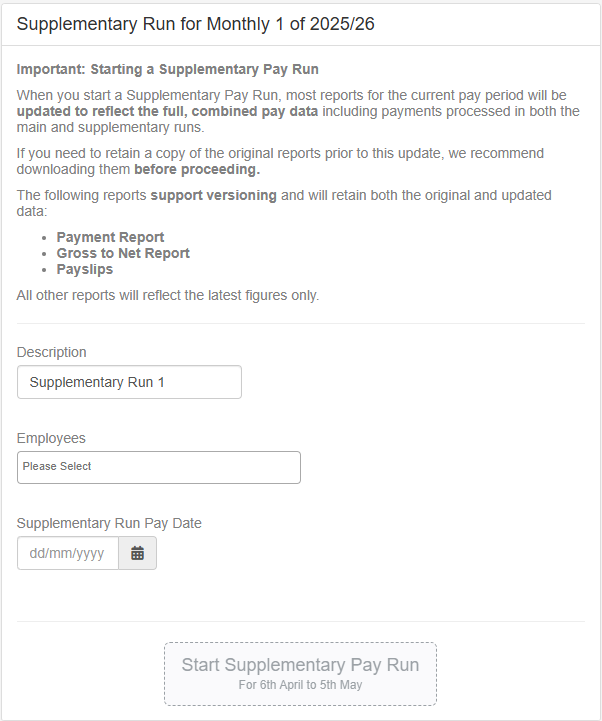

Enter a Description for the supplementary run – this will help you identify it later.

-

Select from the dropdown the Employees who you wish to include in the Supplementary Run.

-

Enter a Supplementary Pay Run Date - the date employees should receive their payment. This must be on or after the current payment date, but before the next payment date – this will be used when producing bacs Stands for Bankers' Automated Clearing Services. It's an electronic system for transferring money directly between bank accounts in the UK, often used for payroll. files.

-

Select Start Supplementary Payroll Run.

-

All employees you selected will appear in the pay run. Their payslips will appear blank.

-

While the pay run is open, apply any permanent changes or updates as part of your usual workflow. If the updates don’t show immediately, you may need to force an update on the employee’s pay run entry.

-

You can check an employee’s payslip A statement provided by an employer to an employee, detailing their wages, deductions, and net pay for a specific pay period.This is a legal requirement under the employment rights act and should be received on or before the pay date. in the usual way. There will now be the option to select ‘Full Pay Run’ or ‘Supplementary Run’. This will allow you to view the full payslip with the employees or any changes added within a supplementary run. This extends to the PDF payslip.

-

Once you are happy with the changes made within the Supplementary Payroll Run, you can go ahead and finalise the payroll in the usual manner.

For any questions regarding reporting and other subjects, you can refer to our Supplementary Pay Run FAQs.