Supplementary Pay Run FAQs

Which employees can be included in a Supplementary Pay Run?

There are three types of employees that can be included in a Supplementary Pay Run:

-

Employees that were in the original Pay Run.

-

New Starters that were added after the Main Run closing, and their start date is on or before the end of the Pay Period.

-

Historic Leavers that you have flagged as ‘Payment after leaving’ in their employee record.

Will I be able to create multiple Supplementary Pay Runs for the same period?

Yes! We have designed the feature so you can create as many Supplementary Pay Runs as required for a single Pay Run Period. You will be able to create multiple Supplementary Runs containing different or the same employee(s). Only one supplemental pay run may be open at any given time.

Can I still Re-open the Pay Run and make corrections that way?

Yes, we are not removing the ability to make corrections this way. If you prefer to make changes by re-opening the Pay Run, and do not need reports that show the difference, then you will still be able to use this functionality.

Can I re-open the original pay run after completing a supplementary run?

No, you cannot re-open the original pay run once a supplementary run has been completed. To re-open the original pay run, you would first need to re-open and delete the supplementary pay run.

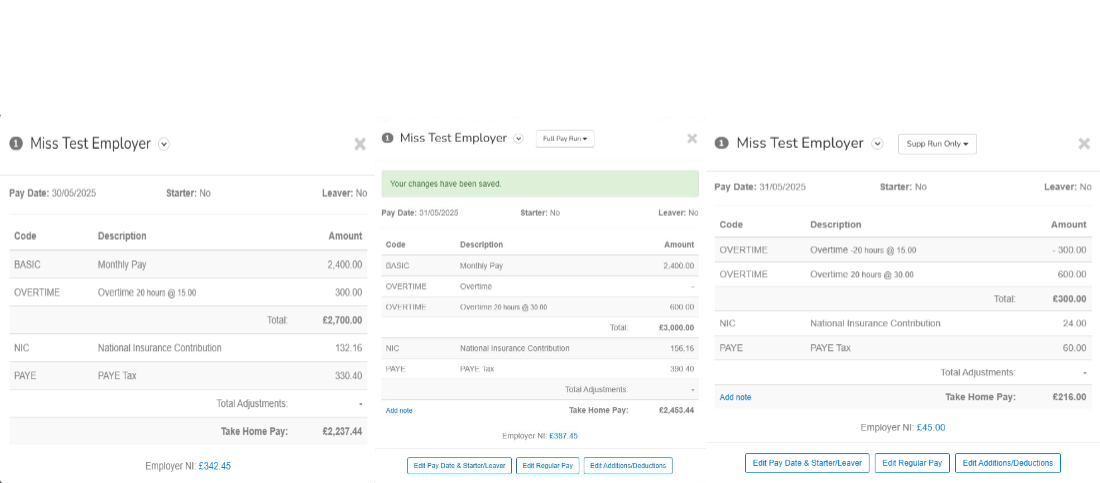

How should pay rate changes be handled in a Supplementary Run?

To correct an incorrect pay rate in a supplementary run:

-

Option 1: You can zeroise the payline which will reverse the original payment. Then, enter a new pay line with the correct rate and units that should have been paid. This approach ensures a clear audit trail and accurate payroll adjustments.

-

Option 2: Alternatively, you can delete the incorrect pay line and then add a new line with the correct details. However, note that deleting lines may not provide the same level of visibility for audit purposes.

What reports are available for a supplementary run?

The following reports support supplementary payroll runs and include versioning options:

-

Required Payments Report – includes payment differences and Bacs Stands for Bankers' Automated Clearing Services. It's an electronic system for transferring money directly between bank accounts in the UK, often used for payroll. files.

-

Gross to Net Report – provides detailed breakdowns of pay changes.

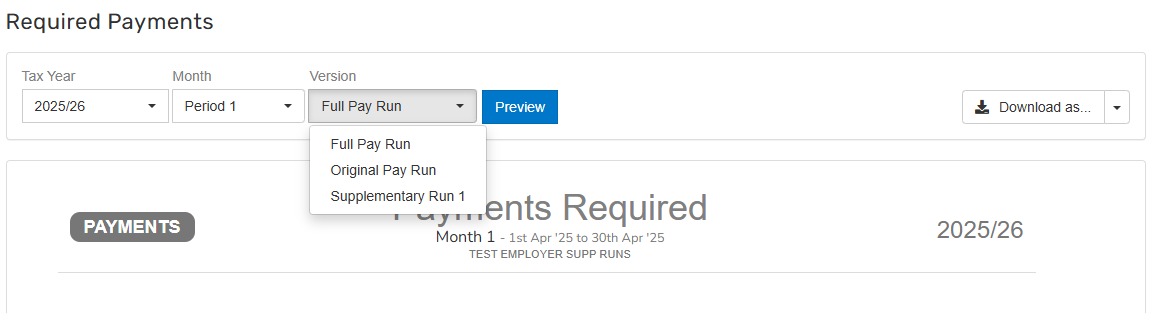

Both reports now feature a Version dropdown that lets you select which version of the payroll run to view.

-

Full Pay Run – Displays the latest PayRunEntry for each employee who had an entry in that pay period. This reflects the most up-to-date version of the payroll.

-

Original Pay Run – Shows only the PayRunEntries that were part of the original (main) payroll run, reported in their original state as of the end of that run.

-

Specific Supplementary Run – Displays only the PayRunEntries included in the selected supplementary run, showing the difference between that entry and the most recent one prior to it. This view isolates changes specific to that supplementary run.

All other reports will show the Full Pay Run version as default.

What Pay Run Automation settings still apply when finalising a supplementary run?

When finalising a supplementary run, some Pay Run Automation settings will continue to function, while others will be disabled.

The following settings will remain active:

-

Send Payslips

-

Send P45s

-

Send Pension Letters

The following settings will be disabled for supplementary runs:

-

Post Payments

-

Post Pension to Connected Service

-

Auto-Open Next Pay Run

-

Auto Submit Journal

Will I be able to create ‘Pre-Runs’?

This feature will not contain ‘Pre Runs’ that are ran before the main Pay Run. This feature or enhancement may be considered in the future.

Good to know:

-

The Full Payment Submission Full Payment Submission is an RTI online submission to be sent on or before each payday. This informs HMRC about the payments and deductions for each employee. (FPS) will always show the original payment date and send to HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. with correction to earlier submission (Late Reason H)

-

Pension contribution changes processed in a supplementary run must be managed externally. These changes will not trigger automatic resubmission to connected services.

-

To account for payment differences, additional Bacs files can be generated using the Required Payments Report and submitted manually. Payroll calculations will assume that any overpayments have already been recovered.

-

Payslips to connected services and sent via email will always send the ‘Full Pay Run’ version.

-

Auto Emails will always send the ‘Full Pay Run’ Version.

-

Rollback over a supplementary payroll run is not supported

-

DPS notices will not be applied automatically if a supplementary pay run is in progress

Find out how to process a Supplementary Pay Run.