Step by step guide to running a payroll

Step 6: Check HMRC notices

If you receive HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. notices by post, you apply the changes in the employee record. If you have no HMRC notices, you can skip this step.

We can connect to HMRC's Data Provisioning Service and retrieve and apply notices for you. These notices include:

-

P6 Updated Tax Code and previous pay detail.

-

SL1 Start Student Loan A government loan that students can use to help pay for their education..

-

PGL1 Start Postgraduate Loan.

-

P9 Updated Tax Code.

-

SL2 Stop Student Loan.

-

PGL2 Stop Postgraduate Loan.

-

Open the required company.

-

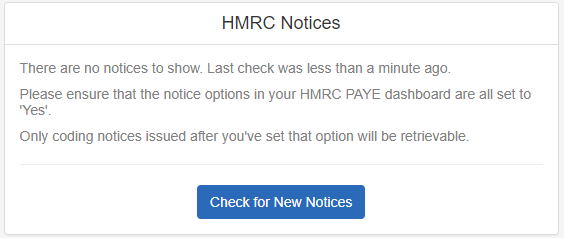

Go to HMRC.

-

Select Notices.

-

Select Check for New Notices.