Step by step guide to running a payroll

Step 7: Make any temporary changes to the payroll

If you have no changes to make in this payroll run, you can skip this step.

-

Open the required company.

-

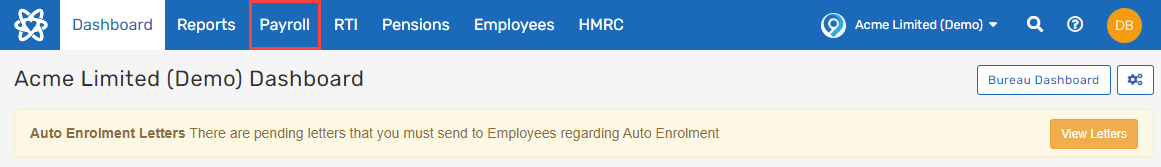

Select Payroll.

-

If you pay multiple pay frequencies, choose the frequency you are running payroll.

-

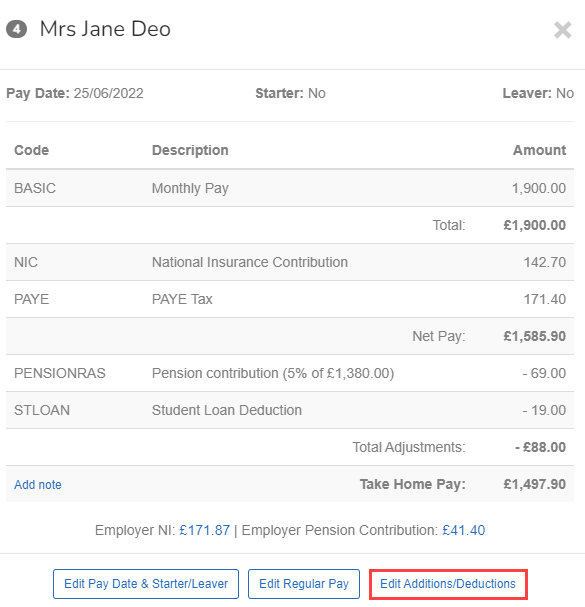

Select the required employee from the list.

You can add a note, select Add note.

To edit an item already on the payslip A statement provided by an employer to an employee, detailing their wages, deductions, and net pay for a specific pay period.This is a legal requirement under the employment rights act and should be received on or before the pay date.:

-

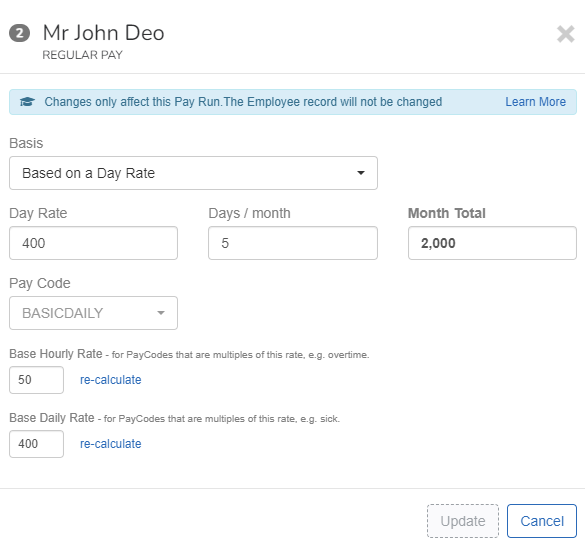

Select the item and make the required changes.

Making changes to the Basic pay The standard amount paid to an employee which excludes additional payments like bonuses, overtime, and allowances. requires you to re-calculate Hourly Rate. Select re-calculate .

-

Select Update.

To add an element to the pay slip:

-

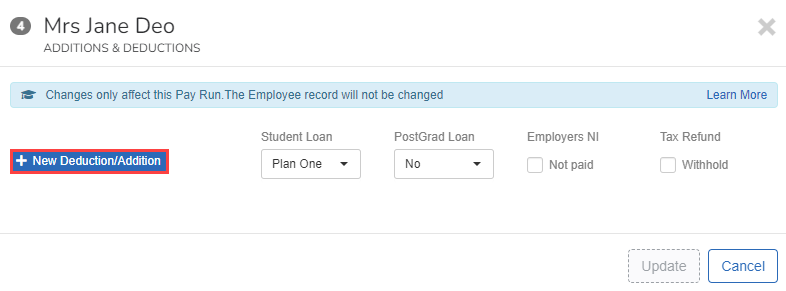

Select Edit Additions/Deductions.

-

Select New Deduction/Addition.

-

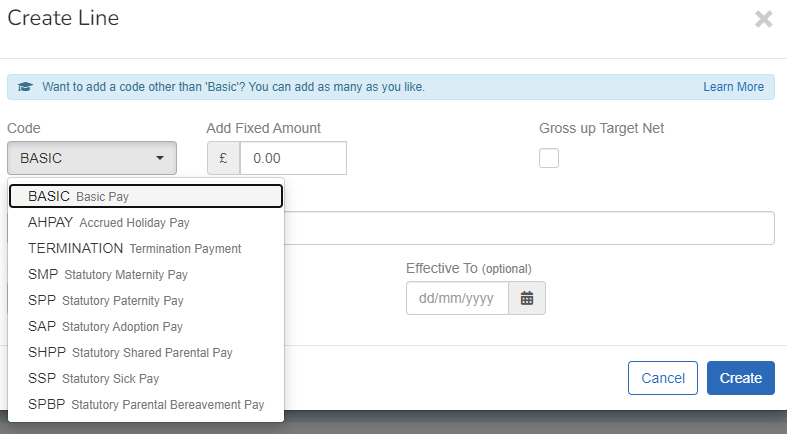

Select the required Code.

-

Enter any further required information.

-

Select Create.

-

-

Repeat for each pay element and employee.

Changes made during payrun only apply to that pay period. The payroll is recalculated after making each change.

-

View the payslip by selecting the payslip icon.