Step by step guide to running a payroll

Step 4: Mark employees as leavers

If you have no leavers this pay period, you can skip this step. Once an employee has been made a leaver, they receive a P45 A P45 is a document issued by an employer to an employee when they leave a job. It shows details about the's employment, including their start and end dates, how much they were paid, and how much tax they paid during their employment. The is made up of four parts: Part 1 is sent to HM Revenue & Customs (HMRC), Part 1A is kept by the employer, and Parts 2 and 3 are to the employee as a record of their earnings and tax paid. The P45 is an important document that employees need to give to their new employer when they start a new job as it provides information about their tax code and previous earnings, which helps the employer calculate their tax and National Insurance contributions.. This will be produced later.

Processing a leaver

-

Open the required company.

-

Go to Employees.

-

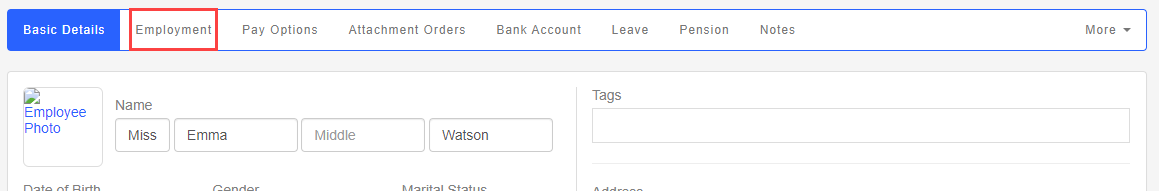

Select the required employee.

-

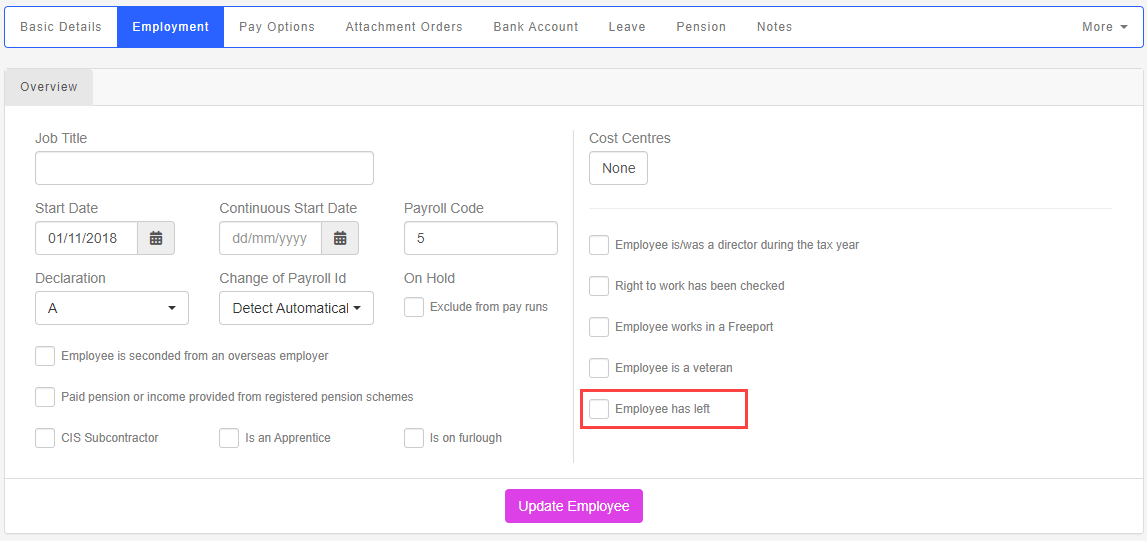

Select Employment.

-

Select Employee Has Left.

-

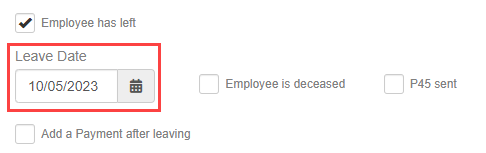

Enter the Leave Date.

- If required, select Add a Payment after leaving.

-

Select Update Employee.

Pension contributions are taken from the payment if the employee meets the criteria and is already a member of a scheme.

If an employees dies, you must use the Employee is deceased indicator as part of the reporting process.

Step 5: Open the payroll run.

Good to know...

-

Once marked as a leaver, you produce a P45 for the employee. This will be produced later.

-

You can make employees leavers in bulk.

-

If you need to pay the employee after they have left, you need to make a payment after leaving.