Configure: Occupational maternity pay (OMP)

When an employee is expecting a baby, they may be entitled to Occupational maternity pay in addition to Statutory Maternity Leave (SML) and Statutory Maternity Pay (SMP).

If they are entitled, employees will always be paid Statutory Maternity Pay (SMP Statutory Maternity Pay is the pay an employer must give to female employees on maternity leave, for up to 39 weeks.) as a minimum.

You can create multiple occupational policies. Within each policy, you can set different entitlements depending on length of service. Within each length of service band, you can set different entitlements and number of weeks the entitlement will apply.

-

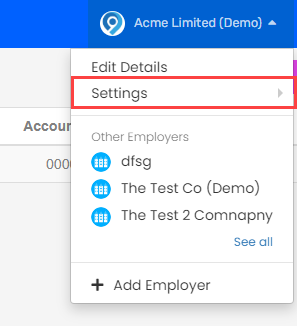

Open the required company.

-

Go to your company name > Settings.

-

Select Occupational Pay.

-

Go to Maternity and select Add a Policy.

Select a policy to edit.

-

Give the policy a Name and select Entitlement Calculation On.

-

Choose if maternity is to be calculated in Days or Weeks.

If the employee is part time, weeks will take into account the employees working pattern. For example, if an employee works two days a week and you set the policy to pay 6 weeks, the employee will get 12 days occupational pay.

-

Select Pay Calculated on and choose from:

-

Percentage Of Annual Salary: Use the employees annual salary as the basis of the additional payment to the employee.

-

Percentage Of Average Weekly Earnings: Using the average weekly earnings will take into account all earnings subject to National Insurance A system of contributions paid by workers and employers in the UK, which funds various state benefits, such as the State Pension and Jobseeker's Allowance. (NI). This is calculated based on the relevant period.

The relevant period is between two dates. Starting at the end of the period and working backwards:

-

Date 1: The end of the relevant period is the last normal pay day on, or before the Saturday of the qualifying week.

-

Date 2: Start of the relevant period is the day after the last normal pay day falling at least 8 weeks before the end of the relevant period.

-

-

Percentage Of Pay Code Set: Using the selected pay code set will take into account all earnings subject to National Insurance (NI). This is calculated based on the relevant period.

-

-

Select Create Policy.

-

Select the policy name.

-

Select New Service Band.

-

Select a service band description to edit.

-

-

Enter a Description.

-

Enter From (Months) and To (Months).

The From (Months) and To (Months) refer to length of service. The entitlements run sequentially based on the Priority Order. Drag the service band to change the Priority Order.

For a single scheme enter 0 to 9999.

-

Select Create / Update Policy

- Select the description of the policy.

-

Select Add Entitlement Band.

-

Select an entitlement band description to edit.

-

-

Enter the Percentage of full pay and the Entitlement (Weeks).

The entitlement (Weeks) is the length of time the employee receives the percentage of full pay. If they are entitled, employees will always be paid Statutory Maternity Pay (SMP) as a minimum.

-

Select Include statutory pay in this value if required.

If selected, the percentage of full pay will take the statutory maternity payment and "top it up" to the percentage of full pay. Otherwise, the statutory maternity payment will be paid on top of the percentage of full pay.

-

Select Create / Update.

To create an additional entitlement band, select Add Entitlement Band.

-

Select Update.

To create an additional service band, select New Service Band.

-

Select Update.

Good to know...

-

GOV.UK Guide: Maternity pay and leave External website

-

GOV.UK Guide: Pregnant employees' rights External website

-

GOV.UK Guide: Employee rights when on leave External website

-

ACAS Guide: Managing your employee's maternity leave and pay External website