Leave settings (Employer)

Jump to custom settings for Days | Accrual - Money | Accrual - Days - Accrual - Hours

-

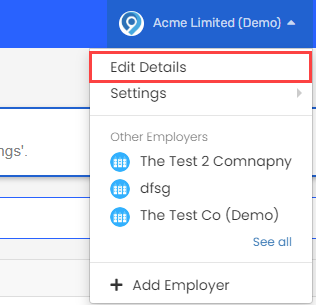

Select the required employer.

-

Go to your company name > Edit Details.

-

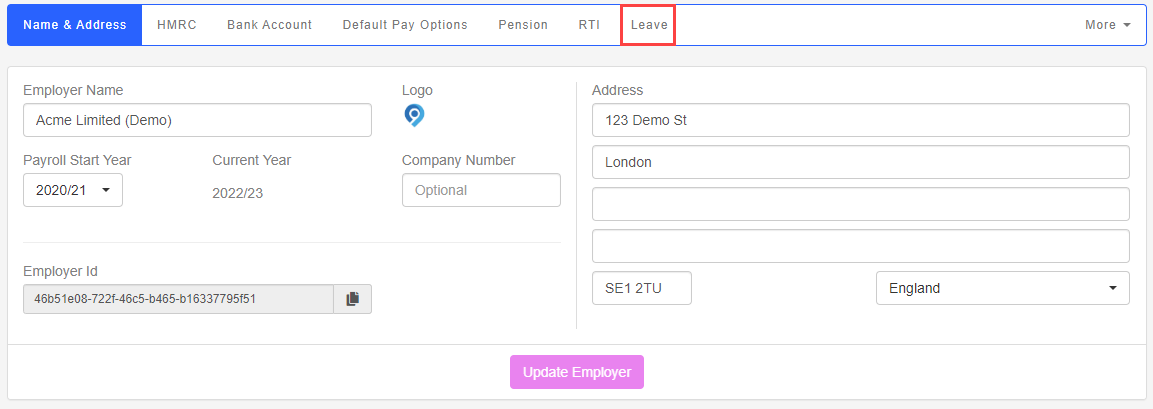

Select Leave.

-

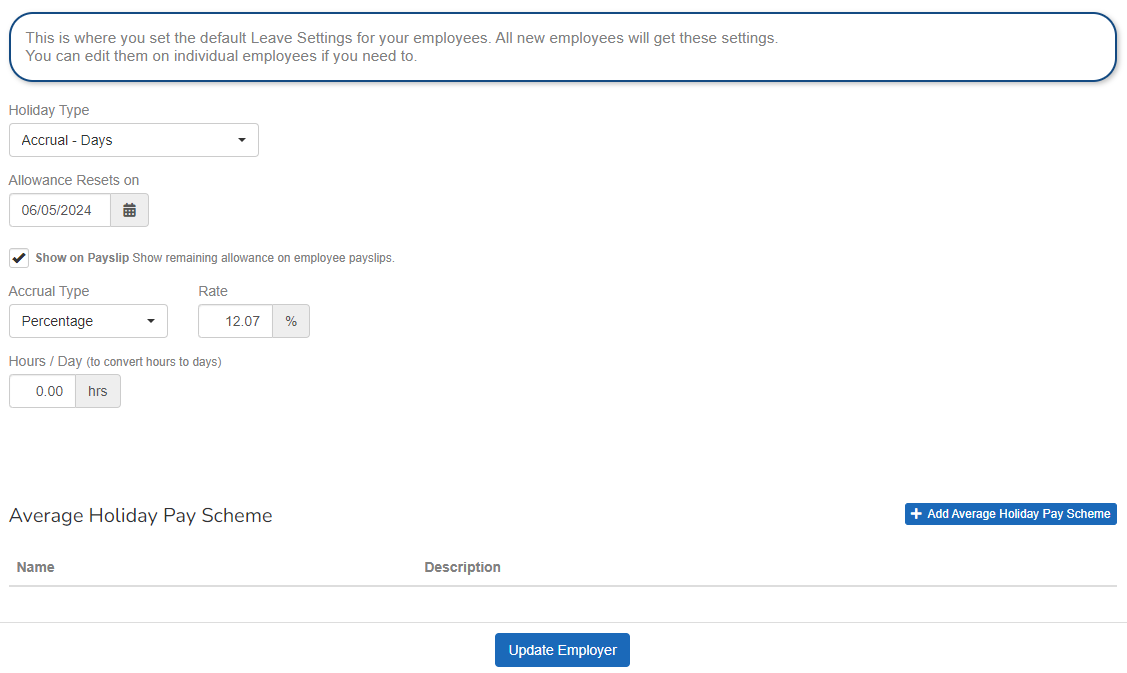

Select the Holiday Type:

- Days: The holiday allowance is set as a number of days.

-

Accrual - Money: Accrue payments to be used for holiday instead of days.

-

Accrual - Days: Accrue holiday days for time worked.

-

Accrual - Hours: Accrue holiday days for time worked.

-

Select Add Average Holiday Pay Scheme if required.

-

Select Update then Update Employee.

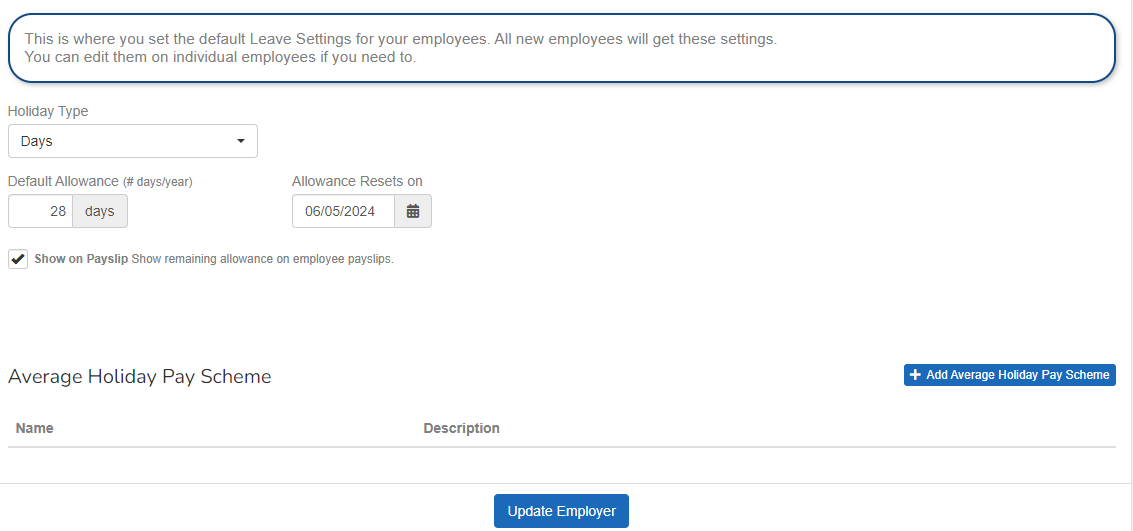

Days

-

Default Allowance: Enter the number of days holiday allowance.

-

Allowance Resets on: Enter the date the holiday allowance resets.

-

Show on Payslip A statement provided by an employer to an employee, detailing their wages, deductions, and net pay for a specific pay period.This is a legal requirement under the employment rights act and should be received on or before the pay date.: Show remaining allowance on employee payslips.

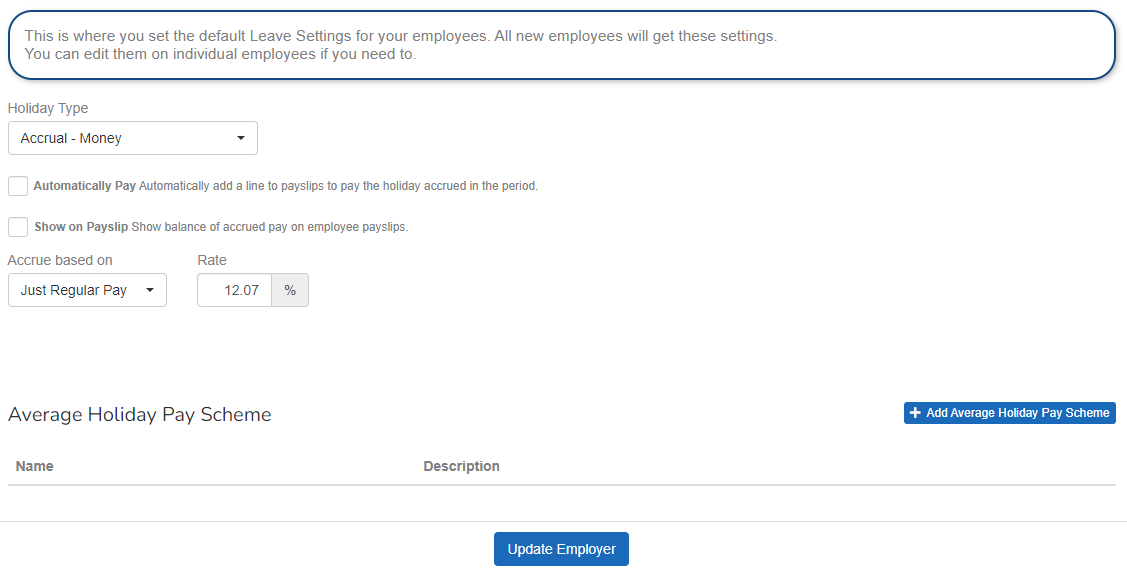

Accrual - Money

-

Automatically Pay: Automatically add a line to payslips to pay the holiday accrued in the period.

-

Show on Payslip: Show remaining allowance on employee payslips.

- Accrue based on:

-

Just Regular Pay: Just the regular amount for the period (excluding any additions or deductions).

-

All Gross Pay The total amount earned by employee before taxes and other deductions are taken.: All taxable payments made to the employee.

-

Working Pattern Hours: Will be calculated based on the Hours on the Employee working pattern.

-

Pay Code Set: Pay code set value for the period (Hours values).

-

-

Rate: The default rate is set to 12.07%.

Accrual - Days

-

Allowance Resets on: Choose the accrual reset date.

-

Show on Payslip: Show remaining allowance on employee payslips.

-

Accrual Type:

-

Percentage: Set the Rate. The default rate is set to 12.07%.

-

Set Amount: Set the Rate as a of days. The default is set to 12.07 days.

-

Accrual - Hours

-

Automatically Pay: Automatically add a line to payslips to pay the holiday accrued in the period.

-

Show on Payslip: Show remaining allowance on employee payslips.

-

Default Rate to use for Payment:

-

Hourly Rate: Will use the employees base hourly rate.

-

Average Holiday If an Employee's work has no fixed or regular hours, their holiday pay will be based on the average pay they received over the previous 52 weeks (or a average based on the available number of weeks if less than the full 52. Rate: Will use the rate calculated from a user defined holiday scheme.

-

Fixed Period Amount: Will allow the user to set the rate for payment on entry.

-

-

Accrue based on:

-

Working Pattern Hours: Will be calculated based on the Hours on the Employee working pattern.

-

Pay Code Set: Pay code set value for the period (Hours values). You can choose the required pay code set.

-

-

Rate: The default is 12.07%. Update if required.

-

Maximum Period Accrual: Enter the cap of the accrued hours in a pay period. Leave blank to have no cap.

Average Holiday Pay If an Employee's work has no fixed or regular hours, their holiday pay will be based on the average pay they received over the previous 52 weeks (or a average based on the available number of weeks if less than the full 52. Scheme: Select + Add Average Holiday Pay Scheme to create one or more average holiday pay schemes.