Employment allowance

HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers.: Employment Allowance A scheme where a business can claim a reduction in the amount of employer's National Insurance contributions (NICs) they have to pay. - Eligibility

Take me there External Website

To claim Employment Allowance:

-

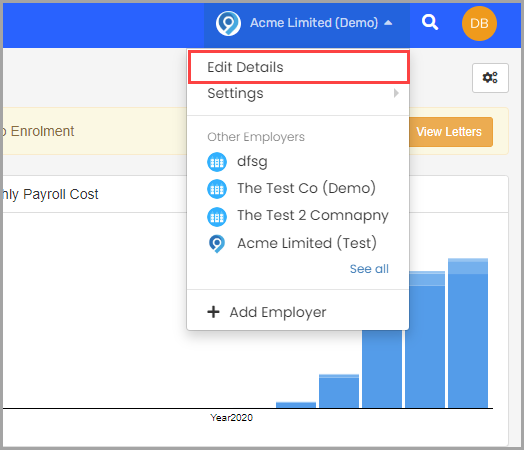

Select the required employer.

-

Select the employer name and choose Edit Details.

-

Go to the HMRC tab.

-

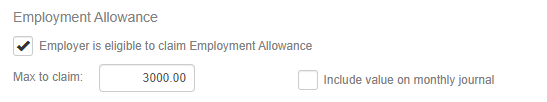

Select Employer is eligible to claim Employment Allowance.

-

Edit the Max to claim if you are splitting the employment allowance between companies.

HMRC: Employment Allowance - Connected companies

Take me thereExternal Website -

Select Include value on monthly journal if required.

The value is included on the journal after your finalise the pay run.

-

Select Update Employer.

HMRC requires an EPS Employer Payment Summary is an RTI online submission sent monthly if, you are reclaiming statutory payments, claiming Employment Allowance (EA is only reported once per tax year), reporting Construction Industry Scheme (CIS) deductions or reporting how much Apprenticeship Levy is due. The EPS is also used to report if no employees will be paid for a whole tax month or longer. to be sent to notify them of the change in the status of the claim.

-

Select Send EPS Now to automatically send an EPS.

Claim Amount

-

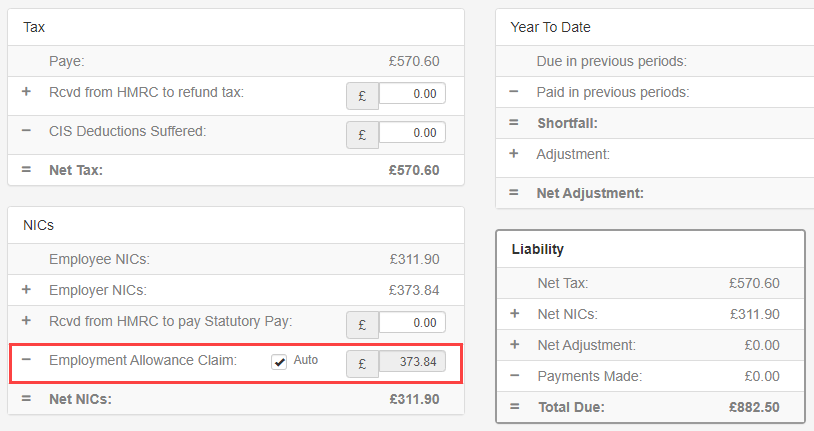

Select the required company and go to HMRC.

-

Select the period.

-

To edit the amount remove the flag from Auto.

-

Enter the required amount.

-

Select Save changes.

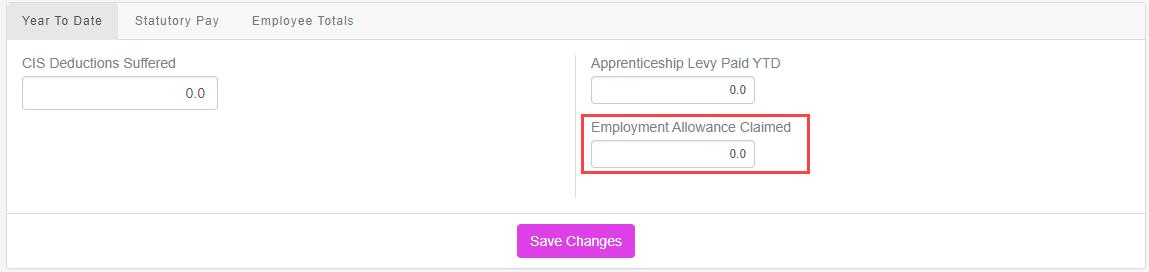

Opening balances

If you start using Staffology Payroll part way thought the year and have already claimed employment allowance,

-

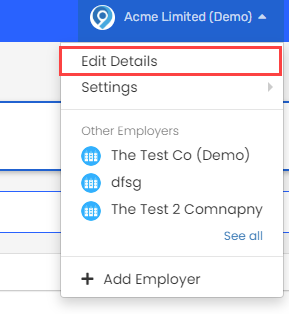

Select the required company.

-

Go to Edit details.

-

Select Opening balances.

-

Enter the Employment Allowance Claimed amount.

-

Select Save Changes.