Make an employee a leaver

Processing a leaver

-

Open the required company.

-

Go to Employees.

-

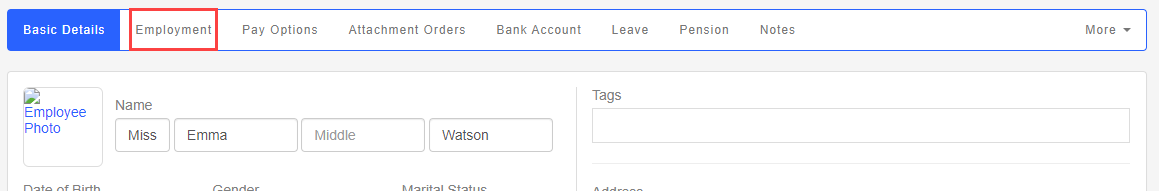

Select the required employee.

-

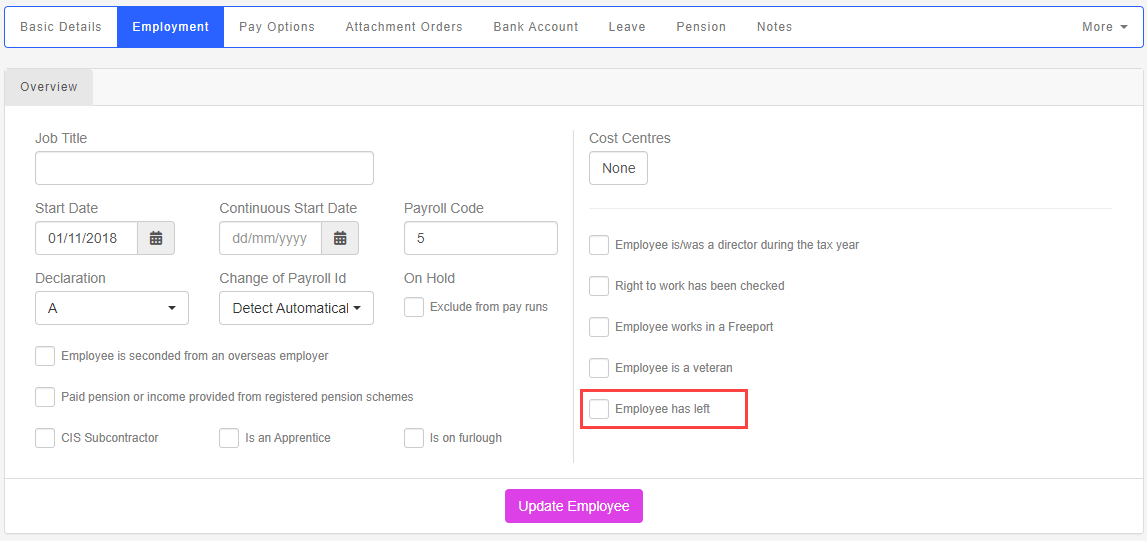

Select Employment.

-

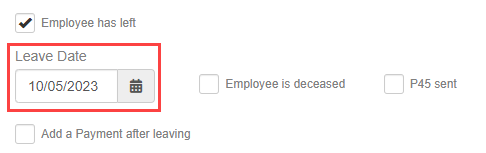

Select Employee Has Left.

-

Enter the Leave Date.

- If required, select Add a Payment after leaving.

-

Select Update Employee.

Pension contributions continue to come out on the payment if the employee meets the criteria and are already a member of a scheme

If an employees dies, you will need use the Employee is deceased indicator as part of the reporting process.

Multiple leavers

If you have multiple people all leaving on the same date, there is a way to do this quickly.

-

Go to Employees.

-

Select the employees you wish to mark as a leaver.

-

Go to the with (selected employees) menu.

-

Select Mark as Leaver and enter the Leaving Date.

-

Select Update Employees.

Payment After Leaving: If you need to pay the employee after they have left, you need to make a payment after leaving.

Good to know...

-

Once marked as a leaver, you can produce a P45 for the employee.

-

You can make employees leavers in bulk.

-

If you need to pay the employee after they have left, you need to make a payment after leaving.