Tax & NI

-

Open the required company.

-

Go to Employees.

-

Select the required employee.

-

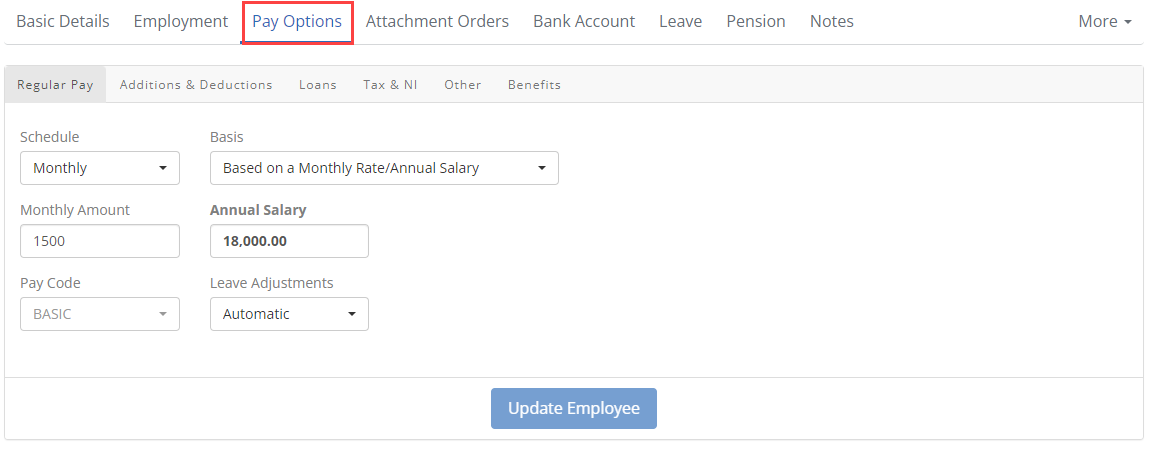

Select Pay Options.

-

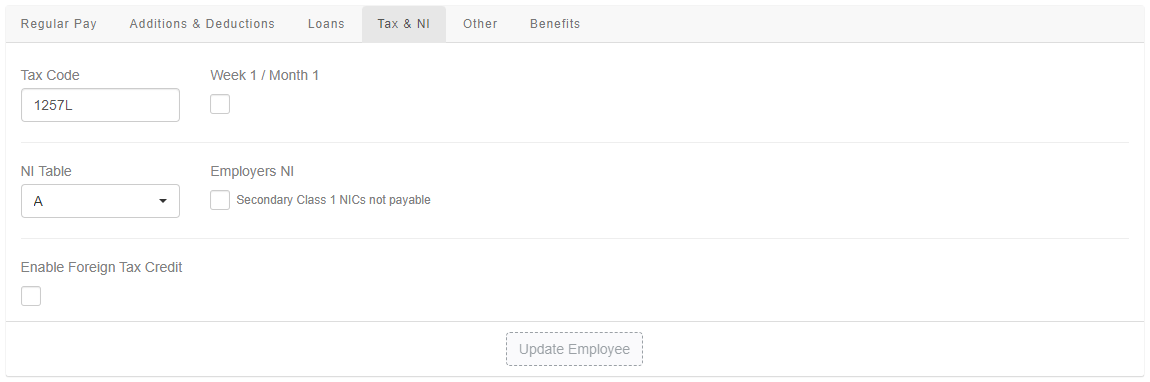

Select Tax & NI.

-

Enter the Tax Code.

-

Select Week 1 / Month 1 as required.

-

Enter the NI Table letter.

-

Select Secondary Class 1 Employees under State Pension age earning more than the threshold a week from one job - they’re automatically deducted by the employer. NICs not payable if required.

-

Select Enable Foreign Tax Credit if required.

-

Select Update Employee.

Good to know...

-

In most cases, tax codes dictate the tax-free allowance an employee receives. HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. divides the tax-free allowance by 10 to provide the tax code number for the employee.

-

K codes are negative tax codes. The employee will be taxed on all pay, plus an additional amount (but not more than 50% in one pay period).

-

Cumulative tax codes: Tax is calculated on the amount the employee has earned to date in the tax year.

-

Week 1 / Month 1 tax codes: Tax is calculated on the earnings in the current pay period only. Year-to-date figures are not taken into account. Can occur when an employee has not provided a P45 A P45 is a document issued by an employer to an employee when they leave a job. It shows details about the's employment, including their start and end dates, how much they were paid, and how much tax they paid during their employment. The is made up of four parts: Part 1 is sent to HM Revenue & Customs (HMRC), Part 1A is kept by the employer, and Parts 2 and 3 are to the employee as a record of their earnings and tax paid. The P45 is an important document that employees need to give to their new employer when they start a new job as it provides information about their tax code and previous earnings, which helps the employer calculate their tax and National Insurance contributions. or a payment after leaving is issued, the employee has not provided a P45 and not completed the starter declaration, or if HMRC are issuing a new tax code which is considerably lower than the one it replaces.

-

GOV.UK Guide: Tax codes. External website

-

GOV.UK Guide: National Insurance rates and categories. External website