Create a new additions & deduction

-

Open the required company.

-

Go to Employees.

-

Select the required employee.

-

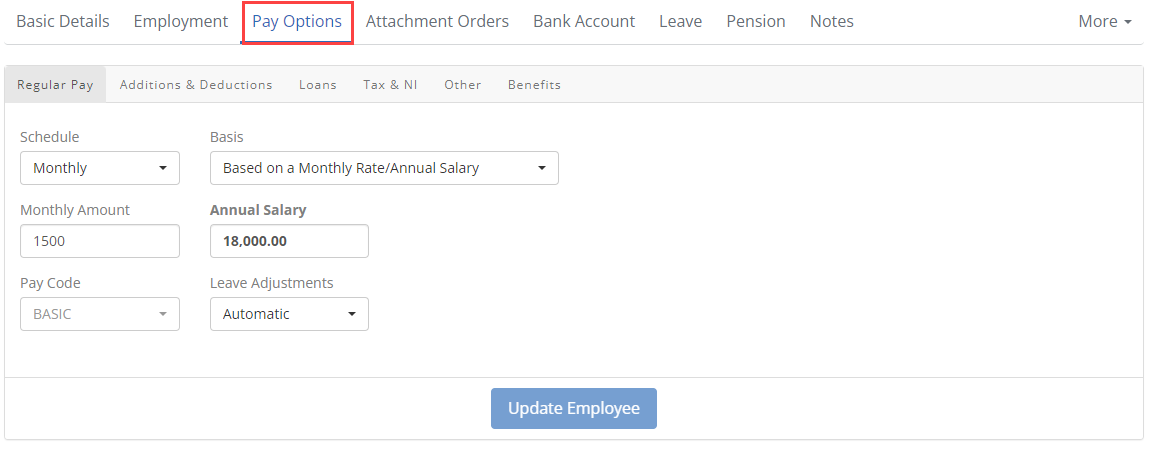

Select Pay Options.

-

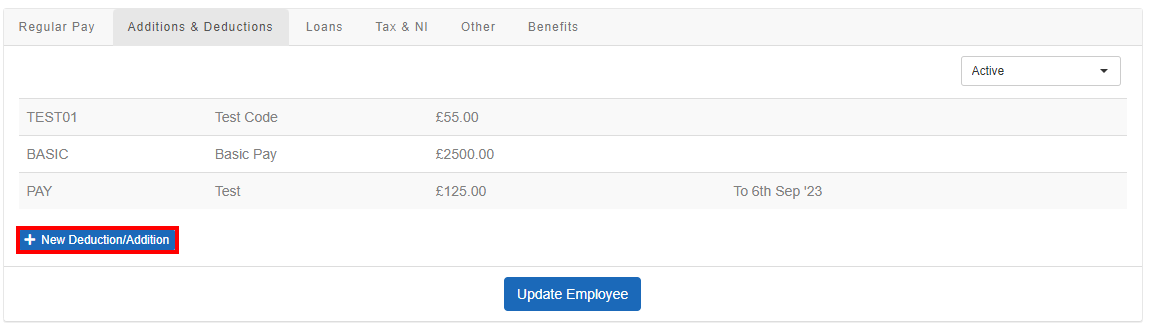

Select Additions & Deductions then New Deduction/Addition.

-

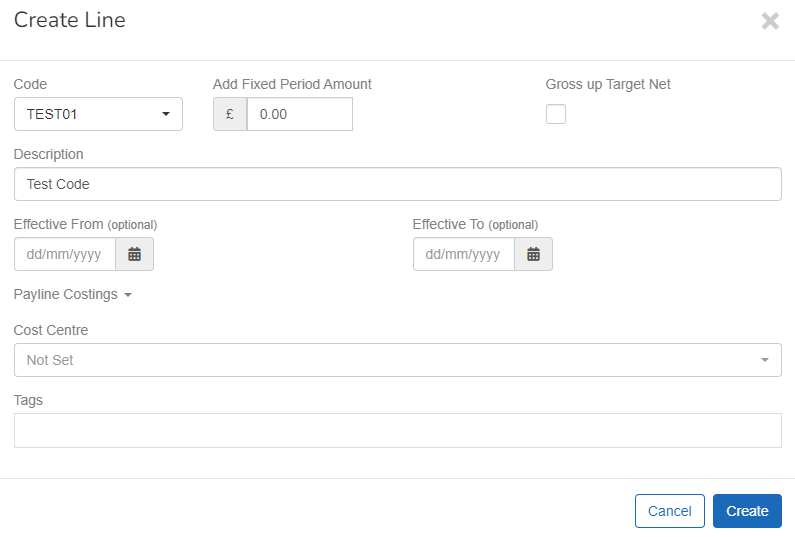

Select the required Code.

-

Enter the amount.

This can be a value, fixed amount, rate or percentage. This is set when you create the pay code.

-

Edit the description if required.

-

Enter the Effective From if required.

-

Leave blank: Will start from the next pay period.

-

Date entered in the past: The pay line will be backdated to this date. A pro-rata calculation is made if the date is part way though a pay period.

-

Date entered in the future: The pay line will start on this date. A pro-rata calculation is made if the date is part way though a pay period.

-

-

Enter the Effective To if required.

-

Leave blank: Will continue forever.

-

Date entered in the future: The pay line will continue until the date entered. A pro-rata calculation is made if the date is part way though a pay period.

-

-

Enter any Payline Costings and Tags if required.

-

Select Create.

-

Select Update Employee.