RTI

Need to send EPS Employer Payment Summary is an RTI online submission sent monthly if, you are reclaiming statutory payments, claiming Employment Allowance (EA is only reported once per tax year), reporting Construction Industry Scheme (CIS) deductions or reporting how much Apprenticeship Levy is due. The EPS is also used to report if no employees will be paid for a whole tax month or longer. submissions for multiple companies with the same PAYE PAYE or Pay as you earn is an HM Revenue and Customs’ (HMRC) system to collect Income Tax and National Insurance from employment. Reference? Find out more

-

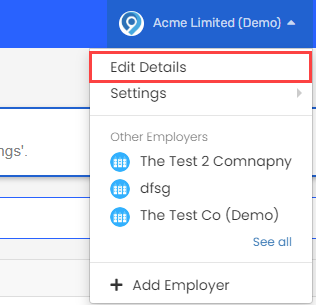

Select the required employer.

-

Go to your company name > Edit Details.

-

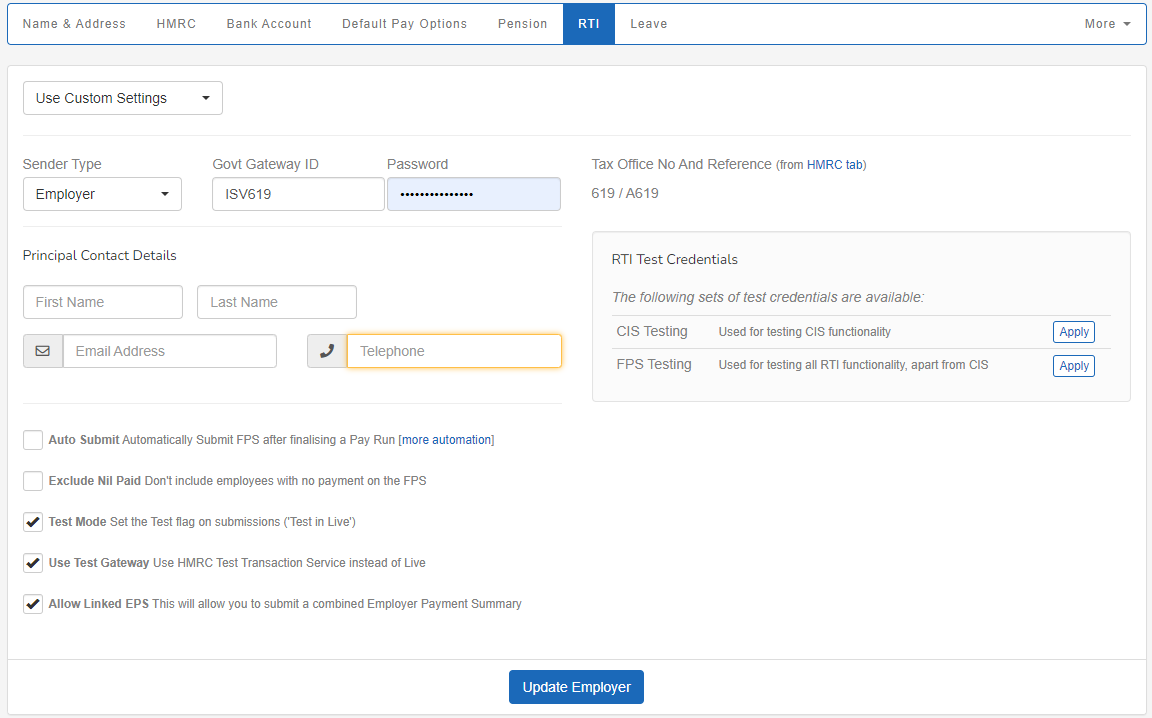

Choose the Sender Type:

-

Acting In Capacity

-

Agent

-

Bureau

-

Company

-

Employer

-

Government

-

Individual

-

Partnership

-

Trust

-

-

Enter the Govt Gateway ID and Password.

-

Enter the Principal Contact Details.

This is person HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. will contact if they have any questions or queries.

-

Choose the following if required:

-

Auto Submit: Automatically Submit FPS Full Payment Submission is an RTI online submission to be sent on or before each payday. This informs HMRC about the payments and deductions for each employee. after finalising a Pay Run. Find out about automation.

-

Exclude Nil Paid Don't include employees with no payment on the FPS.

-

Test Mode Set the Test flag on submissions ('Test in Live').

Test Mode will not apply RTI submissions to your live PAYE account.

This is for testing only. Failure to submit may result in penalties. -

Use Test Gateway Use HMRC Test Transaction Service instead of Live.

Use Test Gateway will not apply RTI submissions to your live PAYE account.

This is for testing only. Failure to submit may result in penalties. -

Allow Linked EPS This will allow you to submit a combined Employer Payment Summary Employer Payment Summary is an RTI online submission sent monthly if, you are reclaiming statutory payments, claiming Employment Allowance (EA is only reported once per tax year), reporting Construction Industry Scheme (CIS) deductions or reporting how much Apprenticeship Levy is due. The EPS is also used to report if no employees will be paid for a whole tax month or longer.. Find out more.

-

-

Select Update Employer.

Good to know...

-

GOV.UK: HMRC online services: sign in or set up an account. External website