Attachment warnings and information

Find out about Attachment of Earnings Orders (AEO A legal order that requires an employer to deduct money from an employee's to pay a debt that they owe.).

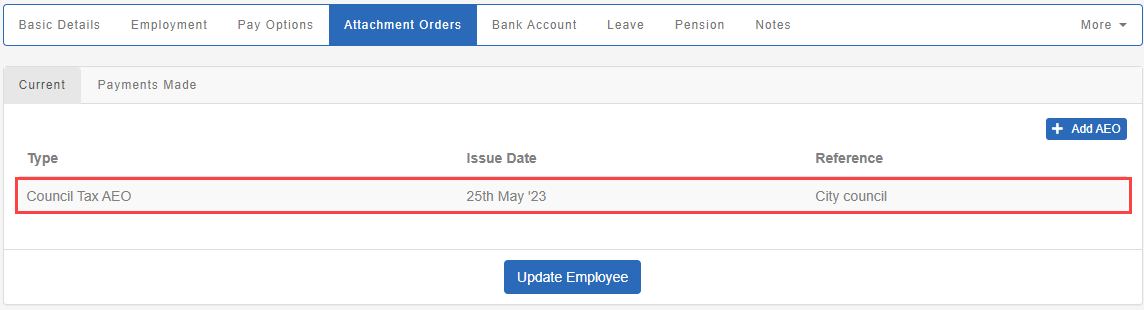

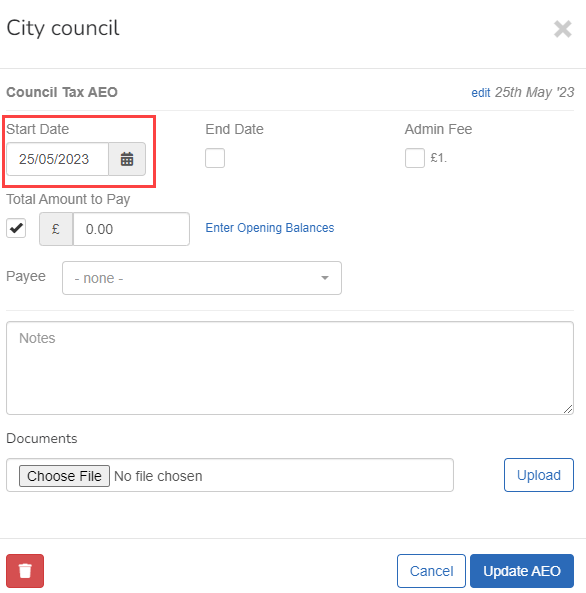

When moving the attachment order for the employee, an invalid start or issue date was found. A new date has been given to the attachment in Staffology Payroll. The start or issue date can impact the order attachments are deducted. You should check, and if necessary change the date.

How to check and change the attachment start or issue date:

-

Open the required company.

-

Go to Employees.

-

Select the required employee.

-

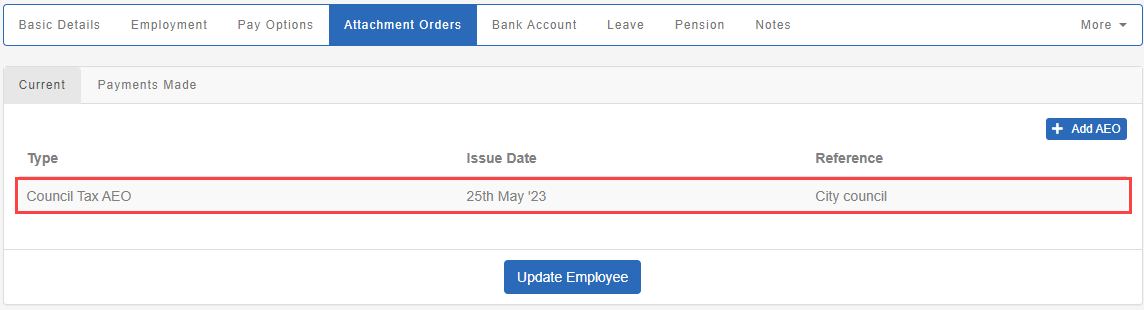

From the Attachment Orders tab, select the required attachment.

-

Enter the correct issue or start date.

-

Select Update AEOA legal order that requires an employer to deduct money from an employee's to pay a debt that they owe..

Do this for each attachment.

-

Select Update Employee.

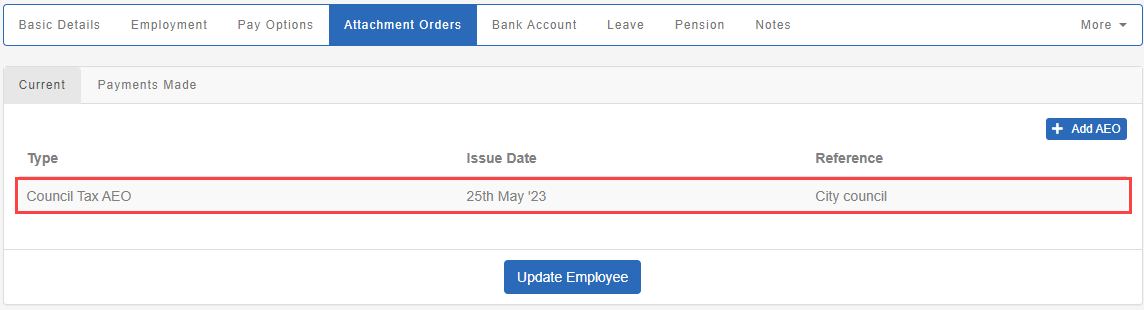

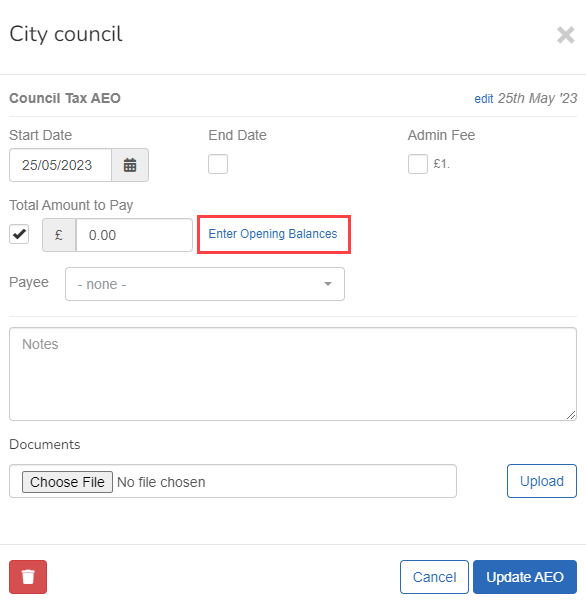

When moving the attachment order for the employee, information for the 'Total Amount To Pay' and 'Previously Paid' was missing. This has to be entered in Staffology Payroll.

How to enter the 'Total Amount To Pay', and 'Previously Paid' for an attachment:

-

Open the required company.

-

Go to Employees.

-

Select the required employee.

-

From the Attachment Orders tab, select the required attachment.

-

Select Enter Opening Balances.

-

Enter the Total Amount to Pay and Previously Paid. If required.

-

Select Update AEOA legal order that requires an employer to deduct money from an employee's to pay a debt that they owe..

Do this for each attachment.

-

Select Update Employee.

When moving the attachment order for the employee, an invalid start or issue date was found. A new date has been given to the attachment in Staffology Payroll. The start or issue date can impact the order attachments are deducted. You should check, and if necessary change the date.

How to check and change the attachment start or issue date:

-

Open the required company.

-

Go to Employees.

-

Select the required employee.

-

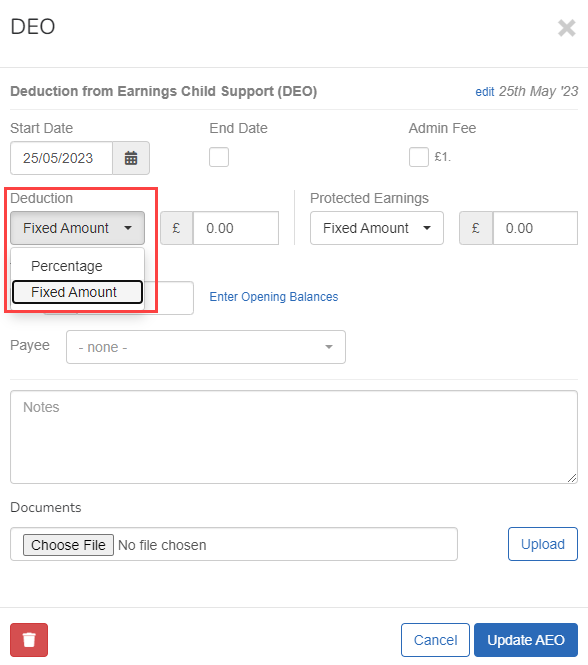

From the Attachment Orders tab, select the required attachment.

-

Select Deduction and choose between Fixed Amount or Percentage and enter the amount.

-

If the attachment contains protected earnings, go to Protected Earnings and choose between Fixed Amount and Percentage and enter the amount.

-

Select Update AEOA legal order that requires an employer to deduct money from an employee's to pay a debt that they owe..

Do this for each attachment.

-

Select Update Employee.

When moving the attachment order for the employee, an invalid payment method was found. You don't need to do anything as it has been changed to the default for the attachment type.

The 'Other' attachment for employee has been upgraded as an AEOA legal order that requires an employer to deduct money from an employee's to pay a debt that they owe. Civil Debt. If the employee has an Attachment configured, where the Type is 'Other' then this is migrated as an 'AEO - Civil Debt'.

Attachment - Other could be used for other things, like a company Loan, if so you need to remove the attachment and set up a company loan.

Good to know...

-

When you complete a pay runs, you can produce a statement to show payments made to an attachment order.

-

You can assign an attachment as a payee, print a report showing all the required payments for the period and include it on the payment file.