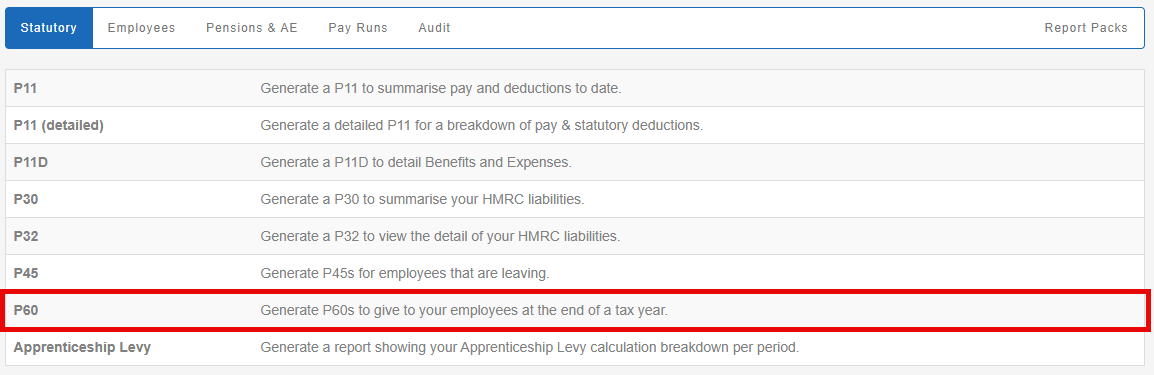

P60

Generate P60s to give to your employees at the end of the tax year.

-

Open the required company.

-

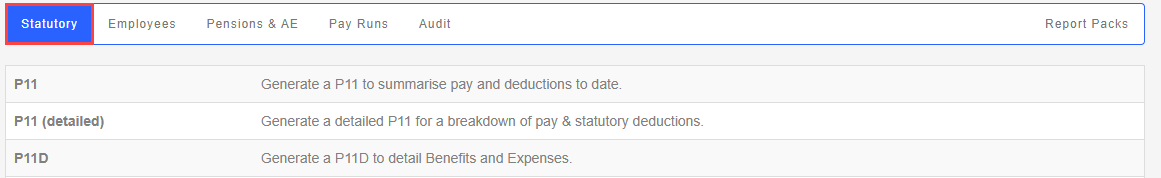

Go to Reports.

-

Select Statutory.

-

-

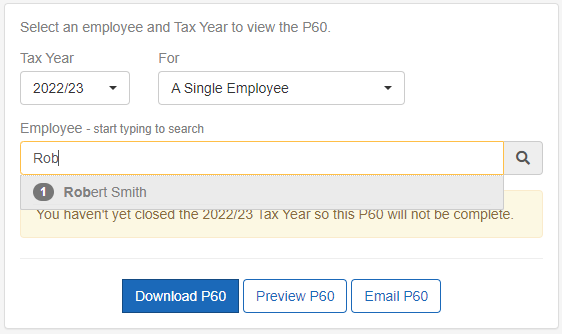

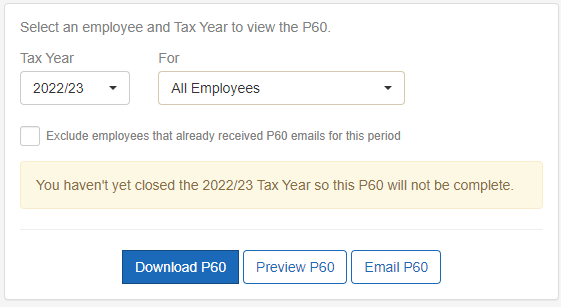

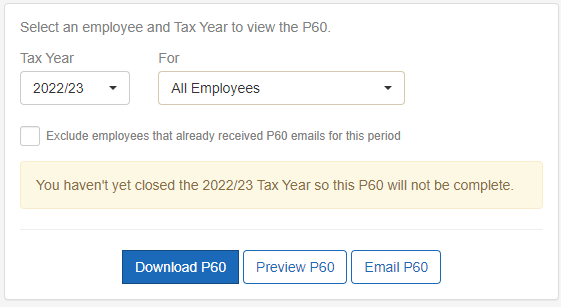

Select a Tax Year.

-

Select a For option.

-

If A Single Employee is chosen:

-

Enter employee name in Search Employees.

-

Select employee from offered list of results.

-

-

If All Employees is chosen:

-

Select Exclude employees that already received P60 emails for this period (if required).

-

-

-

Select Download P60.

-

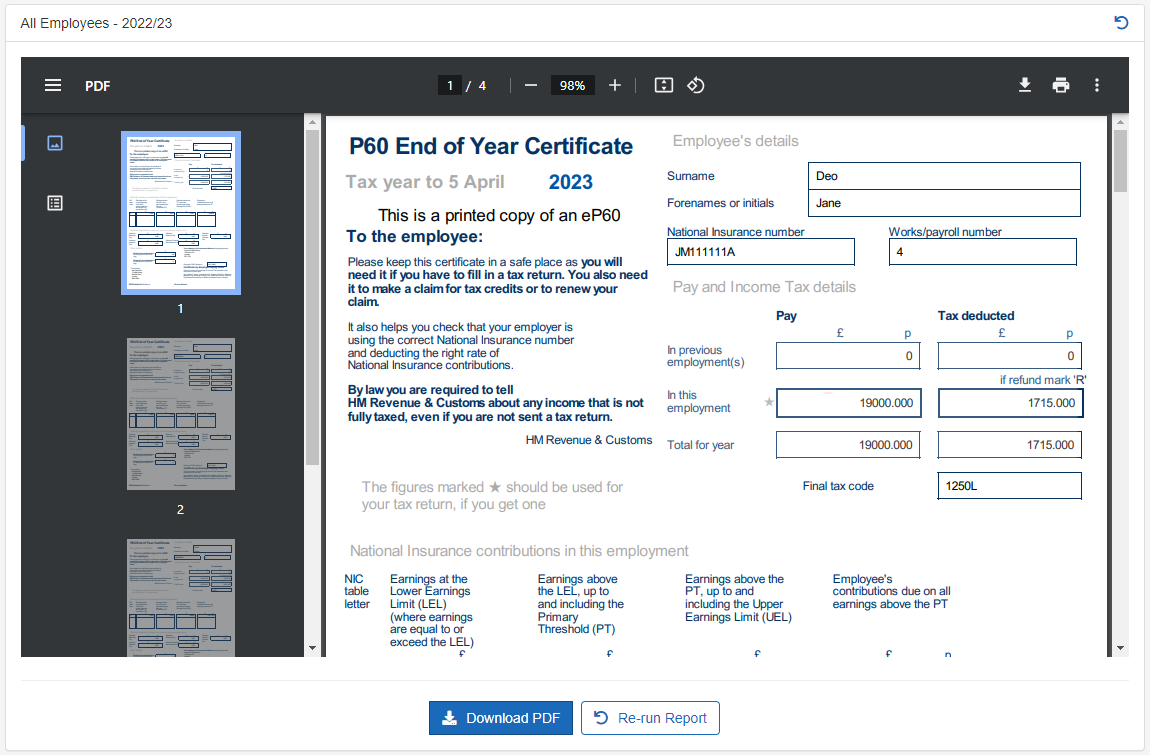

Select Preview P60 (if required).

-

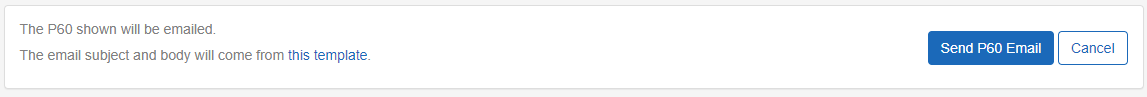

Select Email P60.

-

Select Send P60 Email.

Example...

- P60. PDF