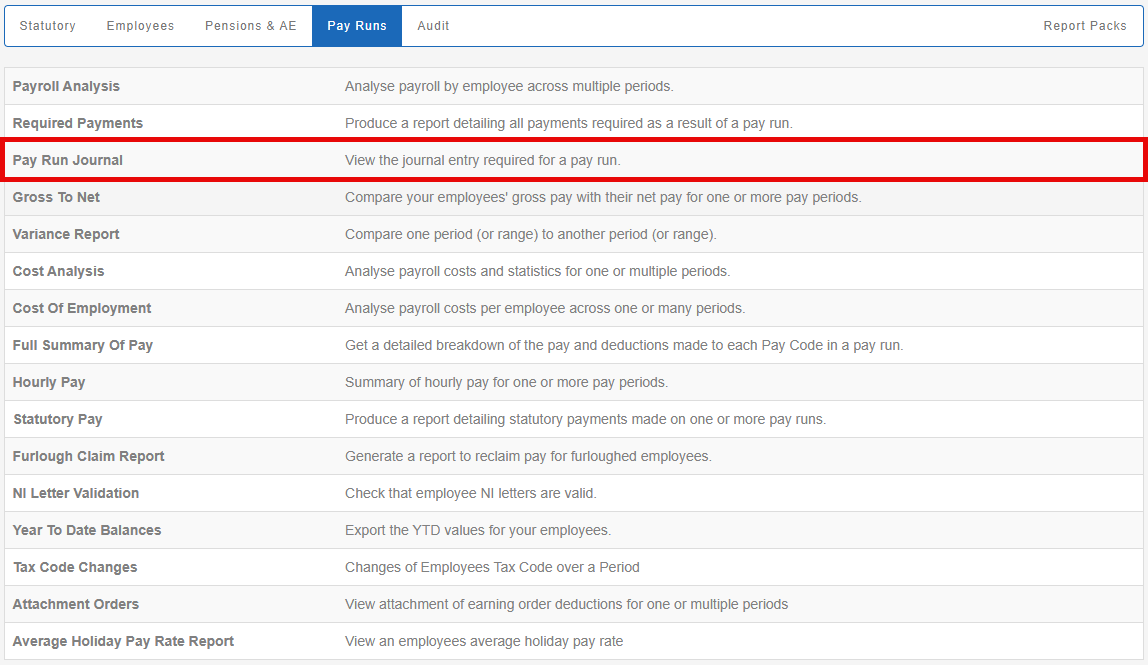

Pay Run Journal

View the journal entry required for a pay run.

-

Open the required company.

-

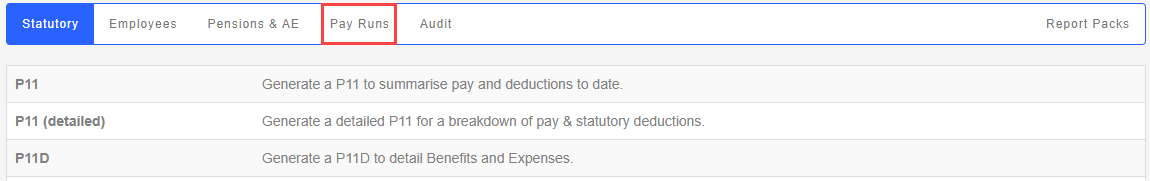

Go to Reports.

-

Select Pay Runs.

-

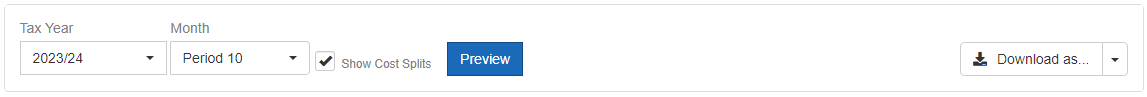

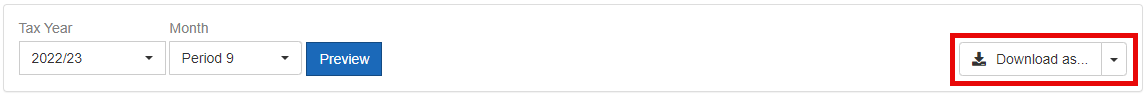

Choose Tax Year.

-

Choose Month.

-

Select Show Cost Splits (if required).

Analysis categories can be displayed on this report

-

Select Include Apprenticeship Levy if applicable.

Include Apprenticeship Levy The Apprenticeship Levy is a UK tax on employers which is used to fund apprenticeship training. It is payable by all employers with an annual pay bill of more than £3 million, at a rate of 0.5% of their total pay bill. It is collected through PAYE alongside other employment taxes. is only available if all pay schedules for the period are updated.

Before you can see Apprenticeship Levy values on your journal, ensure your pay schedule(s) have been fully completed and updated for the period. This is in line with the existing Apprentice A person who is employed to learn a skilled trade, and who will typically work alongside experienced professionals in their chosen field. Levy Report.

-

Select Preview.

-

Select Download as.. (if required)

-

Download as CSV.

-

Download as CSV with employee breakdown.

-

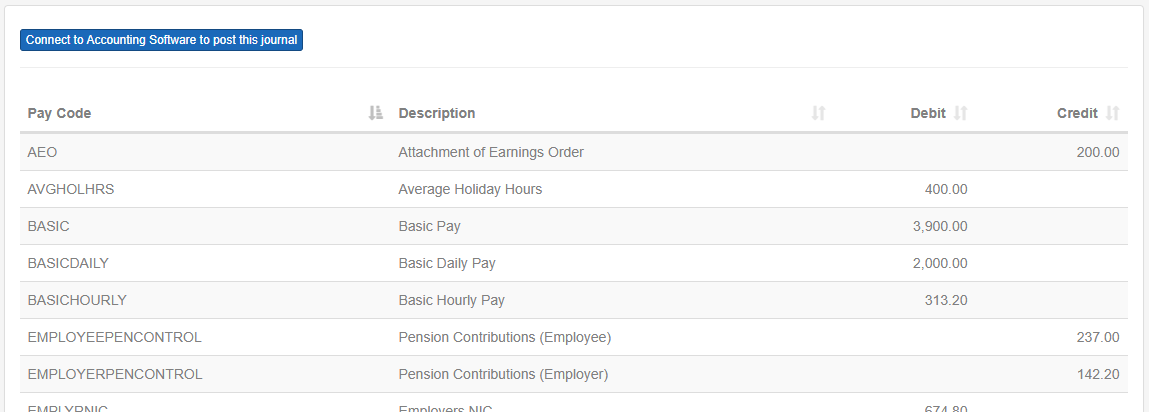

Example...

-

Pay Run Journal. CSV

-

Pay Run Journal (with employee breakdown). CSV