LGPS pension

Step 5: Create the worker groups

-

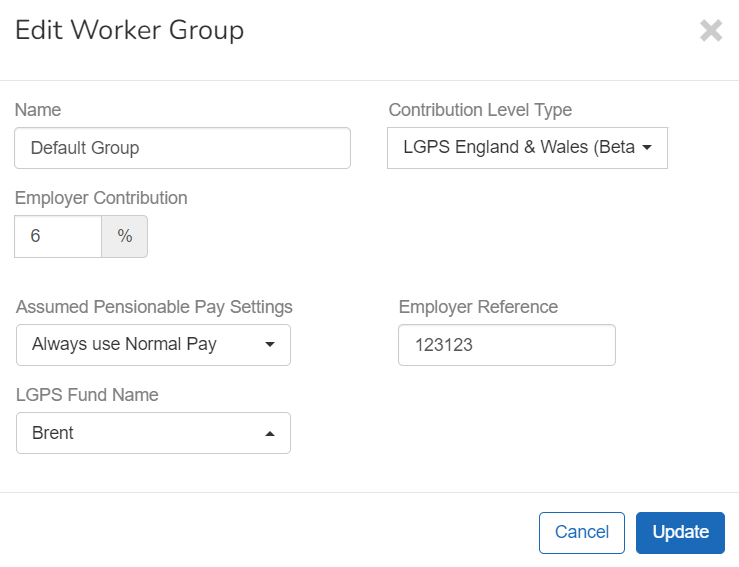

Select Worker Groups and select Default Group.

The first worker group A group of employees who have the same pension contribution level and other settings. must be Teachers Pension England & Wales.

If you have any AVCs or added years, create additional worker groups. Go to Worker Groups and choose +New Worker Group.

-

Go to Contribution Level Type and choose:

-

LGPS England & Wales.

-

Enter the Employer Contribution, Assumed Pensionable Pay Assumed Pensionable Pay is a notional pensionable pay figure that is used to ensure that your pension is not affected if your pensionable pay reduces when you are away from work. It protects you if you are absent because of sickness, injury, or relevant child-related leave etc. Use of assumed pensionable pay would need to be indicated by the relevant pension provider, as it is not always used. Settings, Employer Reference, and choose the LGPS Fund Name

-

-

LGPS APC.

-

Enter he Employer Contribution and Additional Voluntary Contribution as required.

-

-

LGPS Shared APC.

-

Enter he Employer Contribution and Additional Voluntary Contribution as required.

-

-

LGPS ARC.

-

Enter he Employer Contribution and Additional Voluntary Contribution as required.

-

-

LGPS Added Years.

-

Enter he Employer Contribution and Additional Voluntary Contribution as required.

-

-

LGPS Shared APC Lump Sum.

-

Enter he Employer Contribution and Additional Voluntary Contribution as required.

-

-

LGPS Part Time Buy Back.

-

Enter he Employer Contribution and Additional Voluntary Contribution as required.

-

-

-

Select Update.

Check the pension rule is set to Net Pay Arrangement Employees only get Tax Relief. The deduction is made after the NI is caculated but before tax is caculated..

-

Select Settings.

-

Go to Pension Rule and select Net Pay Arrangement.

-

Go to Administrator and enter the Contact Name, Telephone number, Email, and postal Address.

This is the contact within your organisation

-

Select Update Pension Scheme.