LGPS pension

Step 4: Configure the pension scheme

-

Go to Settings.

-

Go to Pension Rule and select Net Pay Arrangement Employees only get Tax Relief. The deduction is made after the NI is caculated but before tax is caculated..

If you select Update Pension Scheme before completing all the steps, Pension Rule is reset.

-

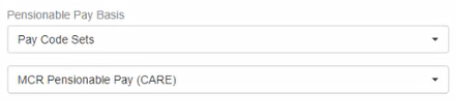

Go to Pensionable Pay Basis and choose Pay Code Sets.

-

Choose MCR Pensionable Pay (CARE).

-

Go to Pensionable Pay Basis and choose Tierable Pay Basis and select the pay code set if required.

-

Select Provider.

-

Go to CSV Format and choose from:

-

LGPS Civica UPM.

-

LGPS iConnect.

You can find contact information on the LGPS website. External website

-

-

Enter:

-

Portal: The employee portal for the pension provider.

-

Website: This can be the same as the portal, an internal site or, a 3rd party website (if you partner with a 3rd party). or you may use the LGPS Members website https://www.lgpsmember.org.

-

Telephone: This is the telephone number for members to contact the pension fund.

-

-

Select the region.

-

England

-

Northern Ireland

-

Scotland

-

Wales

-

Outside of the UK

-

United Kingdom

-

Good to know...

-

If you need to edit the pension:

-

Go to the required company and select Pensions.

-

Select the pension you wish to edit.

-