Step by step guide to running a payroll

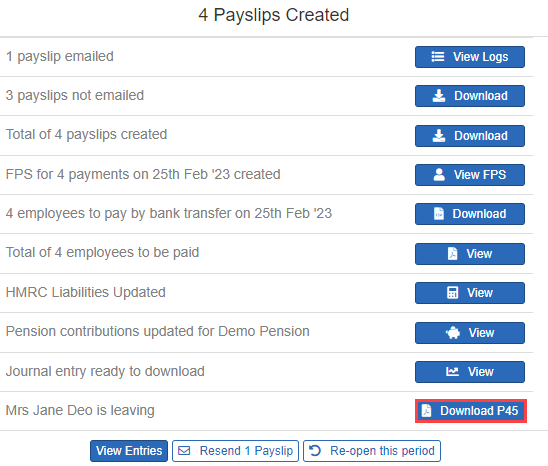

Step 13: Send P45 to leavers

If you have no P45s to send, you can skip this step.

Task list not showing?

Select Payroll from the main menu then View Details to view the task list.

Step 14: Pay the employees.