The rollback process

Read Before you begin.

If you made a mistake in a previous tax year, send an Earlier Year FPS.

-

Open the required company.

-

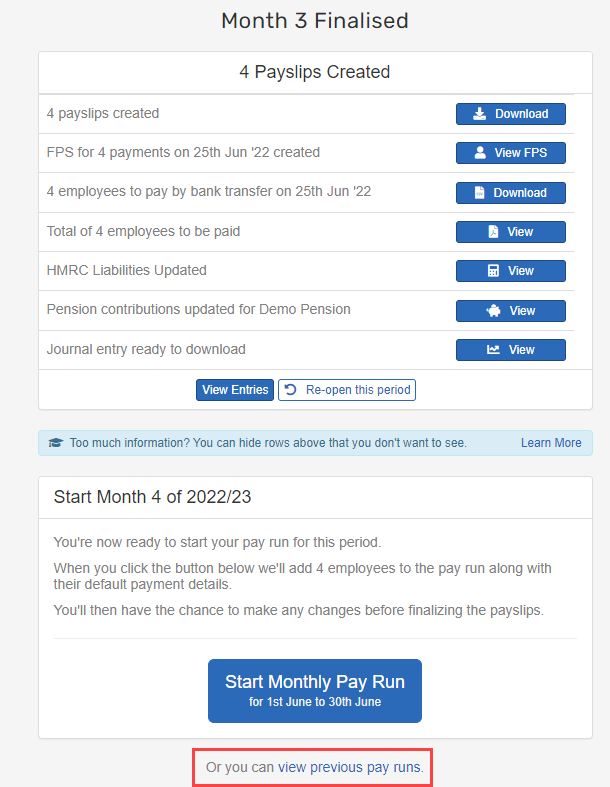

Go to Payroll.

The current pay period must be finalised.

-

Select View previous pay runs.

-

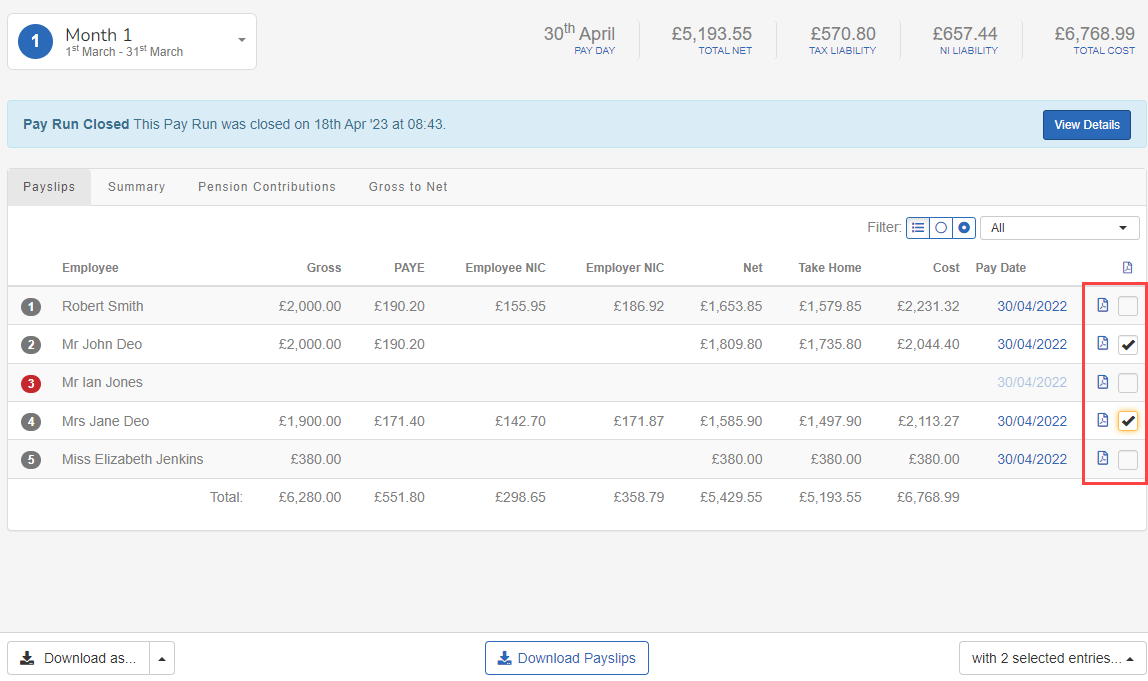

Select the Required period.

-

Select the employees to rollback.

-

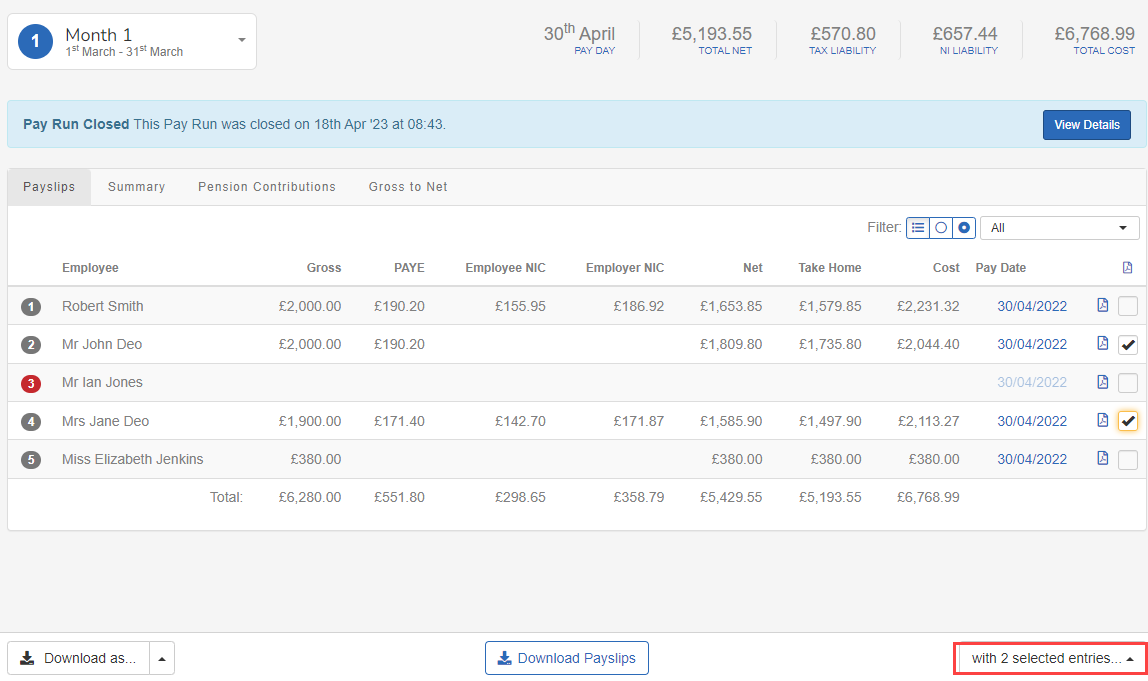

Select with x selected entries... (Where x is the number of employees selected)

-

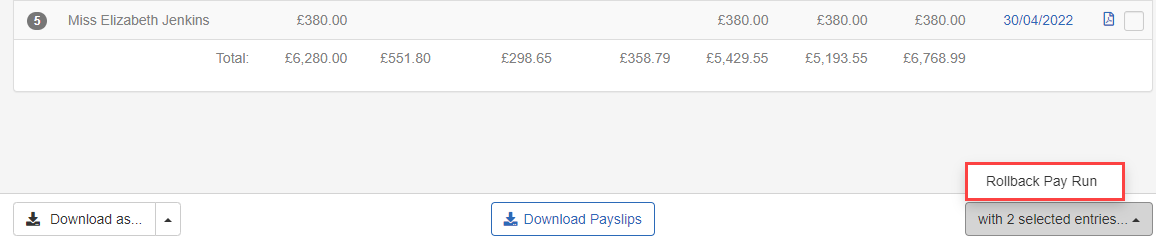

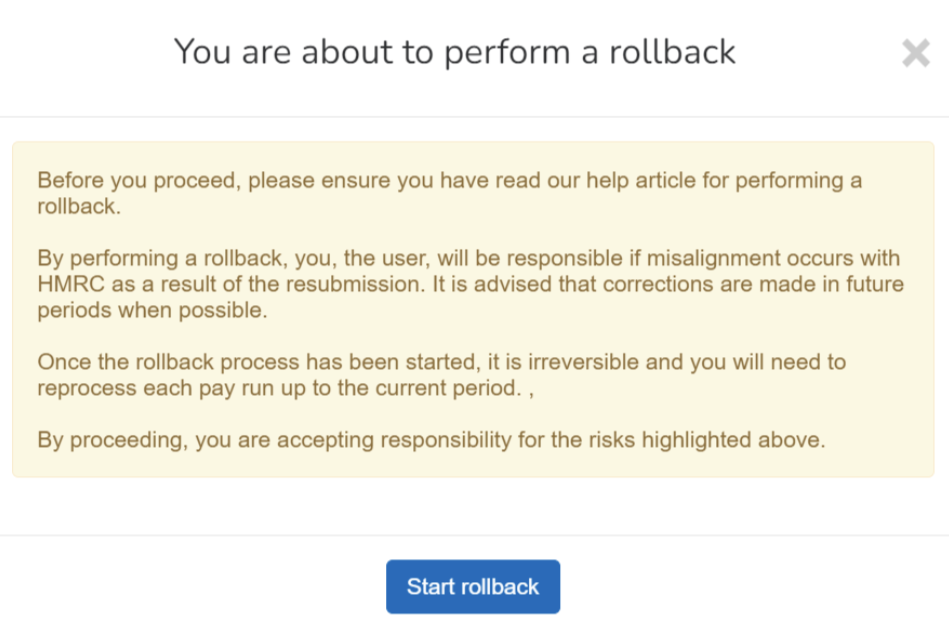

Choose Rollback Pay Run.

-

Select Start Rollback.

Once rollback has commenced, it must be re run up to the current period.

-

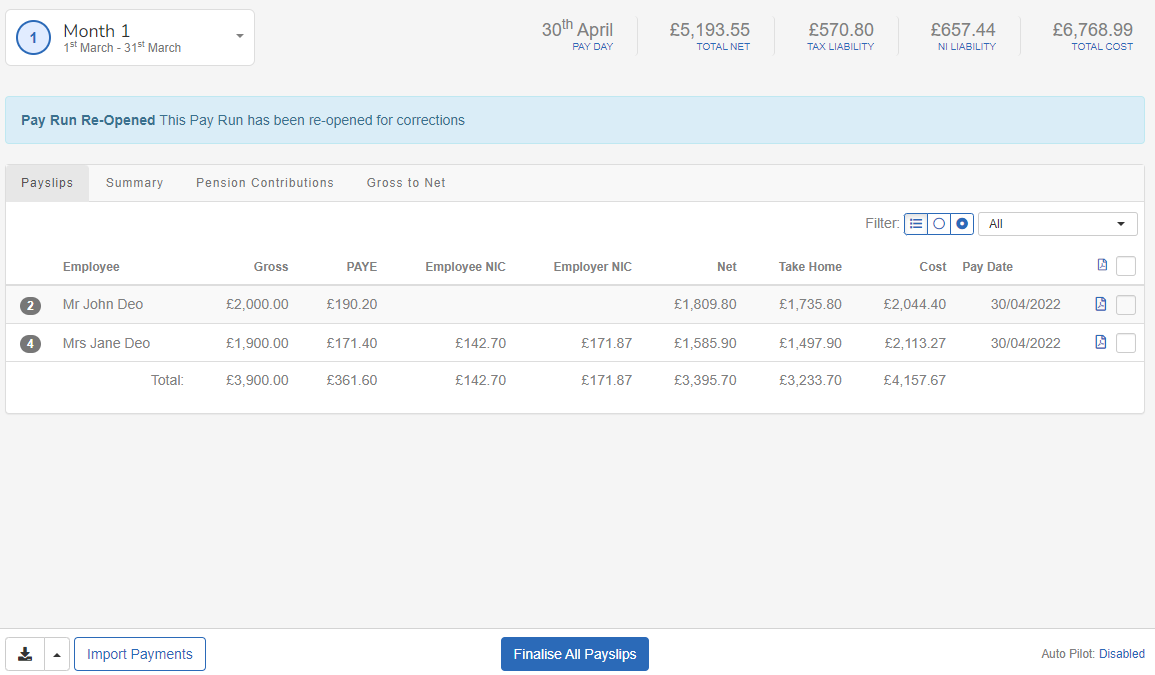

Complete the pay run as normal for the rollback employees.

-

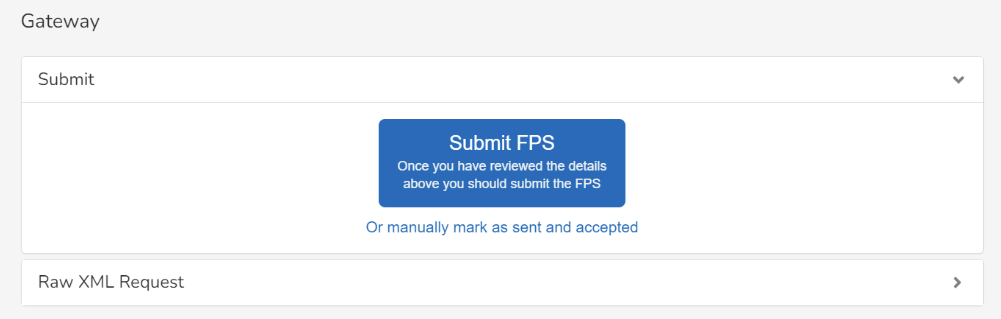

Once complete send an FPS Full Payment Submission is an RTI online submission to be sent on or before each payday. This informs HMRC about the payments and deductions for each employee. for each period finalised during the rollback process.

The resubmitted FPS contains all employees, not just the employees selected for rollback. This will replace the previous FPS. This will be sent with the Reason Code: H correction to an earlier submission. HMRC guidance. External website

Good to know...

-

Employees must have each pay period calculated and finalised individually, bringing them up to date with the rest of the payroll. This is due to the way PAYE PAYE or Pay as you earn is an HM Revenue and Customs’ (HMRC) system to collect Income Tax and National Insurance from employment. works. Each pay period can be impacted by the previous one. If you change the taxable pay in a pay period this can change the tax deduction in the subsequent pay period. This requires a recalculation.

-

Its recommended you document the reason for the rollback, this can be used if questioned at a later date..

-

You must send another full payments submission (FPS). The resubmitted FPS contains all employees, not just the employees selected for rollback. This will replace the previous FPS. This will be sent with the Reason Code: H correction to an earlier submission. HMRC guidance. External website

-

If a misalignment occurs, please contact HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. directly.

-

If you made a mistake in a previous tax year, send an Earlier Year FPS.

-

ACAS Guide: Reclaim money owed by an employee. External website

-

GOV.UK Guide: You paid your employee the wrong amount or made incorrect deductions. External website