Make a correction for a previous year: Earlier Year FPS (EYFPS)

If you discover a mistake after the 15th April covering the previous tax year, you need to perform a Earlier Year Full Payment Submission Full Payment Submission is an RTI online submission to be sent on or before each payday. This informs HMRC about the payments and deductions for each employee. (Earlier year FPS Full Payment Submission is an RTI online submission to be sent on or before each payday. This informs HMRC about the payments and deductions for each employee.).

This can be done for multiple employees at once.

An earlier year FPS replaces the Earlier Year Update (EYU) A notification to HMRC informing them that one or more figures you sent them on your RTI reports for a previous tax year was wrong.

An earlier year FPS allows you to replace the final FPS submission with corrected information.

You need the corrected figures.

-

Select the required company.

-

Go to Employees.

-

Select the required employee.

-

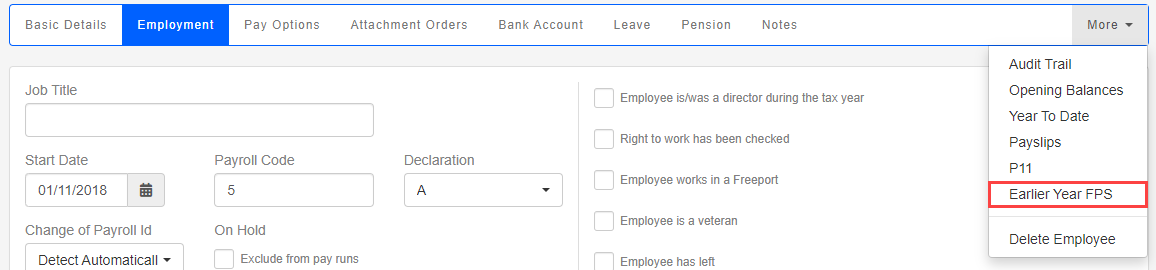

Select More.

-

Select Earlier Year FPS.

-

Select the Tax Year.

The figures for the selected tax year are populated.

If you did not complete the tax year in payroll, you will need to use HMRC Basic PAYE Tools. External website

-

Enter the Earlier Year FPS figures.

These replaces the original FPS figures.

-

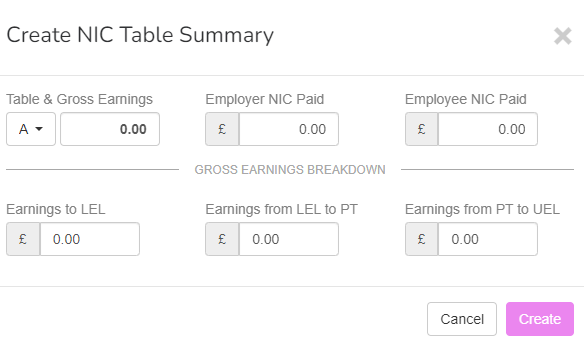

Select New NIC Table Summary.

This is required.

-

Enter the required information and select Create.

-

Select Create.

-

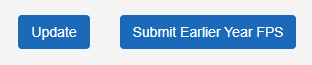

If any figures need further adjustment, select Update.

-

Once complete, select Submit Earlier Year FPS.