Examples: Occupational maternity pay (OMP)

When an employee is expecting a baby, they may be entitled to Statutory Maternity Leave (SML) and Statutory Maternity Pay (SMP Statutory Maternity Pay is the pay an employer must give to female employees on maternity leave, for up to 39 weeks.). Employers can choose to pay more; this is Occupational Maternity Pay (OMP). Find out about Guide to qualifying for statutory maternity leave (SML) and pay (SMP).

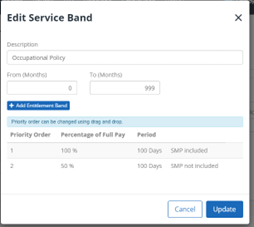

Before paying OMP, you must create an occupational maternity pay (OMP) policy.

Payment calculated in days

When occupational maternity is being paid, we work out the amount an employee is to be paid for each day included in the pay period. Then either add or deduct the statutory pay based on the OMP scheme.

All occupational pay will be calculated on calendar days per month. To keep the calculation consistent we recommend you use the same proration for basic salary.

Example...

Example 1: Percentage of annual salary

Paid daily

Employee's maternity starts on the 15th of April 2024.

Occupational policy is as follows:

-

0-999 months – they are eligible from day 1 for the policy.

-

100% of annual salary for 100 days with SMP included.

-

50% of annual salary for 100 days with SMP not included.

The employee's annual salary is £36,000 with an AWE of £553.84.

This employee is paid monthly

-

Occupational pay calculation = annual salary/frequency/calendar days in period.

-

Example £36,000/12/30 = £100 per calendar day.

(£36,000 divide by 12 months then divide by 30 days in the month) -

The employee would be receiving £553.84 x 90%= £498.45 / 7 Days = £71.21 per day SMP.

As the policy is 100% of pay including statutory the employee would be due £28.79 per day.

£100 (100%) – £71.21 (90% of average weekly earnings) = £28.79 occupational pay.

| Start of SMP week | Days | Occupational due per day | SMP in days | Employee due to be paid | Occupational example | |

| 1 | 15/04/24 | 1 day | £28.79 | £71.21 | £100.00 | 100% of pay |

| 2 | 16/04/24 | 2 days | £28.79 | £71.21 | £100.00 | 100% of pay |

| 3 | 17/04/24 | 3 days | £28.79 | £71.21 | £100.00 | 100% of pay |

| 4 | 18/04/24 | 4 days | £28.79 | £71.21 | £100.00 | 100% of pay |

| 5 | 19/04/24 | 5 days | £28.79 | £71.21 | £100.00 | 100% of pay |

| 6 | 20/04/24 | 6 days | £28.79 | £71.21 | £100.00 | 100% of pay |

| 7 | 21/04/24 | 7 days | £28.79 | £71.21 | £100.00 | 100% of pay |

| 8 | 22/04/24 | 8 days | £28.79 | £71.21 | £100.00 | 100% of pay |

| 9 | 23/04/24 | 9 days | £28.79 | £71.21 | £100.00 | 100% of pay |

| 10 | 24/04/24 | 10 days | £28.79 | £71.21 | £100.00 | 100% of pay |

| 11 | 25/04/24 | 11 days | £28.79 | £71.21 | £100.00 | 100% of pay |

| 12 | 26/04/24 | 12 days | £28.79 | £71.21 | £100.00 | 100% of pay |

| 13 | 27/04/24 | 13 days | £28.79 | £71.21 | £100.00 | 100% of pay |

| 14 | 28/04/24 | 14 days | £28.79 | £71.21 | £100.00 | 100% of pay |

| 15 | 29/04/24 | 15 days | £28.79 | £71.21 | £100.00 | 100% of pay |

| 16 | 30/04/24 | 16 days | £28.79 | £71.21 | £100.00 | 100% of pay |

| £460.64 | £1139.36 | £1600.00 | ||||

Staffology Payroll will default to calendar days in period.

-

For the example the employee would be paid from the 1st – 14th.

-

£36,000/12/30= £100 per day x 14 days = £1,400.

(£36,000 divide by 12 months then divide by 30 days in the month)

Example 2: Percentage of pay code set

Paid daily

The same employee is now being calculated on percentage of pay code set.

Employees maternity starts on the 15th of April 2024.

Occupational policy is as follows:

-

0-999 months – they are eligible from day 1 for the policy.

-

100% of pay code set for 10 Days with SMP included.

-

50% of pay code for 100 Days with SMP not included.

The pay codes included in the pay code set:

-

Annual Basic – £45,000.

-

TLR Allowance - £300 (paid monthly).

-

Car Allowance - £200 (paid monthly).

The calculation to work out the of 100% pay would be:

Annualise the period values:

-

£300 x 12 (frequency) = £3,600.

-

£200 x 12 (frequency) = £2,400.

-

£45000 + £3600 + £2400 = £51,000.

-

Average weekly earnings for this example is £553.84.

-

This employee is paid monthly.

-

Employee due to be paid pay calculation = snnual salary/frequency/calendar days in period.

-

Example £51,000/12/30 = £147.67 per calendar day.

(£51,000 divide by 12 months then divide by 30 days in the month) -

The employee would be receiving £553.84 x 90%= £498.45 / 7 Days = £71.21 per day SMP.

As the policy is 100% of pay including statutory the employee would be due £70.46 per day for the first 10 days.

£141.67 (100%) – £71.21 (90% of average weekly earnings) = £70.46 occupational pay due.

When the employee drops down to 50% on the 15th day.

The calculation would be as follows:

-

£51,000/12/30 = £141.67 x 0.5% = £70.83.

(£51,000 divide by 12 months then divide by 30 days in the month)

| Start of SMP week | Days | Occupational due per day | SMP in days | Employee due to be paid | Occupational example | |

| 1 | 15/04/24 | 1 day | £70.46 | £71.21 | £141.67 | 100% of pay |

| 2 | 16/04/24 | 2 days | £70.46 | £71.21 | £141.67 | 100% of pay |

| 3 | 17/04/24 | 3 days | £70.46 | £71.21 | £141.67 | 100% of pay |

| 4 | 18/04/24 | 4 days | £70.46 | £71.21 | £141.67 | 100% of pay |

| 5 | 19/04/24 | 5 days | £70.46 | £71.21 | £141.67 | 100% of pay |

| 6 | 20/04/24 | 6 days | £70.46 | £71.21 | £141.67 | 100% of pay |

| 7 | 21/04/24 | 7 days | £70.46 | £71.21 | £141.67 | 100% of pay |

| 8 | 22/04/24 | 8 days | £70.46 | £71.21 | £141.67 | 100% of pay |

| 9 | 23/04/24 | 9 days | £70.46 | £71.21 | £141.67 | 100% of pay |

| 10 | 24/04/24 | 10 days | £70.46 | £71.21 | £70.83 | 50% of pay |

| 11 | 25/04/24 | 11 days | £70.46 | £71.21 | £70.83 | 50% of pay |

| 12 | 26/04/24 | 12 days | £70.46 | £71.21 | £70.83 | 50% of pay |

| 13 | 27/04/24 | 13 days | £70.46 | £71.21 | £70.83 | 50% of pay |

| 14 | 28/04/24 | 14 days | £70.46 | £71.21 | £70.83 | 50% of pay |

| 15 | 29/04/24 | 15 days | £70.46 | £71.21 | £70.83 | 50% of pay |

| 16 | 30/04/24 | 16 days | £70.46 | £71.21 | £70.83 | 50% of pay |

| £1129.94 | £1139.36 | £1770.83 | ||||

As the policy does not include the SMP in this value the employee will be paid £70.83 plus their 90% of average weekly earnings.

Example 3: Percentage of average weekly earnings

Paid daily

Employees maternity starts on the 17th of April 2024.

Occupational policy is as follows:

-

0- 6 months – not eligible.

-

7-999 – eligible.

-

100% of pay code set for 6 days with SMP included.

-

75% of pay code for 30 days with SMP not included.

Employee start date of 18/09/2021.

Employees average weekly earnings: 667.89.

-

This employee is paid weekly.

-

Employee due to be paid = £667.89 (average weekly earnings) x 52 / 12 (frequency) / 30 (calendar days in period) = £96.47.

-

Occupational due per day = £96.47 – £85.87 (SMP in days) = £10.60.

Example 4

Paid weekly

Percentage of annual salary – weekly calculation.

Employees maternity starts on the 15th of April 2024.

Occupational policy is as follows:

-

0- 6 months – not eligible.

-

7-999 – eligible.

-

100% for 10 weeks with SMP included.

-

75% for 10 weeks with SMP not included.

-

50% for 10 weeks with SMP not included.

Employee start date is 18/08/2023.

Annual salary of £45,000 and average weekly earnings of £554.67.

-

This employee is paid weekly.

Staffology Payroll will pay the full weeks of SMP and occupational pay to the employee. If a part week is required then it will be paid as occupational pay and recalculated in the next month.

Employee due to be paid is calculated by:

-

£45,000/12/30 x 7 = £875.

(£45,000 divide by 12 months then divide by 30 days in the month)

Occupational due is calculated by:

-

£875 - £498.46 (statutory 90%) = £376.54.

29th and 30th is part week which means the 2 days will be paid in occupational Pay:

-

£45,000/12/30 (calendar days) x 2 = £250.

(£45,000 divide by 12 months then divide by 30 days in the month)

Salary proration:

-

£45,000/12/30 (calendar days) x 14 days = £1750.

May 2024

Part week due to be paid is calculated by:

-

Employee due : £45,000/12/31 (calendar days) x 5 (remaining part week days in May) = £604.84

Occupational due = £604.84 - £498.46 = £106.38