Processing an average holiday pay scheme

Before you begin:

Configuring average holiday pay & Assign average holiday pay scheme to an employee

Enhanced holiday pay will be paid in addition to any other pay codes / elements. Edit any standard amounts required.

-

Open the required company.

-

Select Payroll.

-

Start the payrun as normal.

-

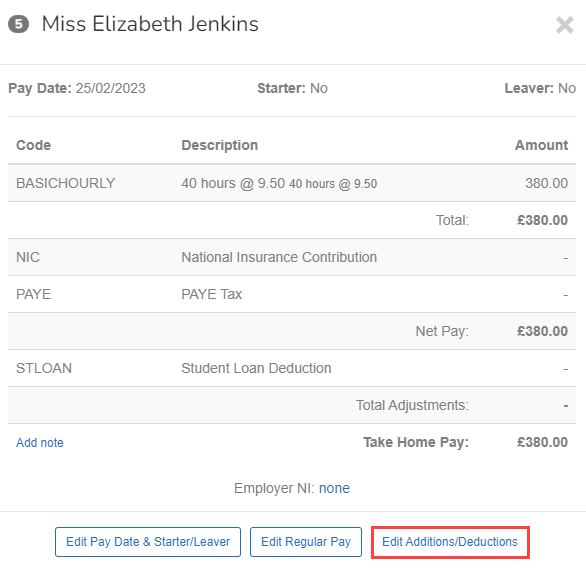

Select the employee due the enhanced holiday pay amount.

-

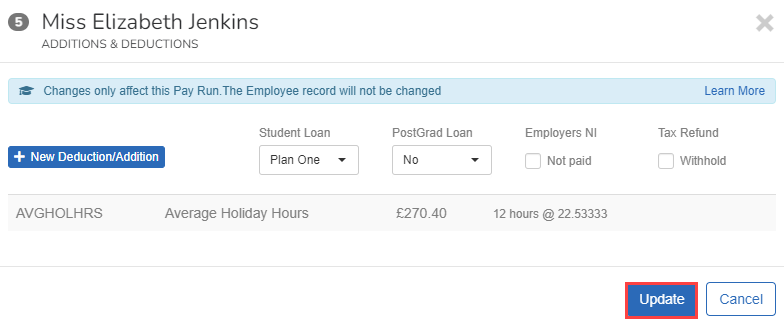

Select Edit Additions/Deductions.

-

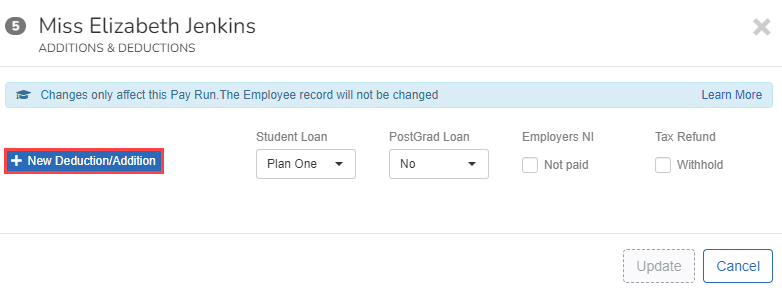

Select New Deduction/Addition.

-

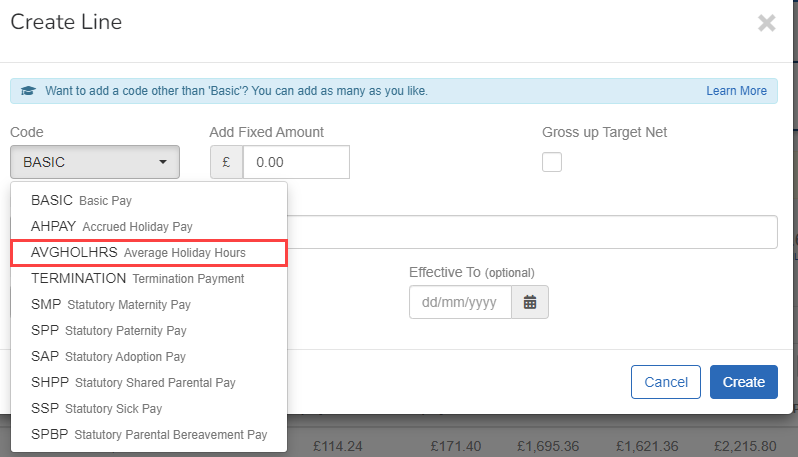

Go to Code and select AVGHOLHRS Average Holiday If an Employee's work has no fixed or regular hours, their holiday pay will be based on the average pay they received over the previous 52 weeks (or a average based on the available number of weeks if less than the full 52. Hours.

-

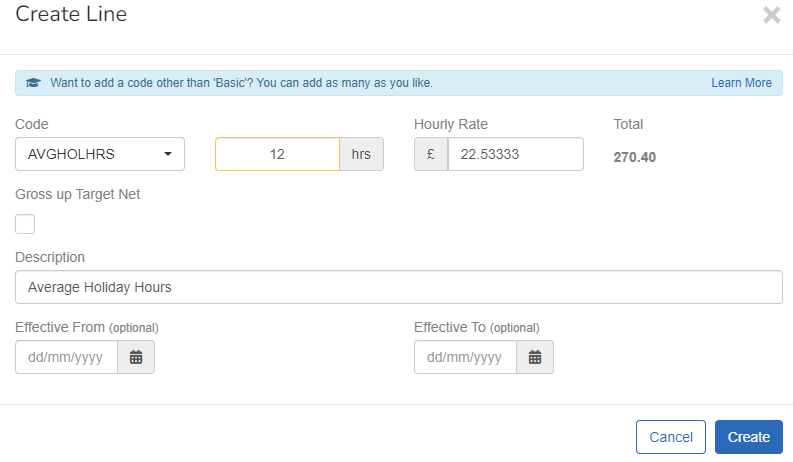

Enter the hours at the enhanced rate.

Hourly Rate shows the enhanced average earnings rate.

-

You can change the description if required.

-

You can enter the Effective From and Effective To dates if required.

Entering an Effective From and Effective To date will result in the average holiday being calculated on a pro-rata basis.

-

Select Create.

-

Select Update.

Enhanced holiday pay will be paid in addition to any other pay codes / elements. Edit any standard amounts required.

Good to know...

-

Where an employee is set to a Monthly paid pay schedule the following calculation needs to occur to accurately calculate the rate of accrual each period

Hours Per Week (Total Hours Worked) * Weeks Paid (on Working Pattern) / 12

-

If an employee is on a working pattern of 40 hours per week and has working weeks of 52.1428 the sum should be

40 * 52.1428 / 12 = 173.80 Per Period -

All other working patterns are unaffected by this as they are straight multiples.