Attachment orders (AEO)

Upon receipt of an attachment of earnings order (AEO), you can set up a deduction to take payments to recover the debt from the employee's wages.

-

Open the required company.

-

Go to Employees.

-

Select the required employee.

-

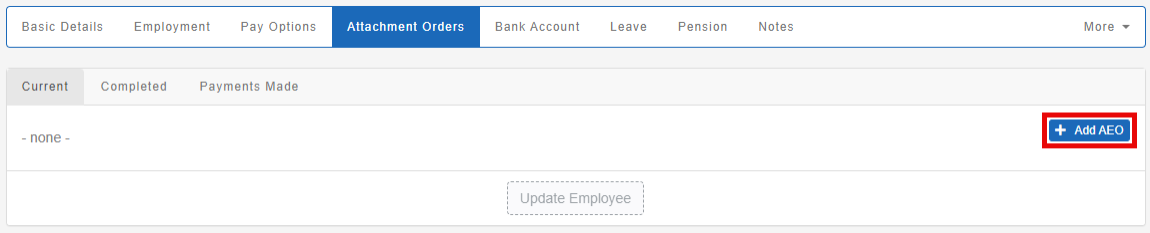

Select the Attachment Orders tab.

-

Select + Add AEO A legal order that requires an employer to deduct money from an employee's to pay a debt that they owe..

-

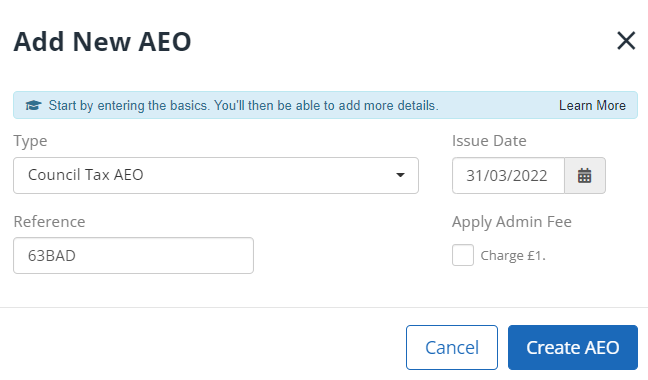

Select the Type from the list:

-

AEO Maintenance - Payment of unpaid TV licence or road traffic fines.

-

AEO Fines.

-

Deduction from Earnings Child Support (DEO).

-

AEO Civil Debts - For civil debts such as unpaid credit cards or money owed for work done.

-

Community Charge Pre 92 - Payment of unpaid poll tax prior to 1992

-

Community Charge Post 92 - Payment of unpaid council tax after 1992.

-

Council Tax AEO - Payment of unpaid council tax.

-

Magistrates Court Attachment.

-

Earnings Arrestment (Scotland) - A Scottish order for civil debts and fines such as utility bills or unpaid fines.

-

Current Maintenance Arrestment (Scotland) - A Scottish order for maintenance to a spouse or child.

-

Conjoined Arrestment Order (Scotland) - A Scottish order for the combination of more than one EA or CMA.

-

Income Support Deduction - Issued by the Department of Work and Pensions to recover Income Support paid whilst an employee was on trade dispute.

-

Earnings Arrestment (2006) - A Scottish order for civil debts and fines such as utility bills or unpaid fines.

-

Centralised Attachment Payment - Centralised method of payment for debt and maintenance.

-

Direct Earnings Attachment - Issued to collect overpaid benefits in England, Scotland, Northern Ireland and Wales.

-

Direct Earnings Attachment Higher - Issued to collect overpaid benefits in England, Scotland, Northern Ireland and Wales.

-

Direct Earnings Attachment Fixed - Issued to collect overpaid benefits in England, Scotland, Northern Ireland and Wales.

-

Council Tax AEO (Wales) - Payment of unpaid council tax in Wales.

This determines how the deduction calculates.

-

-

Select the Issue Date

-

Enter the Reference shown on the AEO instruction documentation.

-

If required, select Charge £1.

You are allowed to charge your employees a £1 admin fee for each AEO you have to process.

-

Select Create AEO. Depending on the type of AEO chosen, you may need to provide more details.

-

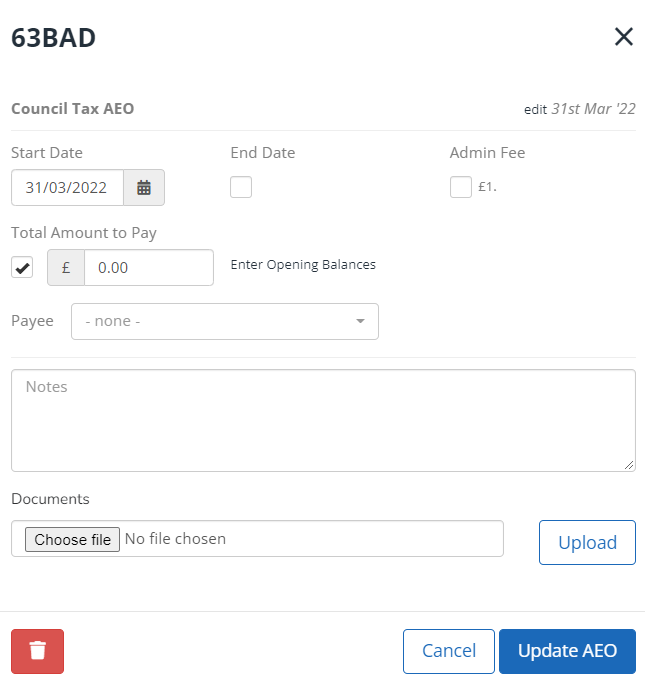

Enter the Start Date for the order. Compete the remaining fields as follows:

Field Detail End Date (optional) Enter an End Date to automatically stop the order on that date. Deduction If applicable, enter the amount to deduct either as a fixed amount or percentage. If this does not show, it’s because it calculates automatically based on the chosen type or AEO.

This field cannot appear as a negative.

Protected Earnings If applicable, enter the Protected Earnings.

To ensure employees maintain a certain level of income, some orders specify Protected Earnings.

Total Amount To Pay If applicable, enter the Total Amount to Pay for the order. Once the amount is reached, deductions automatically stop.

Enter Opening Balances

You can now enter opening balances for the order.

Previously Paid

The employee may have already made contributions towards the total amount to pay, either in a previous payroll package or previous employment. If so, you can enter the amount here. If this field does not display, select Opening Balances.

Starting Arrears

Some orders require that any shortfall in previous payments carries forward. If this is the case, enter any shortfall in Starting Arrears (select Opening Balances if Starting Arrears does not display). Any future arrears calculate automatically.

Documents

You can attach supporting documentation for an order. Select Choose File, find and select the required document, then Upload. You can upload various supporting documents such as pdf, docx, xls or png.

You can delete any attached documents you no longer need by selecting the red cross.

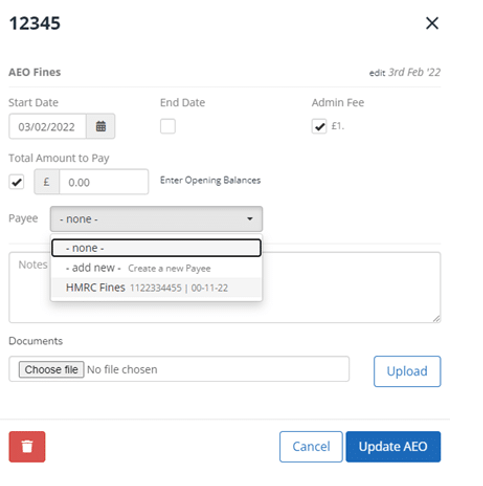

Work with Payees

Here you can select from the Payees already created under Settings > Payees.

How to add a Payee to an Employee's AEO

-

Select the required Payee from the list.

You can select add new to create a new payee from here, rather than the Settings menu.

-

Select Update AEO then Update Employee.

The attachment configuration is now complete, and any required deductions are made during pay run.