HMRC Notices

Before you can download HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. notices and automatically apply them, you need to check a few settings on the HMRC Goverment Gateway.

Find out more

We can connect to HMRC's Data Provisioning Service and retrieve and apply notices for you. These notices include:

- P6 Updated Tax Code and previous pay detail

- SL1 Start Student Loan A government loan that students can use to help pay for their education.

- PGL1 Start Postgraduate Loan

- P9 Updated Tax Code

- SL2 Stop Student Loan

- PGL2 Stop Postgraduate Loan

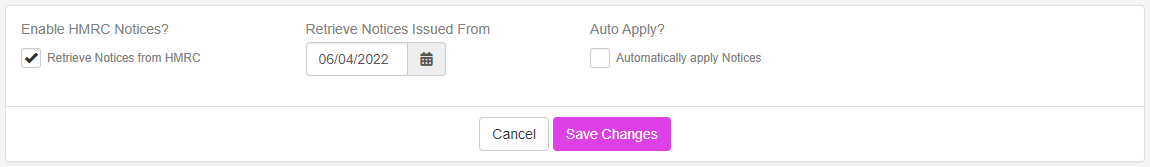

HMRC notice settings

-

Open the required company.

-

Select HMRC > Notices.

-

Select Enable HMRC notices to enable HMRC Notices.

-

Choose the date you want to Retrieve notices issued from.

Recommended setting

If you have been updating the employee record manually, you choose the current date. -

Select if you want the messages to be automatically applied.

Recommended setting

Automatically apply notices set to on. A check is made twice a day for new messages.

View notices

Select HMRC in the main menu, then Notices. If there are any retrieved notices, they are listed here.

There is also a button to check for new notices. We automatically do this twice a day, but you can also use this button to run immediate checks.

We strongly recommend using the Auto Apply feature to apply notices automatically. You can also manually apply a notice by choosing it in the list and selecting the button to apply it

You need to ensure that the notice options in your HMRC PAYE dashboard are all set to ‘Yes’. Only coding notices issued after you set this option will be retrievable.

Notices are matched to employees based on the NI number. If that fails, we try to match the “Works Number” from HMRC to the Payroll Code of the employee. If we do not find a match, this will be indicated on-screen.

Good to know...

-

Before you can download HMRC notices and automatically apply them, you need to check a few settings on the HMRC Goverment Gateway.

Find out more -

When you log into Staffology Payroll, we look for and apply any notices that have effective dates that fall within the date range for the pay run.

-

This system is known as the DPS system (Data provisioning system)

-

HMRC service status page

External website